Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Singaporeans' love for their country generally gets stirred up in August.

This year, festivities (and crowds) returned in full force to the Marina Bay area for the National Day Parade (NDP) after two years of getting disrupted by the pandemic.

But that's not the only piece of good news for Singaporeans this August.

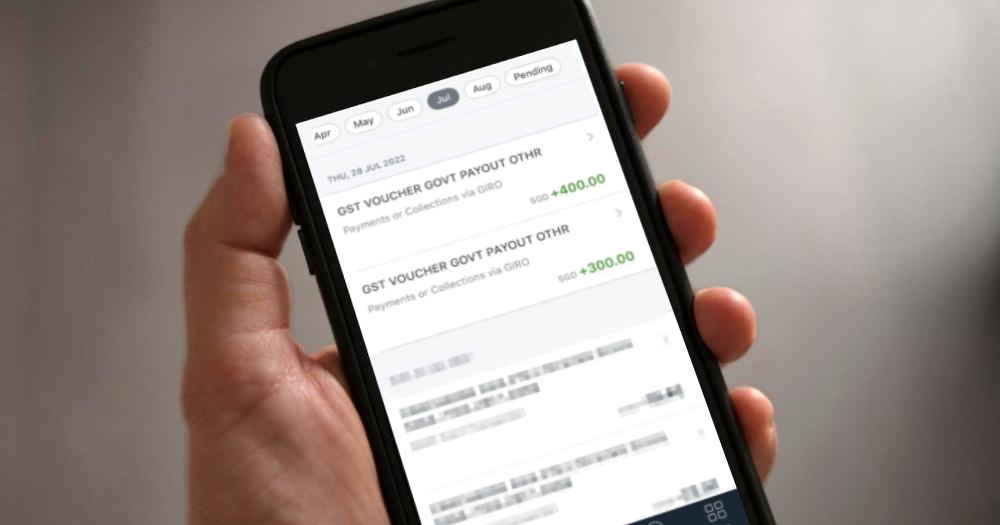

Many of them, who are fluent in the love language of money, would also have extra reason for cheer thanks to the GST voucher (GSTV) — and for some, S$700 of GSTV in cash.

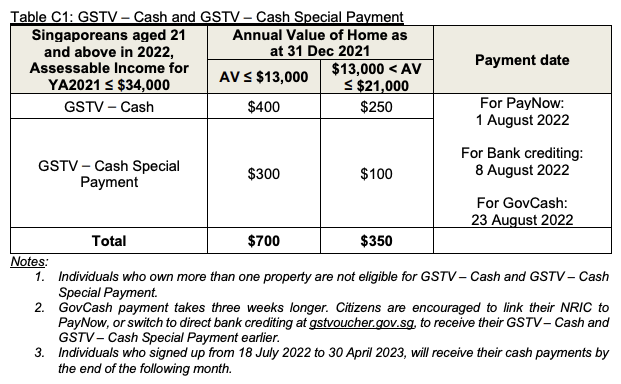

Screenshot via Ministry of Finance (MOF) website.

Screenshot via Ministry of Finance (MOF) website.

But wait, what does GSTV have to do with GST?

MOF explains on its GSTV website that GST vouchers provide direct help to lower- and middle-income Singaporean households and seniors.

The GSTV is not to be confused with other direct transfers from the government, such as the 2018 "SG Bonus" benefit of S$100 to S$300, as well as the 2020 "Solidarity Payment" and "Care and Support – Cash payment", between S$300 and S$900, with amounts depending on one's assessable income in the relevant years, and one's property ownership.

Instead, the GSTV — as its name suggests — has more to do with Goods and Services Tax (GST).

Here's the link between GST and GSTV:

GST is an important source of government revenue, amounting to S$12.6 billion (or 20.8 per cent of the total S$60.7 billion of tax collected in financial year 2021, according to IRAS's most recent annual report).

However, the burden of paying this 7 per cent (and rising) consumption tax can be a heavy one, especially for lower-income groups, and thus, GSTV helps to alleviate that burden somewhat.

MOF says the GSTV is "fairer and more effective", as compared to the alternative options, such as implementing a multi-tier GST system (where those who earn less pay less GST), or not imposing GST for basic necessities.

