Follow us on Telegram for the latest updates: https://t.me/mothershipsg

It's Build-to-Order (BTO) application season again, with 3,740 flats being put up for sale last week by the Housing and Development Board (HDB).

The offerings include units in the highly-sought after locations of Kallang/Whampoa and Toa Payoh, which may be of interest to those seeking a place near to the CBD.

These flats won't come cheap, however, with prices for 4-room flats in the McNair Heights development starting at a cool S$532,000, excluding government grants.

In deciding which neighbourhood to ballot for, potential buyers might be thinking about an additional variable this time around: the prospect of future price controls, as well as further cooling measures.

Price controls to be expected

Last November, Minister for National Development Desmond Lee said that new regulations for HDB flats built in prime locations would be introduced.

The objectives of the new regulations, as he explained them, were as such:

- To prevent flats in prime locations from becoming the exclusive domain of the more affluent members of society.

- To prevent prices being pushed up as properties are traded, to the point that they are unaffordable for "ordinary people".

- To address the issue of fairness, as BTO buyers in prime locations receive a "windfall" from higher subsidies on the initial purchase price, as well as greater room for price appreciation in future.

What new measures can be expected?

Soon after, at an event in Jan. 2021, Deputy Prime Minister (DPM) Heng Swee Keat said that the government would pay "close attention" to the stability of the property market so that young Singaporeans could continue to own homes.

While specific policies were not spelled out by Lee and Heng, Lee said that resale transactions of hotly-demanded units would be restricted, so their prices would be moderated.

Meanwhile, Heng's reference to stability, and saying that the government did not want the property market to "run ahead of the underlying economic fundamentals" echoes the language used when cooling measures have been announced.

Given how Heng noted "some gathering of momentum in prices" in Singapore, the concern he was addressing was more likely to be prices rising too quickly, as opposed to a stagnation or slowdown in the market.

In fact, past press releases announcing cooling measures for the property market also emphasised the importance of "economic fundamentals", and stability in the property market (specifically, that it should remain "stable and sustainable").

Similar language was used in 2018 , 2013, 2011, and 2010. Screenshot from MAS website.

Similar language was used in 2018 , 2013, 2011, and 2010. Screenshot from MAS website.

With that in mind, here's a look at past implementation of cooling measures, as well as past and present policies to control the prices of HDB flats. While these do not necessarily predict new policy measures to come, they might provide some indication for the future.

Cooling measures that have been implemented previously

"Cooling measures", for the uninitiated, refers to government intervention to slow down property transactions and restrict price increases.

The government in 2018 said that there had been a "sharp increase in prices", calling for measures to "cool the property market" and "keep price increases in line with economic fundamentals."

Two changes were announced: raising Additional Buyer’s Stamp Duty (ABSD) rates and adjusting the Loan-to-Value (LTV) limits.

Raising ABSD didn't impact HDB market much previously

Back in 2018, changes to the rate of ABSD impacted the market for HDB flats much less significantly than the private property market.

The rate of ABSD remained inapplicable (or, at zero per cent) for Singapore Citizens purchasing their first property, such as first-time BTO buyers.

And while ABSD was raised to 12 per cent for those buying a second property, it could be waived if they sell their first property within a specified time limit — which would be required under HDB rules anyway.

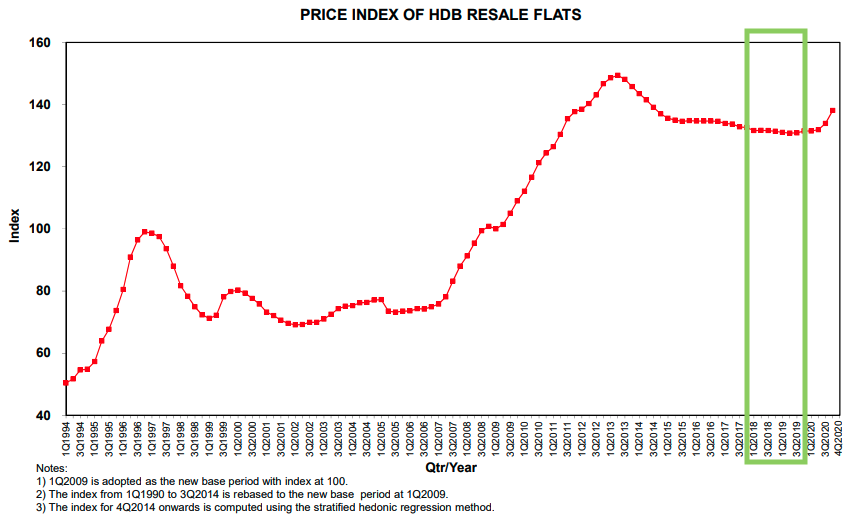

HDB Price Index via HDB website.

HDB Price Index via HDB website.

The hike in ABSD rates in 2018 can therefore be seen as mainly targeting the private property market.

However, DPM Heng's recent comments suggest that if new measures were to be implemented, it would include the HDB market as well.

This is because he spoke about helping young Singaporeans own homes — and likely isn't referring to merely keeping condo prices down so we young people can all go buy one.

Therefore, if the government were to use ABSD to control the price of HDB flats, it would have to be applied in a different way than it is currently, rather than simply increasing the rates under the current rules.

How might the HDB resale market be cooled through ABSD?

ABSD could be used to cool the HDB resale market.

However, to have a significant impact, it would have to be imposed on the largest and most significant group of HDB resale flat buyers: existing homeowners buying a resale HDB property (as opposed to first-time homeowners looking for a resale flat).

This would be a drastic change from the current arrangement, where HDB buyers do not pay any ABSD.

Imposing ABSD (or, a similar tax) would likely slow down the rate of transactions in the resale market in the same way that it did for private properties in 2018.

