Here's the single best news you were waiting for – and which you wait eagerly for every year there is a Singapore Budget announcement:

The government will be paying out, depending on how much you earn, $100, $200 or $300 in cash to all Singaporeans aged 21 and up this year.

This on the back of our pretty good budget surplus this year of S$9.61 billion, which comes down to:

- exceptional statutory board contributions, mainly from the Monetary Authority of Singapore of $4.6 billion, and

- increased stamp duty collections from a stronger property market of $2 billion.

$700 million of this bounty will be shared with us, the people.

But before we get to the part you're most interested in, just an FYI:

Here's the breakdown:

1. Assessable income < $28,000: $300

These include retired seniors and students.

2. Assessable income from $28,001 - $100,000: $200

This would catch a good number of working adults.

3. Assessable income > $100,000, or own more than one property: $100

So even the rich aren't left out.

A total of 2.7 million Singaporeans will get this goodie. Woohoo.

Who will get it: All Singapore citizens aged 21 and up

When you'll get it: end-2018 ( :( )

[related_story]

And here's a breakdown of all the other goodies announced:

A) GST vouchers

These will be given to 1.4 million Singaporeans aged 21 and up this year, who have an assessable income of $28,000 or less:

- If your home's annual value is up to $13,000, you'll receive $300, and

- If your home's annual value is between $13,001 and $21,000, you'll receive $150.

Who will get it: Singaporeans aged 21 and up this year, with assessable income of under and up to $28,000

When you'll get it: August 2018

B) U-Save rebates will go up by $20 over next 3 years

This will be increased by $20 per year for the next three years (2019 - 2021), for 900,000 HDB households. This is expected to cover the anticipated increase in electricity and gas expenses that will arise as a result of the new carbon tax.

Here's the breakdown:

1- & 2-room flats

- 2018: $380

- 2019-2021: $400 each year

3-room flats

- 2018: $340

- 2019-2021: $360 each year

4-room flats

- 2018: $300

- 2019-2021: $320 each year

5-room flats

- 2018: $260

- 2019-2021: $280 each year

Executive/multi-generation flats

- 2018: $220

- 2019-2021: $240 each year

Who will get it: everyone staying in HDB flats apart from those who own more than one property

When you'll get it: January, April, July, October 2018 through 2021

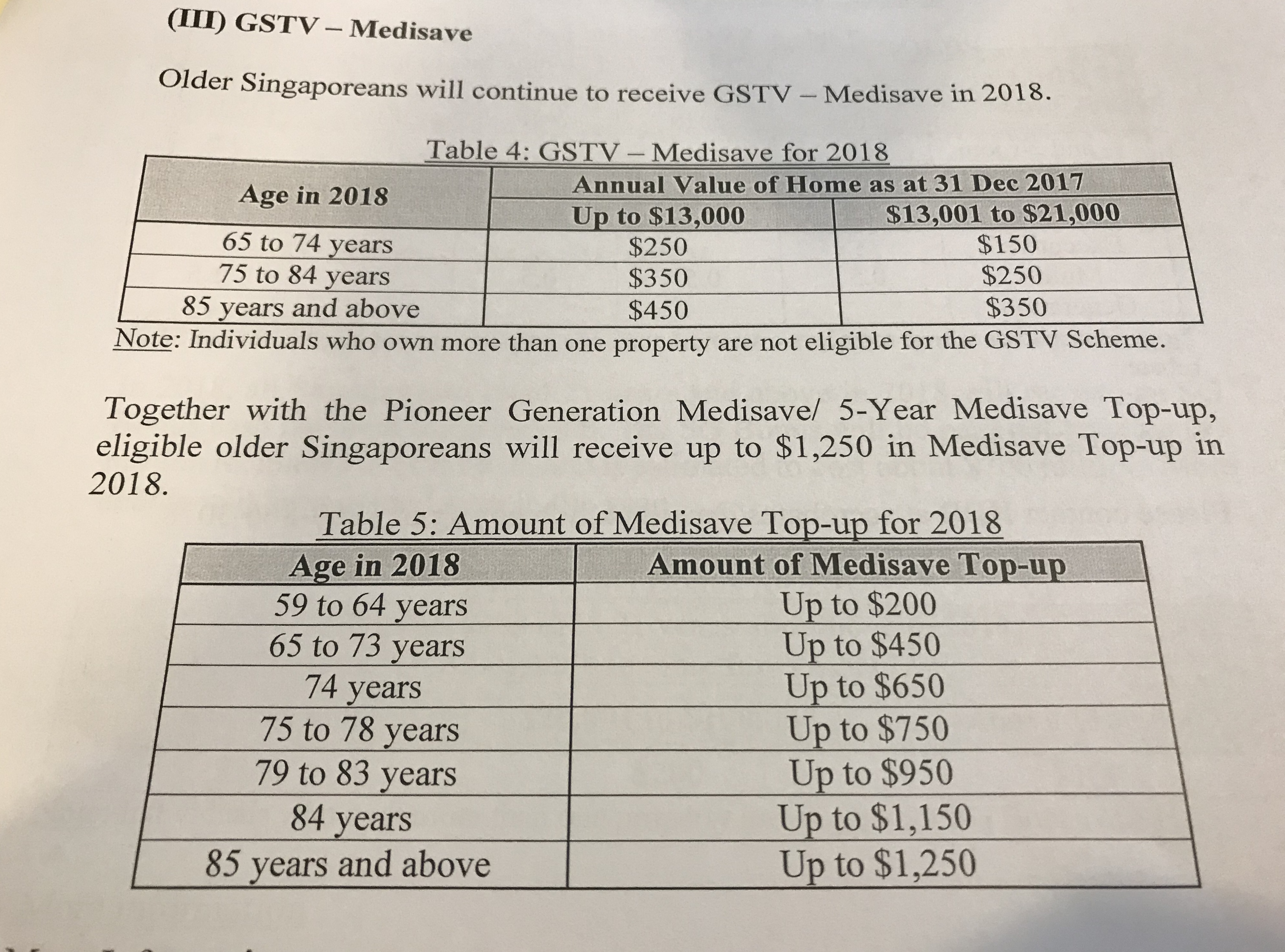

C) Medisave vouchers for the elderly still in place

These continue from previous years, for elderly Singaporeans aged 65 and above, deposited directly into their Medisave accounts.