GSTV was made a permanent scheme in 2012, and today, it has four components: Cash, MediSave top-ups, offsets for utility bills, and rebates on Service & Conservancy Charges (S&CC).

A quarter of GSTV — Cash recipients are young S'poreans

The cash payout this year is limited to 1.5 million Singaporeans, roughly a quarter of the population.

In response to Mothership's queries on the statistics of young Singaporeans (21-35 years old) receiving the voucher, MOF replied that about 370,000 young Singaporeans, roughly a quarter of the 2022 GSTV recipients, will receive the cash payout.

You may or may not be a GSTV recipient this time around.

So, who doesn't get GSTV in cash?

Let's assume that you're a Singaporean, that you're residing in Singapore, and that you don't own more than one property — all criteria for receiving the GSTV.

Taking that assumption, the two easiest ways to be disqualified from GSTV cash payouts are: Earning more than S$34,000, and having an Annual Value of Home (AVH) of S$21,000 or more.

>S$34,000 income earned in 2020

If you're not eligible for GSTV this round, it could simply be that you earned more than S$34,000 of assessable income in the Year of Assessment 2021 (or, your "YA 2021 AI", in typically-Singaporean acronym form).

Simple math: S$34,000 works out to around S$2,833 per month, so if your monthly salary is at least that, no GSTV cash payout for you.

Note that your YA 2021 AI isn't what you earned in 2021.

Rather, it's what you earned in 2020.

This is because the Inland Revenue Authority of Singapore (IRAS) only assesses your income the year after it is earned.

"Can't CPF contributions serve as quick and relatively-foolproof evidence of one's income?" you might ask.

But, that wouldn't be able to capture other income sources such as rental income, or the incomes of those who are self-employed and who may not have CPF contributions.

In other words, yes — there is a one-year lag in assessing how much you really need the cash assistance from GSTV, but if there's a more efficient or faster way of finding out how much Singaporeans are earning, IRAS would definitely want to know.

Annual Value of Home (AVH) S$21,000 or more

Another key criteria that would make some Singaporeans ineligible to get the GSTV is Annual Value of Home (AVH) — or, the estimated gross annual rent of the property where they live, if it were to be rented out.

