It's been a rather eventful beginning of the week, with Uber’s sale of its Southeast Asian assets to Grab.

With it came rumours, stories of unceremonious departures from Uber's offices... and even a piece of what can legitimately be defined as "fake news".

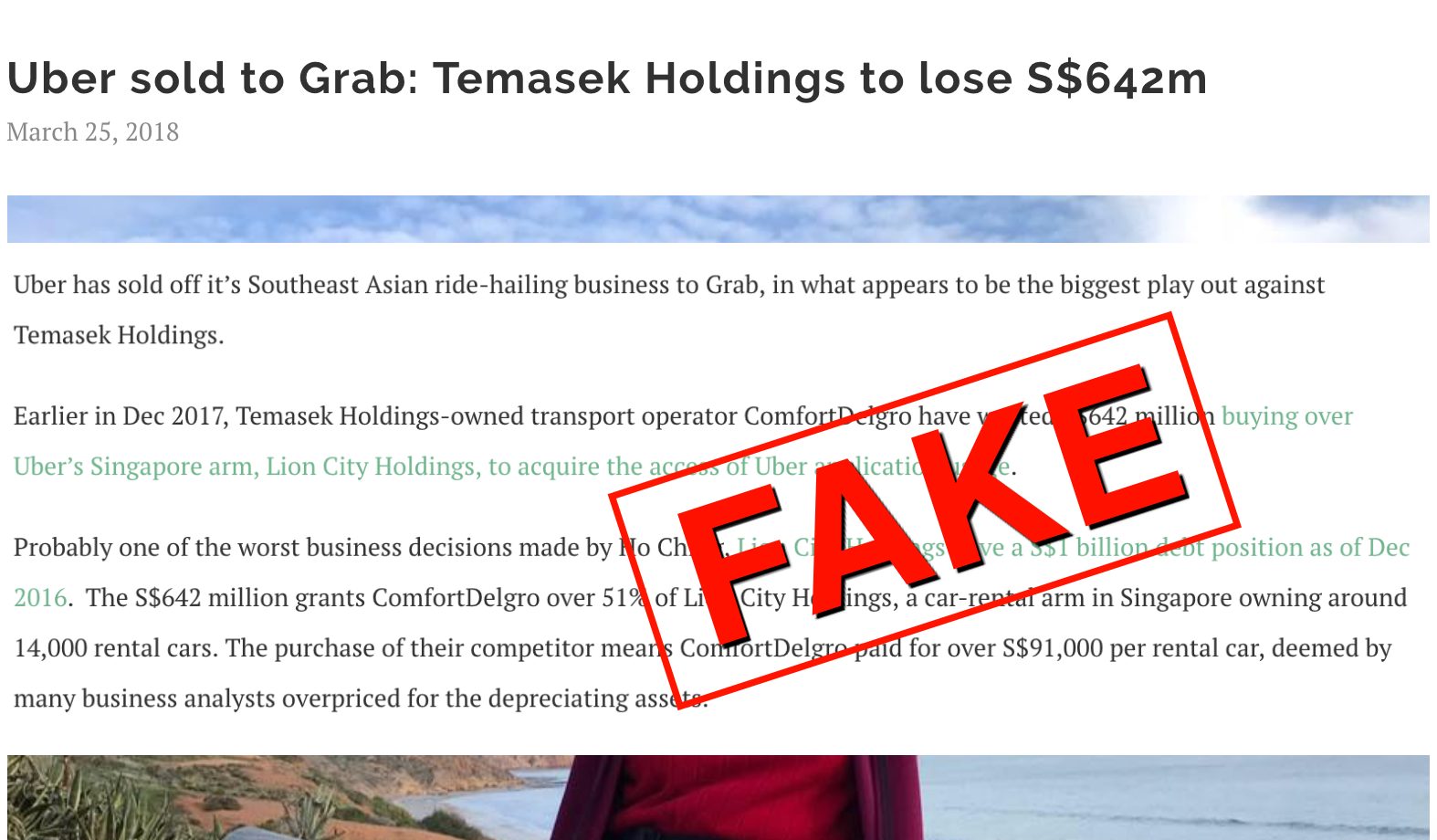

Amid the flurry of reports analysing the event itself, its announcement and the fallout that ensued, one local website ran an article on Sunday, Mar. 25, claiming that "Temasek Holdings" will lose S$642 million in the transaction:

Screenshot via States Time Review's website

Screenshot via States Time Review's website

In its article, the author claimed the following:

"Temasek Holdings-owned transport operator ComfortDelgro have wasted S$642 million buying over Uber’s Singapore arm, Lion City Holdings, to acquire the access of Uber application usage."