Here's the breakdown:

Tables via MOF

Tables via MOF

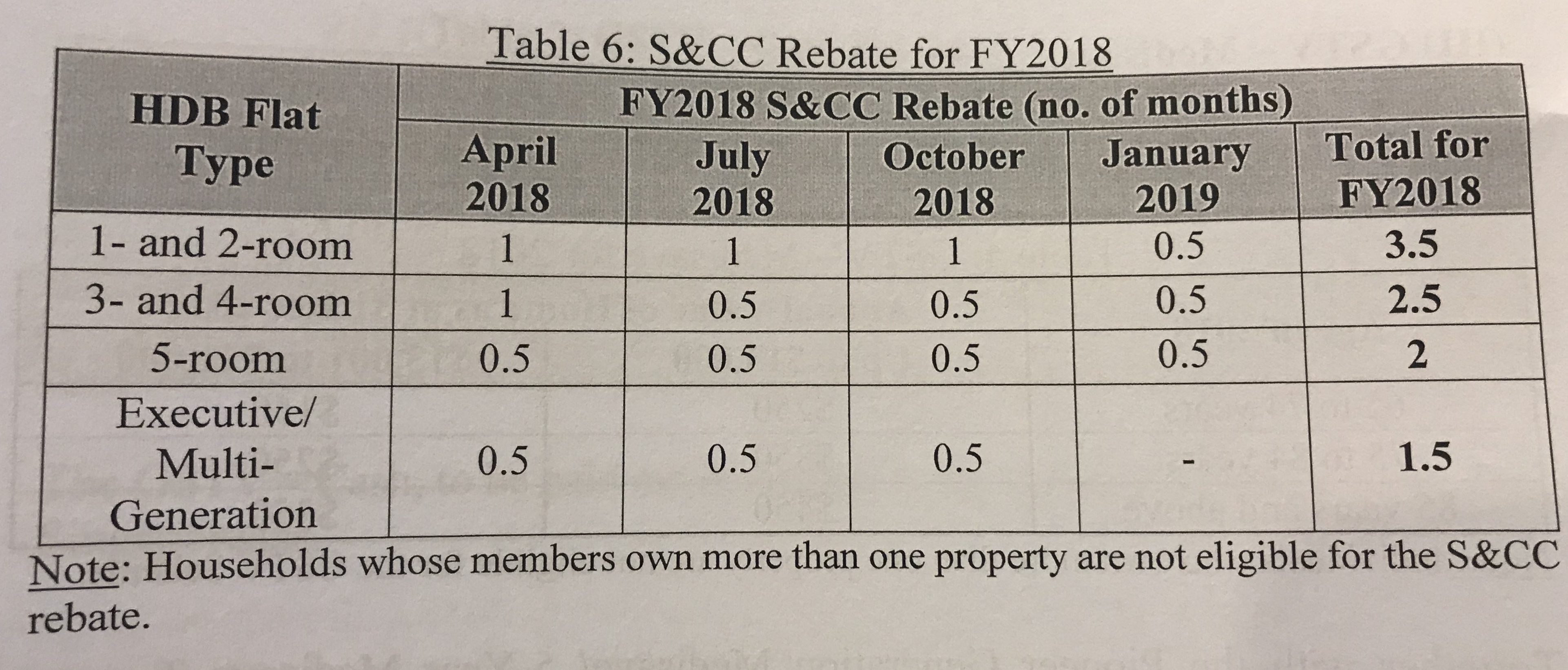

D) Service and Conservancy rebates

HDB households will still receive service and conservancy charge rebates of between 1.5 and 3.5 months.

Here's the breakdown:

Table via Ministry of Finance

Table via Ministry of Finance

E) Increased proximity housing grant for singles & families

For families:

- buying a resale flat to live with their parents or children (married or single aged 35 and up), will receive a $30,000 grant, up from $20,000 currently.

For singles aged 35 and up:

- and buying a resale flat to live with their parents, will receive $15,000 in proximity housing grant, up from $10,000 currently.

- and buying a resale flat to live near (within 4km) their parents' home, will receive $10,000 in proximity housing grant.

And yes, you might have noticed — the definition of "near" will also be changed effective immediately — it's now defined as within 4km instead of being in the same town or within 2km distance.

When this will happen: Immediately

Who will benefit: People buying resale flats, in particular singles aged 35 and up

F) More money for schooling kids

1) Higher Edusave contributions

Primary school students will receive a top-up of $230 from 2019 onwards, up from $200 at the moment.

Secondary school students will see an increment of $50 in contributions from next year onwards, from $240 to $290 annually.

2) More money given out in financial assistance scheme bursaries, Edusave Merit Bursary

Pre-university students in need will receive an increased quantum in bursaries, to $900 from $750 currently.

Under the School Meals Programme in secondary schools, more meals will be covered as well.

For these bursaries, as well as the Edusave Merit Bursary and Independent School Bursary, the qualifying income criteria has been raised to $6,900 (gross monthly) and $1,725 (per capita).

Top photo adapted from gov.sg by Tan Guan Zhen

Here are some totally unrelated but equally interesting stories:

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.