Once again, that time of the year has arrived.

On Feb. 18, Finance Minister Heng Swee Keat delivered the 2019 Budget Statement at 3.30pm in Parliament.

Themed "Building a Strong, United Singapore", Heng stated that the aim was to continue building up Singapore to face these four challenges:

- The shift in global economic weight towards Asia;

- Rapid technological advancements;

- Changing demographic patterns,

- Decline in the support for globalisation.

Heng elaborated that these challenges would be met by making Singapore:

- A global city and home for all;

- A caring and inclusive society;

- A vibrant and innovative economy;

- Safe and secure.

We show you the key points to look out out for from Heng's speech.

A surplus gained in 2018, a deficit projected for 2019

In 2018, the Singapore economy grew by 3.2 per cent in 2018, with the overall budget at a surplus of S$2.1 billion or 0.4 per cent of our GDP -- a $2.7 billion increase from the S$0.6 billion deficit forecast a year ago.

Heng stated that this was due to the unexpected two-year suspension of the Kuala Lumpur-Singapore High-Speed Rail Project and higher than expected stamp duty collections.

This year, the government has projected an overall budget deficit of S$3.5 billion.

Heng stated that apart from an increase in the total expenditures of government ministries, part of the deficit would also be a result of S$6.1 billion being set aside for the Merdeka Generation Package and S$5.1 billion being set aside for long-term care support.

Ang pows for all

You can definitely expect quite a few goodies to be handed out.

Perhaps the one that will have greatest immediate impact would be:

Bicentennial Bonus

Consisting of a total of S$1.1 billion in benefits, the bonus is aimed at helping the populace, especially those from low-income families, with daily expenses.

Here's what you can expect of this package:

- A Bicentennial GST voucher payment of S$150 to S$300, for people aged 21 and above, depending on the annual value of your home.

- Those with a value of up to $13,000 will receive S$300, while those between S$13,000 to S$21,000 will receive $150.

- This is on top of the regular GST Voucher payment given out annually.

- An additional 10 per cent added to payments made under the WIS scheme, for work done in 2018. This payment will range from a minimum of S$100 to a maximum of S$360, in cash, depending on your age starting from 35, and whether you are an employee or self-employed.

- A 50 per cent Personal Income Tax rebate for the Year of Assessment in 2019. The rebate is capped at S$200 and is applicable to all taxpayers.

- A S$150 top-up in the Edusave accounts of Primary and Secondary school students.

- A top-up of either S$250 or S$500 for students aged 17-20 in their Post-Secondary Education Accounts (PSEA), depending on whether their annual home value for 2018 exceeded S$13,000.

- Between S$300 to S$1,000 in CPF top-ups for those with lower CPF balances, aged 50 to 64. This range depends on the age of those eligible, and whether they have below S$30,000 or between $30,000 to S$60,000 in their CPF balances.

Merdeka Generation Package

You are eligible for the package's benefits if you are:

- Born between 1950 and 1959 and became a Singaporean citizen before 1997, or

- Born in or before 1949, became a Singaporean citizen before 1997, but did not receive the Pioneer Generation Package.

Many of the benefits that you can expect to receive under this package are healthcare-related.

They are:

- A one-off S$100 top-up to your PAssion Silver card which be used for, among other things, Community Club activities, entry to public swimming pools, and public transport.

- An annual MediSave top-up of S$200 per year, starting from this year to 2023.

- Additional subsidies for outpatient care, such as special subsidies at clinics and dentists under the Community Health Assistant Scheme (CHAS), and an additional 25 per cent off subsidised bills at polyclinics and public Specialist Outpatient Clincs (SOCs)

- Additional MediShield Life premium subsidies, where there will be an additional 5 per cent subsidy for annual premiums, that will then increase to 10 per cent after the age of 75.

- Additional participation incentive of S$1,500 for joining CareShield Life, once it is available from 2021 onwards.

Moar benefits in general

These include the enhancement of CHAS whereby:

- CHAS will be extended to cover all Singaporeans for chronic conditions, regardless of income.

- Subsidies will be extended for common illnesses to CHAS Orange cardholders.

- Higher subsidies will be given for complex chronic conditions.

As such, more than S$200 million a year is expected to be given out in CHAS subsidies.

There will also be the establishment of a S$5.1 billion Long-Term Care Support Fund aimed at:

- Providing for CareShield Life subsidies and other long-term support measures as ElderFund

This S$5.1 billion includes the S$2 billion earmarked from last year's budget.