And in another part of the article, this skilled computation was included:

"... the S$642 million grants ComfortDelgro over 51% of Lion City Holdings, a car-rental arm in Singapore owning around 14,000 rental cars...

(Also,) the purchase of their competitor means ComfortDelgro paid for over S$91,000 per rental car, deemed by many business analysts overpriced for the depreciating assets."

So here are two problems with these bald assertions:

1) Temasek has no stake or investments in ComfortDelgro or Uber

A spokesperson for Temasek (yes, by the way, it's called Temasek now, not Temasek Holdings) confirmed to Mothership that it is not an investor in ComfortDelgro. Nor does it own any stake in the company whatsoever.

Neither does Temasek hold any part of Uber, or its wholly-owned subsidiary Lion City Rentals — so in essence, the above paragraphs aren't worth the internet real estate they are typed onto.

2) Temasek *is* a shareholder in Grab, though.

But since we're talking about Uber and Grab and who has a stake in them, now might be a good time to explain that one of Temasek's funds is in fact an existing shareholder in Grab.

Vertex Ventures, the name of the fund, which is a standalone entity with its own management, investment committee and Board, participated in Grab's Series A round of financing back in 2014.

It is also a subsidiary of Temasek — it is one of its investment platforms — i.e. Temasek, as a Limited Partner, puts money with Vertex, and Vertex decides on its own what to do with the money, but of course strives to make plenty of it in order to share returns on Temasek's money to Temasek.

[related_story]

But here's the difficulty with this entire thing:

Here's a list of facts of our own about States Times Review (STR), the site that published this article.

- It's owned and run by one Alex Tan, who is a permanent resident in Australia and who formerly stood as a Reform Party candidate in the 2011 General Election in Singapore.

- What this means is that STR essentially does not require the Singapore government's approval to operate.

Why? Tan and his site are both based and hosted there, and so it doesn't come under the government's broadcasting (class licence) notification (which was the lever it used against The Real Singapore, soon after Ai Takagi and Yang Kaiheng started living and publishing to the website from here), so there is still nothing here that can stop the site from publishing.