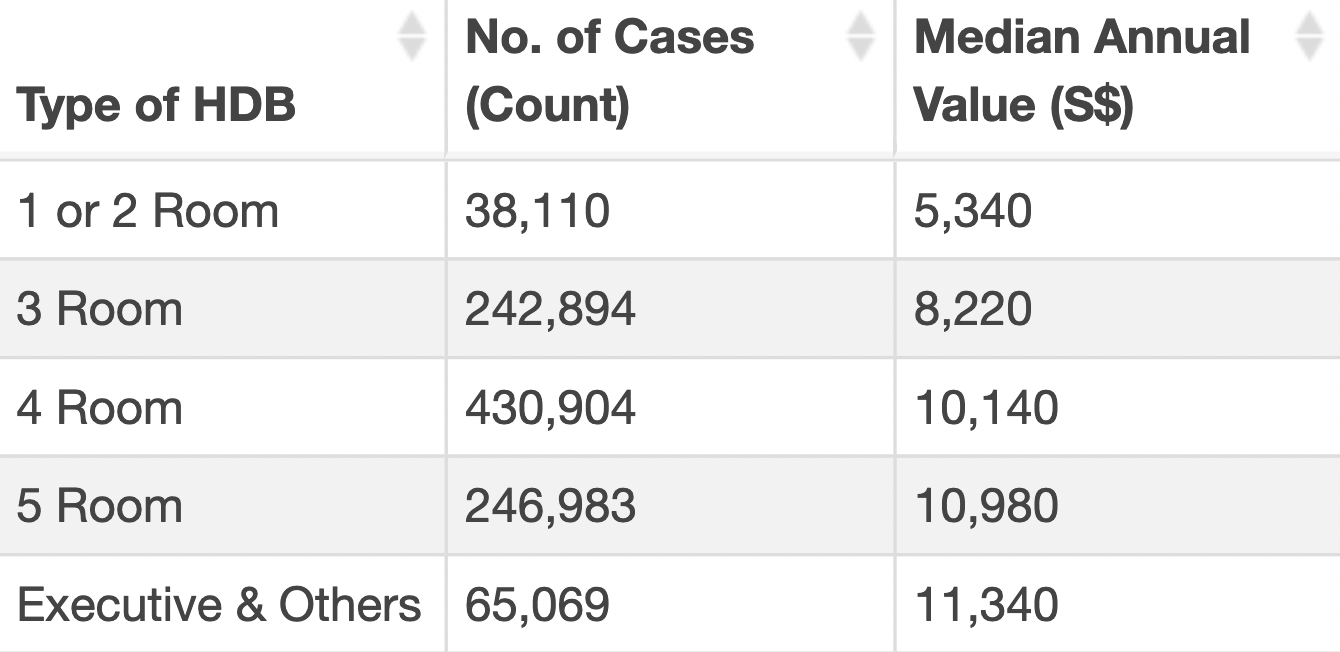

The median AVH for a four-room flat in 2021, according to data.gov.sg, is S$10,140, which works out to S$842 a month.

