Follow us on Telegram for the latest updates: https://t.me/mothershipsg

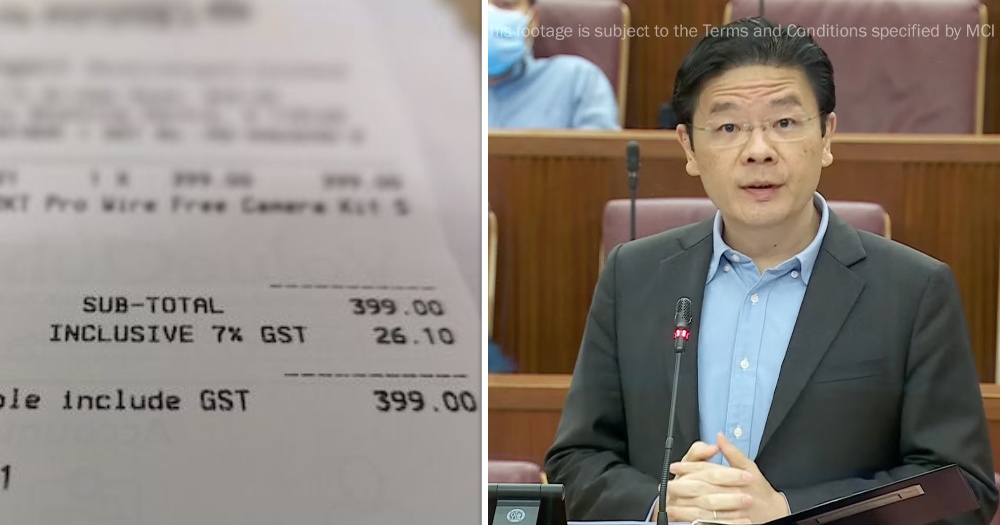

The increase in Goods and Services Tax (GST) will be delayed till 2023, said Minister for Finance Lawrence Wong in Parliament, as part of the 2022 Budget statement (Feb. 18).

The increase will be staggered over two steps.

The first increase will take place in Jan. 2023, from seven to eight per cent, followed by another increase from eight to nine per cent in Jan. 2024.

Wong shared that the revenue from the increase in GST will go towards supporting healthcare expenditure and to take care of older Singaporeans.

This is the first time that Wong is delivering the Budget statement, since he took over as Finance Minister in 2021.

Details

In his speech, Wong stated that the GST will continue to be absorbed on publicly-subsidised healthcare and education.

Wong added that town councils will be provided with an additional S$15 million per year to absorb the additional GST payable on services and conservancy charges.

There will also be no increase in government fees and charges for one year from Jan. 1, 2023. This will apply to license fees, as well as fees charged by government agencies for the provision of services.

To address concerns that businesses might use the increase in GST as an excuse to raise prices, a new Committee against Profiteering will be set up. This will be headed by the Minister of State for Trade and Industry Low Yen Ling.

Close to S$40 million will also be set aside under the Productivity Solutions Grant (PSG), so businesses can apply for subsidised accounting and point of sale solutions.

Wong added that an additional top-up of S$640 million to the previously announced S$6 billion Assurance Package will be provided.

This is expected to cover at least five years of additional GST expenses for the majority of Singaporean households and about 10 years' worth for lower-income households.

A long time coming

The two per cent planned increase in GST, from seven to nine per cent, was first announced in 2018 by then-Finance Minister Heng Swee Keat.

The hike was meant to take place between 2021 to 2025.

In 2020, Heng announced that the GST hike would not take place in 2021, considering revenue and expenditure projections, and considering the economic outlook.

More details were given during Budget 2021, with Heng specifying that the hike was likely to be implemented sometime from 2022-2025, and will happen "sooner rather than later".

The Workers' Party (WP) called for an avoidance of the GST hike in the same year, in favour of other approaches, like easing rules to allow for a greater Net Investment Returns Contribution.

Drawing focus to Singapore's path for 2022, Prime Minister Lee Hsien Loong cited a need to raise GST in his New Year's message on Dec. 31, 2021, now that the economy is emerging from Covid-19.

He shared that Budget 2022 will "lay the basis" for sound and sustainable government finances for the next stage of Singapore's development.

Ahead of the statement, Wong also touched on a need to invest more in "our people" and "our social infrastructure" on Feb. 9.

He shared that a GST increase will help generate the revenues needed, to fund Singapore's growing healthcare needs and better take care of senior Singaporeans.

Related stories:

Follow and listen to our podcast here

Top image via Joshua Lee and MCI Singapore YouTube

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.