Could Loan-to-Value ratios be further tightened?

In 2018, LTV ratios were tightened, restricting potential homebuyers in terms of how much of their property could be paid for with a loan from a bank or financial institution.

This could have the effect of cooling the property market by cutting down on speculative purchases — in other words, purchases by those hoping to borrow heavily so they can acquire property that might be beyond their means, in hopes that the prices will rise.

If LTV ratios were further tightened, it means that potential homebuyers would — in general — need to look at purchasing cheaper properties, or save up for longer before purchasing a home.

Tightening LTV ratios would cool the market, but have unwanted consequences

However, Minister Desmond Lee's comments in late 2020 make it clear that price control policies are in the works specifically for HDB flats in prime areas.

Therefore, if LTV ratios are tightened, it would all the more mean that relatively-pricier prime-location flats would only be feasible for richer folks, while growing ever-more out of reach of those with lesser means.

What other ways are there to control HDB prices?

Tightening the current cooling measures by changing ABSD rates and LTV ratios are two ways to moderate prices, though in a much more drastic way that affects the entire market.

But there are many other existing policies that can possibly be tightened or tweaked, to control HDB resale prices.

Increasing supply not feasible

One obvious way to keep prices low is to maintain, or increase, the supply of new flats.

However, this would be unsustainable in the long run. As former Minister for National Development noted in a 2019 speech, "we cannot simply meet demand through building new BTO flats entirely, because there may be a risk of oversupply of such new flats."

Price-setting not in line with "economic fundamentals"

Another theoretically-possible way to ensure that those who are not wealthy can still live in prime areas would be to set price ceilings for new or resale flats in those areas, by mandating that they should not be sold above certain stipulated prices.

However, this would not be in line with "economic fundamentals" spoken of by the government, since the prices of prime-area properties would be artificially kept low, even while they are still in hot demand.

Ways to lower the market value of new flats

Therefore, since controlling prices by adjusting the supply of flats, or by setting prices are both not feasible, the only other way is to lower the value of the flats.

There are at least four possible ways to lower the market value of new flats while keeping to "economic fundamentals".

1. Build smaller new flats

One way to lower the value of flats is to build smaller flats, which have lower market value, and can be priced accordingly. Building more of the smaller 3-room and 4-room flats would allow for more flats to be constructed in any given development, and therefore keep the prices of the units at an affordable level for more homebuyers.

In fact, this is actually already happening in prime areas.

There have been three BTO projects in Kallang/Whampoa in the last two years (Feb. 2019, May 2019, and Feb. 2021), with each of them offering 3-room flats and a limited number of highly-oversubscribed 4-room flats, with no 5-room flat option.

This was also the case for other recent projects in highly-popular areas, such as Toa Payoh in Feb. 2020, Geylang in Aug. 2020, and Bishan in Nov. 2020.

Could 4-room flats possibly be phased out for future developments in prime areas?

2. Shorten leases of new flats

Another way to lower the value of flats in prime areas is to shorten the leases for new flats.

While most new HDB properties start off with 99-year leases, shorter leases are not unheard of — with the recent Feb. 2021 BTO launch offering a number of 2-room Flexi flats at McNair Heights on short leases of between 15 and 45 years.

However, these are offered only to those aged 55 and above, meaning that new flats with shorter leases targeted at young Singaporeans would be quite a game-changer.

Shortening the lease of a given HDB unit would reduce its initial selling price, since buyers are getting the same product, but for a shorter time.

Also, as the leases run down over time, there would be less incentive for potential buyers to bid up the prices of these properties. Those seeking to purchase the properties for speculative purposes would likely be deterred as well, since they would have a shorter window of time to re-sell the property to a subsequent buyer.

3. Set longer Minimum Occupation Periods (MOPs)

Currently, anyone who purchases a HDB flat (except a 1-room flat) is required to live in it for a minimum time period (usually five years) before it can be sold, or before another property can be purchased.

A longer MOP, implemented specifically for buyers of new prime-area flats, would serve as a disincentive to homeowners, making it less attractive for them to sell their flats, said an expert interviewed by The Straits Times.

However, it would also have the effect of limiting the number of times a property can be bought and sold before it is returned to the government.

For example, a flat with 91 years remaining on its lease could be sold up to 18 times with a five-year MOP for each new owner, but would only see a maximum of 13 transactions if the MOP was lengthened to 7 years.

This could also create an unintended effect of pushing prices upwards, since the supply of flats available to be sold at any given time would be reduced, meaning that competition for such flats is stiffened.

4. Restrict owners further

Another way to lower the value for both new and existing flats is to tighten the rules on what homeowners are allowed to do with their homes, for example, in terms of renting out or subletting the properties. The rules, restrictive as they are, could be tightened more.

This would deter a group of buyers who are not seeking to be "genuine" homeowners — those looking to make a buck via rental income, and not for a home to live in.

With less buyers in the market, prices are more likely to remain stable.

Other unanswered questions

There are some unanswered questions that remain with regard to possible price control policies.

What is a prime area?

While Minister Desmond Lee spoke of regulation for flats in prime areas, there is currently no available list of the exact locations which are considered prime areas.

Areas such as Tanjong Pagar, Bras Basah, Kallang, Geylang and so on are unlikely to be excluded from the list of prime areas, due to their proximity to the CBD.

However, would areas like Bishan — located much farther from the CBD — be counted on the list as well, given its superlative accessibility, as well as a recent slew of S$1 million HDB transactions?

And what of Jurong, long touted as a second CBD?

The government's definition of a "prime area" will be of keen interest to potential homeowners, given that it will be subject to new regulations.

Top image via Singapore Tourism Board website

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.