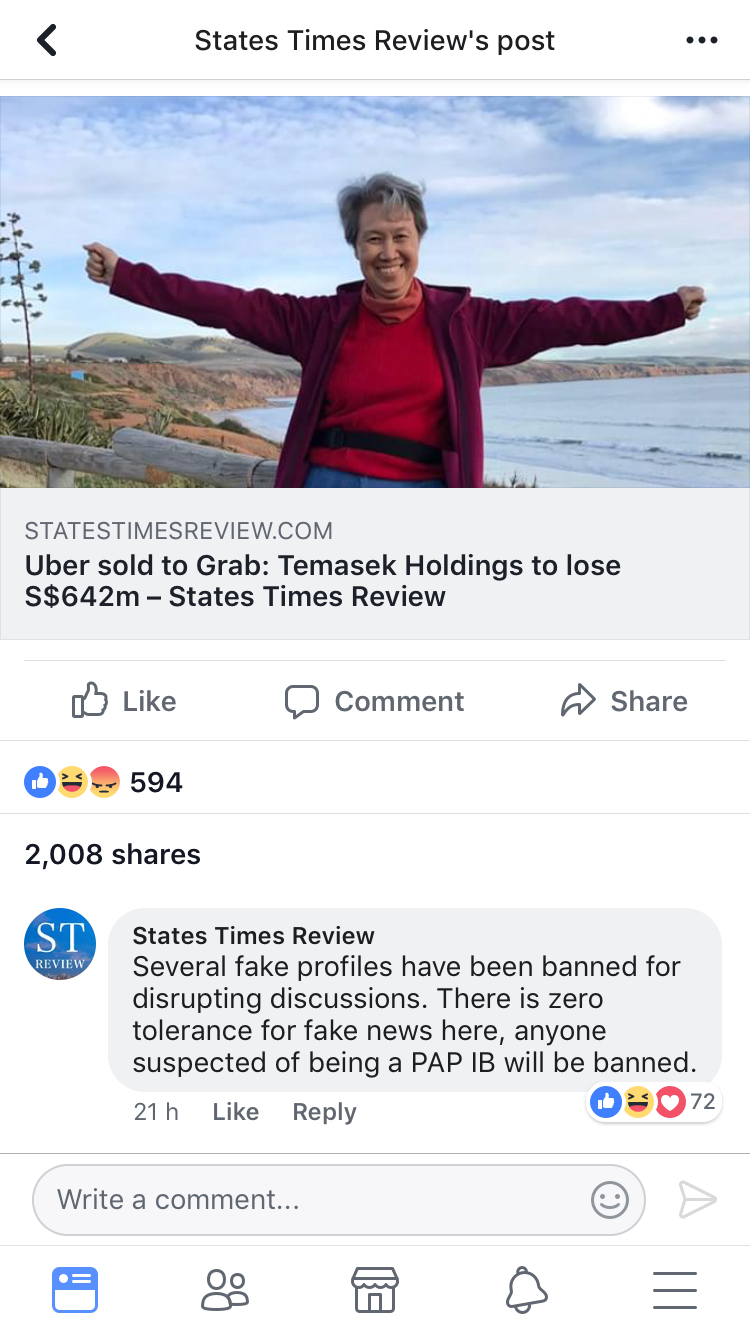

At the moment, despite its immense inaccuracies, the article is still up, and has seen substantial circulation on Facebook:

Screenshot from Facebook

Screenshot from Facebook

And here's the number of shares from its Facebook post too — do take the time to check out their comment on it as well:

Screenshot from STR's Facebook post

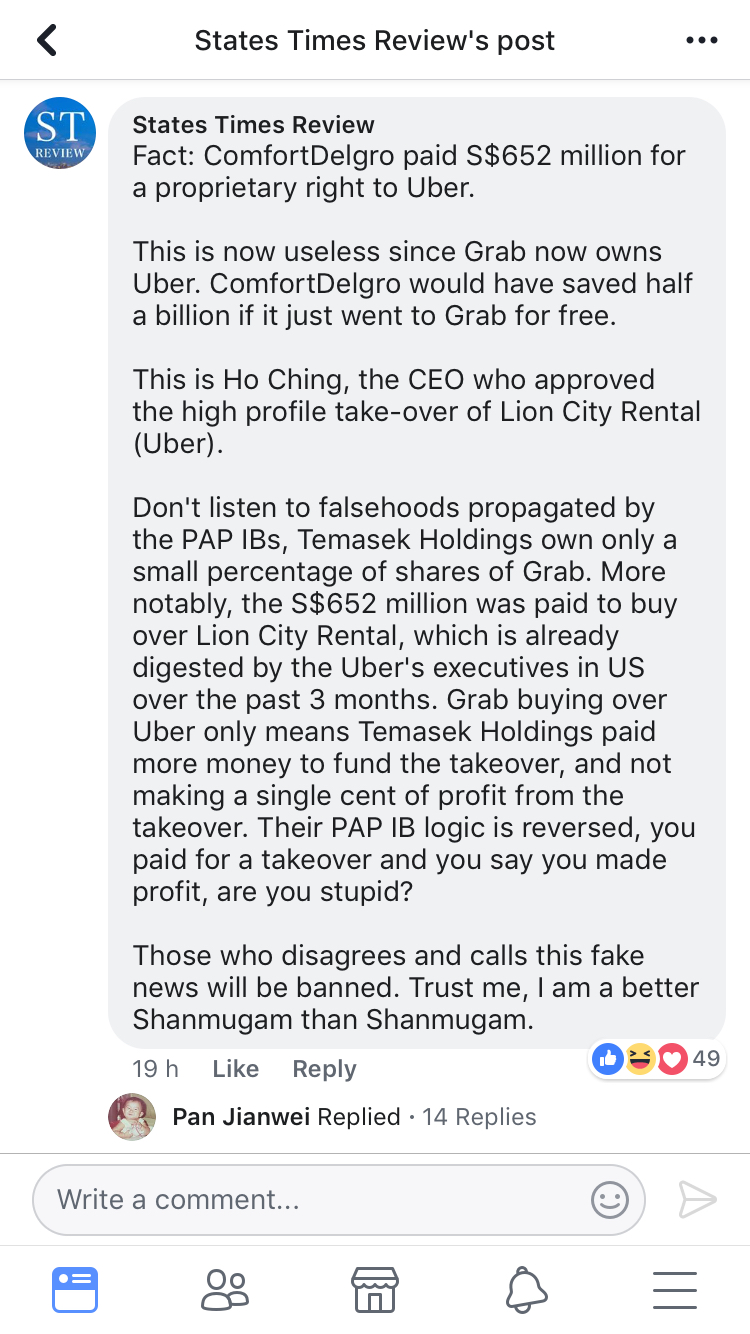

Screenshot from STR's Facebook post

And here's a follow-up comment from STR stating that it is a "better Shanmugam than Shanmugam":

Screenshot from STR Facebook post

Screenshot from STR Facebook post

Enough Internet for today.

Top image adapted via States Time Review's website

Here’s a totally unrelated but equally interesting story:

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.