Hyflux is a global environmental solutions company founded in 1989 by Singaporean businesswoman Olivia Lum.

You might have seen a few Hyflux-related articles on your timeline recently.

The most prominent one arguably about Lum, as the Hyflux CEO, receiving flak for her massive remuneration as her company is in trouble financially.

But here's the thing: Hyflux has been in quite a bit of trouble for some time now.

In 2017, it experienced its very first full year of losses, of S$81.9 million.

In May 2018, things got so bad that they applied for a court-supervised process to reorganise their liabilities and businesses.

And just how bad had things become by then?

To re-cap: In 2010, Hyflux was worth around S$2.1 billion.

In 2018, they had a market value of S$165 million.

That's a near two billion decrease in value.

So, now we see the scale of what happened, let's go on to how this happened.

Hyflux has pinned the blame mainly on the "prolonged weakness" in the local power market.

One of the most symbolic signs of their decline has been Tuaspring.

Here it is.

It is the largest desalination plant in South East Asia, with a designed capacity of 318,500m³/day of desalinated water.

The plant had a book value of over S$1.4 billion.

To understand how hyped the plant was, here's a video from 2016, espousing the potential benefits of the plant.

Unfortunately, the plant did not meet those lofty ambitions.

It struggled to turn a profit, and within two years, it was being described by analysts as a "noose" around Hyflux's neck that needed to be loosened.

A S$1 billion noose.

So Hyflux, facing an uncertain future, with mounting debts, had really limited options.

One of the more viable options, as anyone with a noose around their neck will attest, is to get rid of the noose.

Attempts to sell desalination plant

Hyflux has subsequently requested for five extensions in their bid to get a buyer.

The latest extension will last up till, and including, Feb. 28, 2019.

During the fourth extension, Hyflux mentioned two parties who had shown advanced interest in purchasing the plant.

Bloomberg reported that the only one who had demonstrated interest was allegedly Sembcorp.

The same Bloomberg report claimed that the valuation by Sembcorp was below Hyflux's book value of S$1.3 billion.

To be fair to Hyflux, Tuaspring is very much unlike existing businesses.

Tuaspring, back in 2018, was already supplying 70 million gallons of desalinated water a day.

They were also under contract with Public Utilities Board (PUB) for 25 years.

Which meant any potential sale had to be approved by PUB as well.

Here's what Lum had to say about their situation:

“Every name that even come to the door, even before doing paper due diligence, it has to be approved first. This process, of course, takes a long time. Some of them are overseas companies so the water agency has to know their background and who they are before allowing them.”

So, what now?

An integral reason as to why they haven't faced liquidation yet is because of the moratorium granted to them.

Which effectively meant creditors couldn't collect the money from them during that specified time.

The clock is ticking though, as the moratorium effectively ends on April 30, 2019.

Since the Tuaspring albatross does not appear to be going anywhere soon, there had to be other ways to get some money in.

Enter Salim and Medco.

The Salim Group, controlled by the Salim family, is Indonesia's largest conglomerate with businesses spanning property, palm oil and food manufacturing, including the popular IndoMie. Medco or PT Medco Energi Internasional Tbk, is a publicly listed Indonesian Oil and Gas company founded by Arifin Panigoro.

Their consortium, SM Investments, has been hailed as "white knights" and providing Hyflux a much needed "lifeline", described by some as a "rescue plan".

So, what is their rescue plan?

Their offer, chosen from a field of 16 potentially interested companies, will see Salim and Medco acquire 60 percent of Hyflux for S$400 million.

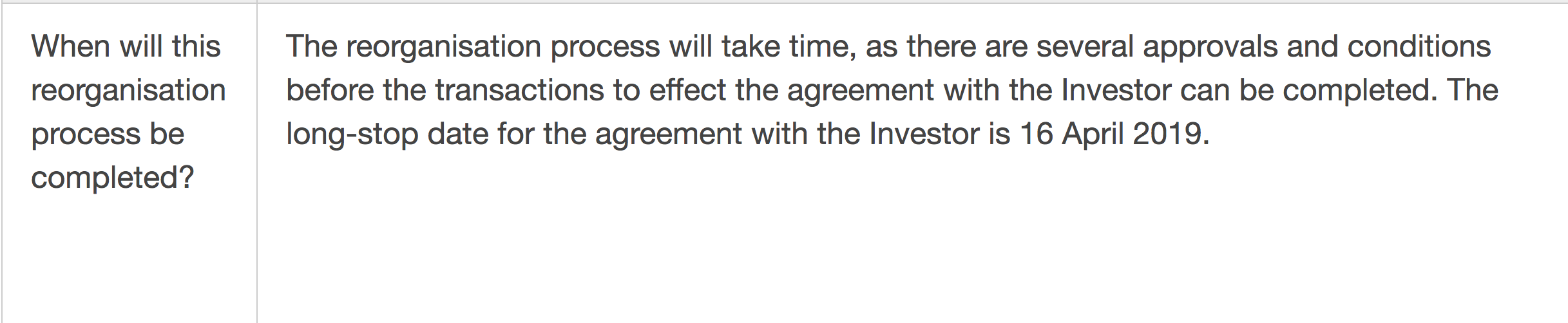

As mentioned above, the moratorium ends on April 30, 2019.

The long-stop date for the agreement with the investor is April 16, 2019.

So great, problem settled.

Problem is not settled

The crux of the issue, and why it has prompted so much coverage, as well as outcry, is the plight of the current investors.

Some 34,000 mom-and-pop investors were affected by the Hyflux situation.

In a Channel NewsAsia article on May 2018, investors were quoted as saying they were taken aback by the entire situation.

That disbelief and shock has apparently gradually turned to anger over the months.

Their anger stems from the perceived unattractiveness of the two plans placed in front of them.

One which might lose them a lot of their investment, the other, liquidation, signalling a complete 100 percent loss.

So, what exactly is the outcome of the much touted restructuring?

Under their restructuring plan, a holder of Hyflux's perpetual securities and preference shares will receive roughly 10 percent of what they invested.

In other words, the 34,000 of them, who are currently owed S$900 million will receive a total of S$27 million and a 10.38 percent of the company under the restructuring act.

Despite the proclamations of the offer being a rescue plan, the deal has not gone down well with these investors at all.

They have started a petition calling for government action to help acquire Tuaspring at the price of S$1.3 billion.

Hyflux themselves have vehemently denied wanting any form of bailout from the government.

Although the petition insists that the acquiring of Tuaspring should not be considered a bailout.

What next

Unlike a year ago, where investors were thrown into limbo, with uncertainty over the next step the company would take, the options here have been gone through ad nauseam.

Either accept the deal or face liquidation.

A third townhall meeting will be held on March 13, and all the shareholders will vote on the scheme of arrangement by the end of March.

Image from Hyflux and Google Maps

Content that keeps Mothership.sg going

?⏩?

Finally escape from your CNY fatigue with these heavily discounted cruise fares.

???

Get insurance against keyboard warriors now wow.

✈️?️

Here's a handy guide to maximising your miles. Don't say we neh teach.

⌚??

There were already watch phones in the 90s. You could have been a Kamen Rider.

?

Event of the year (especially if you have a 'SAM' in your name).

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.