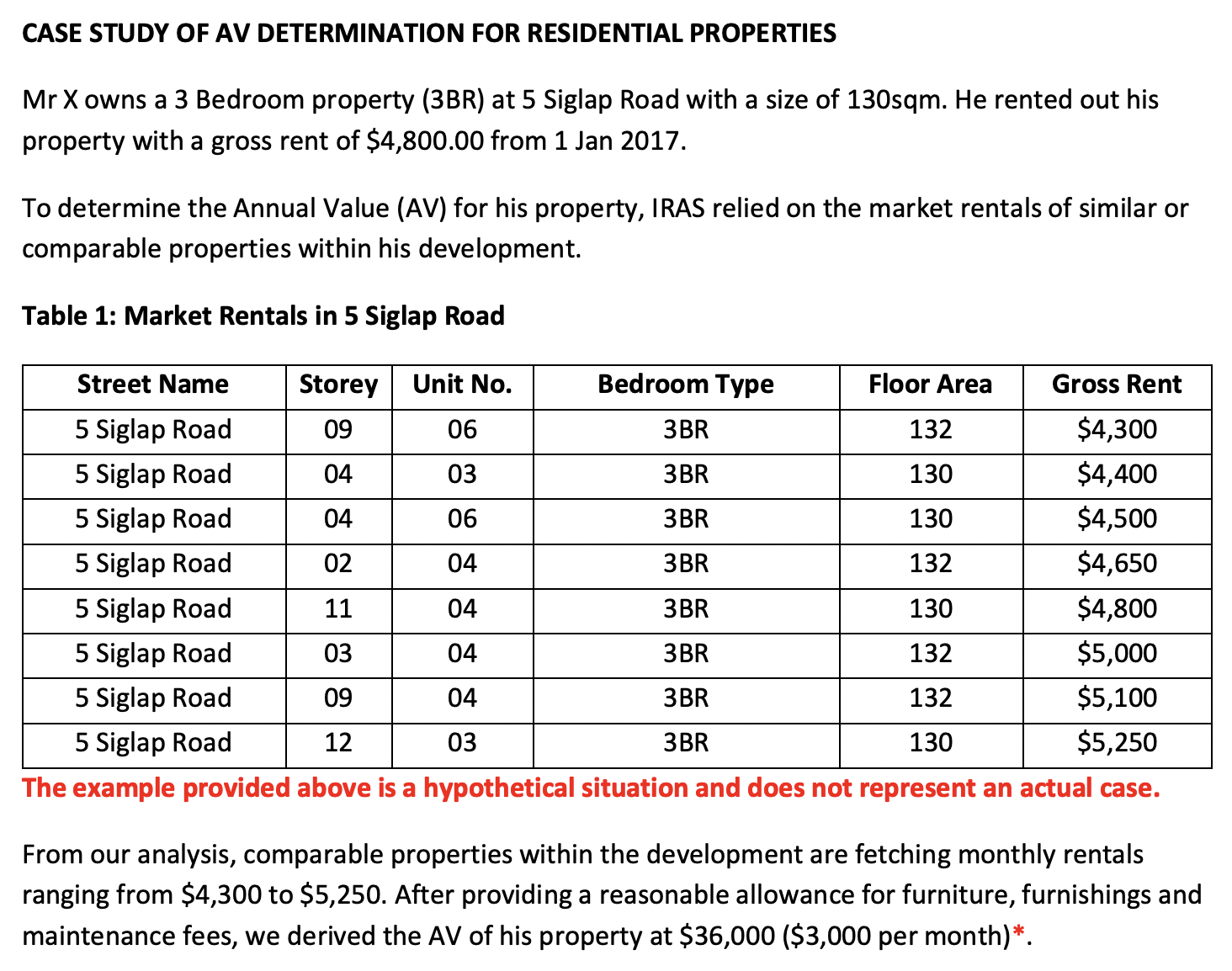

But, as IRAS explains, AVH factors in "a reasonable allowance" for things like furniture, furnishings, and maintenance fees and is thus lower than the actual rental rate.

Here's a case study the tax authority created to explain this, in which a property rented out for S$4,800 monthly is given an annual value based on S$3,000 per month:

Screenshot via IRAS's "Case study of AV determination for residential properties".

Screenshot via IRAS's "Case study of AV determination for residential properties".

Therefore, according to a MOF spokesperson, all HDB flats are under the threshold of S$21,000 AVH, along with "a good number" of condominiums, and even some lower-value landed properties.

Here's the median AVH for different types of HDB flats in 2021:

Screenshot via data.gov.sg.

Screenshot via data.gov.sg.

Why does this number determine your eligibility for this lucrative government benefit of cash with no strings attached?

The short answer is that it's an efficient way of gauging how wealthy someone (and their family) is. The lower the AVH, the more likely the person (and their family) will be in greater need of financial support.

It's straightforward because it zooms in on residential property — likely to be the largest asset a household owns — and uses that as an indication of wealth, instead of trying to capture all of the household's assets (which may include hard-to-value assets like cars, watches, jewelry, and increasingly, cryptocurrency and/or NFTs).

It's efficient, because the AVH of homes in Singapore are already calculated each year (as it determines how much property tax the owners must pay).

Here's more, from an MOF spokesperson:

"There are individuals who may not deriving much income, but have substantial savings or good access to family support. This is why we also look at the Annual Value of the property (“AV”) that the individual lives in, as well as whether the individual owns more than one property, to assess how well-off the individual and his/her family may be."

The spokesperson also added that one's assessable income and AVH are "proxies" that "provide an efficient way for the government to determine eligibility for the GSTV using available data, without requiring citizens to apply individually".

There are some who may be in need due to "extenuating circumstances", but do not meet the criteria, the spokesperson noted. They can write in to MOF via the GSTV website and their situation will be assessed "on a case-by-case basis", said MOF.

Past cash payouts under GSTV scheme

Here's a look back at the past five years' cash payouts under the scheme, which had similar eligibility criteria as this year, but was limited to Singaporeans with assessable income under S$28,000.

- 2017:

- Up to S$300, with a one-off special payment up to S$200 for a max of up to S$500 (amounts depending on AVH).

- Around 1.37 million eligible.

- 2018:

- Up to S$300.

- Around 1.39 million eligible.

- 2019:

- Up to S$300.

- Around 1.4 million eligible.

- 2020:

- Up to S$300.

- Around 1.4 million eligible citizens.

- 2021:

- Up to S$300, with an additional special payment up to S$200 for a max of up to S$500 (amounts depending on AVH).

- Around 1.4 million Singaporeans.

For 2022, more were eligible as the assessable income threshold was increased to S$34,000:

- 2022:

- Up to S$400, with an additional special payment up to S$300 for a max of up to S$700 (amounts depending on AVH).

- Around 1.5 million Singaporeans.

Looking ahead, the eligibility conditions for 2023's GST voucher are similar to this year's, but the payout is set to grow to S$500, depending on one's AVH.

The higher amount is part of the government's moves to "neutralise" the impending GST hikes from Jan. 1, 2023 onwards.

Today you learnt.

Photo by sittikan raingkun from PxHere and via Mothership reader

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.