The Goods and Services Tax (GST) will be raised from 7 per cent to 9 per cent, at an unspecified time between 2021 and 2025.

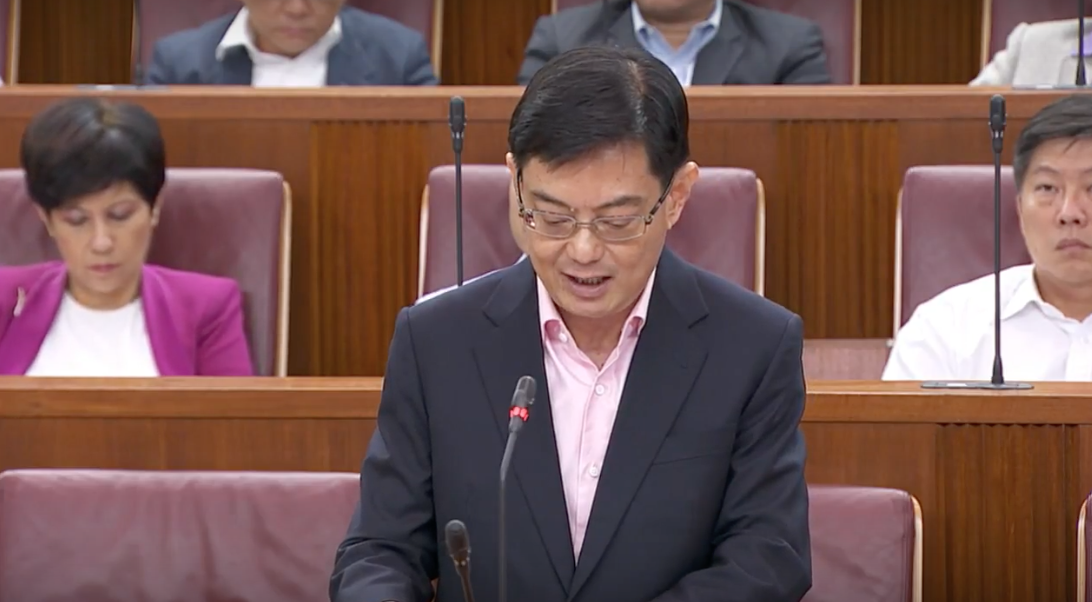

Minister for Finance Heng Swee Keat announced this widely-anticipated decision during his 2018 Budget statement in Parliament on Feb. 19, 2018.

GST hike: From 7 to 9 per cent

In 1994, GST was introduced in Singapore at 3 per cent.

It was raised to 4 percent in 2003, 5 per cent in 2004, and then 7 per cent in 2007.

Currently at 7 per cent, our GST is one of the lowest in the world.

GST will be increased to 9 per cent between 2021 and 2025.

According to Heng, this move is in preparation for expected expenditure in healthcare, infrastructure, security and education from 2021 to 2030:

"Between 2021 to 2030, if we do not take measures early, we will not have enough revenue to meet our growing needs."

Supporting the lower and middle-income

GST will be implemented in a progressive manner.

It will continue to be absorbed on publicly subsidised education and healthcare.

In order to support lower and middle-income brackets, there will be an offset package.

When the GST is increased, the permanent GST voucher scheme will also be enhanced with a S$2 billion top up - Up from the S$800 million disbursed each year.

[related_story]

Other things you may need to pay for

Other than the GST hike, there will also be other measures that potentially affect Singaporeans.

Carbon tax

To encourage businesses to reduce their carbon emissions, a carbon tax will be introduced on all facilities producing 25,000 tonnes or more of greenhouse gas emissions per year.

This decision is part of Singapore's commitment to address climate change and to improve our energy efficiency.

The tax of $5 per tonne of carbon dioxide-equivalent will be introduced from 2019, and the rate will be reviewed by 2023.

But what does this mean for consumers?

Even if power generation companies pass on the full costs of the carbon tax to consumers, the increase is likely to be minimal at about one percent (or about $0.30 to $1.10 per month).

However, in order to help households adjust, U-Save rebates will be given to eligible HDB households for three years. These rebates are expected to cover the expected increase in electricity and gas expenses arising due to the tax.

Foreign domestic worker (FDW) levy

For the past 10 years, the demand for FDWs in Singapore has increased by 40%.

And currently, about 80% of Singaporean FDW employers are paying a concessionary levy of $60 per month.

In order to meet the changing demands, there will be three changes in the FDW levy framework as of April 1, 2019:

- For the first FDW employed without levy concession, the monthly levy will be raised from $265 to $300.

- For the second FDW employed without levy concession, the monthly levy will be raised from $265 to $400.

- The qualifying age for levy concession under the aged person scheme will be raised from 65 to 67 years.

However, households with persons aged 65 and 66, which are under the aged person scheme, will continue to pay the same rate of $60.

Imported services tax

Currently, GST is only applicable on imported services provided by an overseas supplier if it has an establishment in Singapore.

However, with the advent of the digital economy, it is increasingly common for services to be obtained from overseas suppliers without a presence here.

From Jan. 1, 2020, GST will be introduced on imported services such as consultancy, marketing, apps and music purchased from overseas suppliers.

This will affect both Business-to-Business and Business-to-Consumers imported services, and not e-commerce for goods.

Top photo screenshot from Budget livestream.

Here are some totally unrelated but equally interesting stories:

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.