Additionally, the ComCare Long-Term Assistance will also see a:

- Raise in the basic monthly cash assistance. For example, a two-person household can expect to receive an additional S$130 per month, bringing their assistance to a total of S$1,000.

Cash goodies will not be the only things being handed out though.

Greater support for workers

Existing schemes such as the Career Support Programme and WIS Scheme can expect to see extensions and enhancements.

In particular, the Career Support Programme will be extended by two years to provide wage support for companies that hire Singaporeans who are mature and retrenched, or in long-term unemployment, until March 31, 2021.

As for the enhancement of the WIS Scheme, which will begin from 2020 onwards, this will see the qualifying income cap raised from S$2,000 to S$2,300 per month, and higher maximum annual payouts of up to S$4,000 a year. (Editor's note: We previously wrote S$4,000 a month, this is a mistake. It should be S$4,000 a year)

The government will also be engaging in a reduction of the foreign worker quota in the services sector.

Here's how the reduction works:

- Currently, the quota of Service Sector Dependency Ratio Ceilings (DRCs) -- that is, both Work Permit and S-Pass holders -- in the service sector stands at 40 per cent. The government's intention is to reduce this to 38 per cent from Jan 1, 2020 and 35 per cent from Jan. 1 , 2021.

- As for the quota of Sub-DRC -- that is, S-Pass holders -- it currently stands at 15 per cent. The government's intention is to reduce this to 13 per cent from Jan. 1, 2020 and 10 per cent from Jan. 1, 2021.

A new agency for defence

Called the Home Team Science & Technology Agency, the organisation is expected to be established by the Ministry of Home Affairs (MHA) by the end of this year.

Heng added that MHA will also take steps to help ensure the private security industry is an effective partner in the Home Team.

Additionally, a sixth pillar of Total Defence, known as Digital Defence, has also been instituted.

Heng defined Digital Defense as:

"We must all play our part to be secure, alert and responsible online, be it through practising good cyber hygiene, being vigilant against fake news, and helping one another use technology safely."

Heng stated that these efforts come as part of Singapore's effort to improve the Home Team's ability to carry out its mission of safeguarding Singapore, as threats to security grow in sophistication.

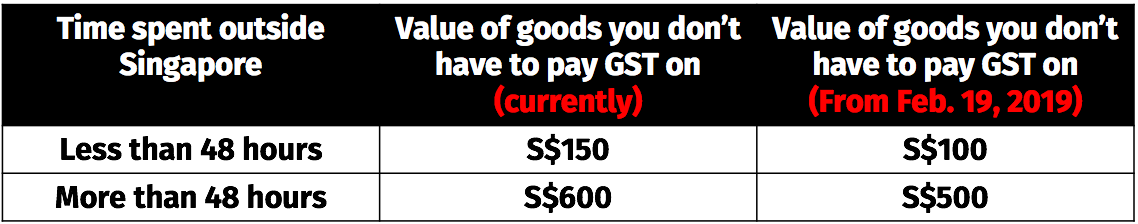

Reducing the GST import relief for travellers

Building on the previous Budget's announcement of a GST on imported services, Heng added that the GST relief on travellers for goods purchased abroad would be reduced.

For travellers who spend more than 48 hours abroad, the relief from the payment of GST will be reduced from S$600 to S$500.

Whereas for travellers who spend less than 48 hours abroad, the amount would be reduced from S$150 to S$100.

Here's a table to help you see the changes better:

Table by Jeanette Tan, stats via MOF

Table by Jeanette Tan, stats via MOF

Moreover, the allowable quantity of duty-free alcohol that can be purchased by travellers arriving in Singapore will be reduced from three litres to two, starting April 1, 2019.

Here's how you will be able to purchase spirits, wines and beers under the reduced allowance:

[caption id="" align="alignnone" width="1053"] Table by Jeanette Tan, stats via MOF[/caption]

Table by Jeanette Tan, stats via MOF[/caption]

Additionally, sometime between 2021 and 2025, the GST will go up to 9 per cent.

Heng added that help will be provided for lower-income households and the elderly however, with an enhancement of the permanent GST Voucher Scheme, and a GST offset package to help cushion the initial impact of the GST increase.

All the Budget 2019 stories you need to know:

Top image screenshot from CNA

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.