Peter Tan Shou Yi is being sued by Prudential for S$2.5 billion for allegedly trying to recruit 250 top agents from Prudential to Aviva.

The High Court trial commenced on July 16, 2019.

According to the Straits Times, Tan is being sued by Prudential for "significant and long-lasting loss" over the alleged poaching of their 250 agents.

Which apparently left them without agents for 70,000 policies.

Prudential further alleged that Tan instigated 221 agents and 23 agency leaders to join Aviva Financial Advisers in mid-2016.

The S$2.5 billion number was derived from the estimated loss in profits based on the assumption that the agents would have stayed on in Prudential for perpetuity.

According to the Business Times, Tan had allegedly promised a team of 250 as part of his 10-year contract with Aviva.

This was allegedly part of Aviva's war chest of S$100 to S$150 million to gather a base of 250 agents

Prudential is claiming that Tan's actions breached contractual obligations of non-solicitation that were established in an agency instruction sent to agents.

Tan's defence is that the terms don't apply to him, as the agreements he had signed did not reflect this instruction.

Peter Tan organisation

But who exactly is Peter Tan?

Well, some might know him as the incredibly successful Prudential agency manager.

In fact, according to BT, from 2011 to 2015, PTO was the top producer in Prudential, accounting for S$141 million in new business profits and a total annual premium equivalent (APE) of S$192 million.

APE is a measure used for comparison of life insurance revenue by normalising policy premiums into the equivalent of regular annual payments.

Tan, however, didn't have the smoothest of journeys to the top.

According to an interview with Millionaire Asia, Tan revealed some of the hardships he faced.

Growing up, Tan had to cope with just one meal a day at times, and an extended family that did not care for him.

Money was so tight, he even climbed into a monsoon drain to retrieve a 10-cent coin that had dropped inside.

Insurance

Tan scored a scholarship with the Singapore Armed Forces and earned his Masters in Defence Technology, and an MBA in banking and finance, and qualifications as a Chartered Financial Analyst.

He eventually decided on insurance as a career.

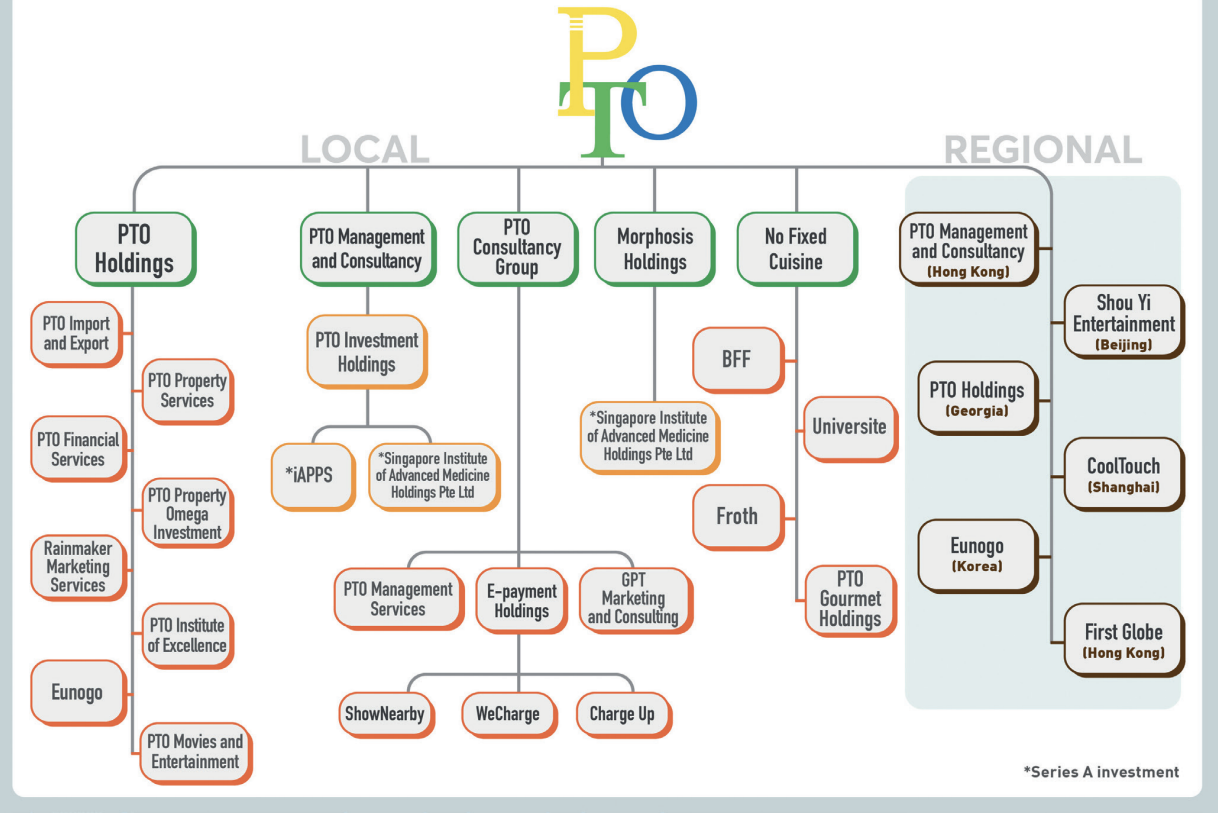

Despite only earning S$200 during his first month in insurance, success soon came rolling in, and he would eventually establish business conglomerate PTO Holdings.

Here is a nifty little flowchart showing just how expansive it has become.

Screenshot from Millionaires Asia

Screenshot from Millionaires Asia

Tan also shared with Millionaire Asia his vision of turning PTO Holdings into a "billion-dollar unicorn".

Tan also models himself as a sales savant of sorts, even adopting nicknames like "Sales Godzilla".

But being a salesman, even one of Godzilla-esque capabilities doesn't really capture what Tan has set out to do.

Motivational guru

Here is how PTO described Tan in one of their write ups:

"This preview gives you a chance to engage with Peter Tan whom many industry experts regard as the best management guru in Asia."

Here are a series of videos uploaded on PTO's YouTube channel.

In it, Ann Kok, yes that Ann Kok, is searching for insights, wisdom, and finding answers.

And she tries to basically understand the intricacies of life by having a cup of coffee with Tan.

Here's just one of 12 videos where Tan imparts life skills to Kok.

The video usually ends with asking people to find out more about the tools of success by going to the website.

Tan has also written 30 motivational books, and lives by the phrase "live to inspire, and inspire to live".

He is, after all, also dubbed the management Godzilla.

Unsurprisingly, there are a lot of testimonials regarding his mentorship and management.

And one might wonder if there were issues of loyalty involved in the mass migration of agents to Aviva.

This was a point that came up during the trial, with Paul Tan who is part of the team, from Rajah & Tann, representing Prudential.

Here's his quote according to ST:

"The defendants would like the court to believe that this mass migration... was the result of coincidence, normal attrition, and possibly even loyalty to (Mr Tan).

One swallow may not make a summer, but 244 agents make it an unlawful, illegitimate en bloc solicitation of Prudential's agents."

The trial is set to run for 65 days.

Images from PTOIE

Content that keeps Mothership.sg going

?️?

Want to go JAPAN this year or not??

?

This is why everybody deserves a second chance.

??

Click here if you need some tear-jerking wholesomeness

??

Got burning questions for the CPF Board?

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.