The government will be cutting the allowable quantity of duty-free alcohol that can be purchased by travellers arriving in Singapore from three litres to two, starting April 1, 2019.

It will also be reducing the value of goods purchased overseas that will be entitled to relief from payment of goods and services tax (GST) from S$600 to S$500 — where a traveller spent more than 48 hours overseas — and from S$150 to S$100 for travellers who spend less than 48 hours abroad.

These announcements were made by Finance Minister Heng Swee Keat at the tail-end of his 2019 Budget speech in Parliament on Monday, Feb. 18, as measures to ensure the "resilience" of Singapore's tax system.

Here's how the breakdown will work:

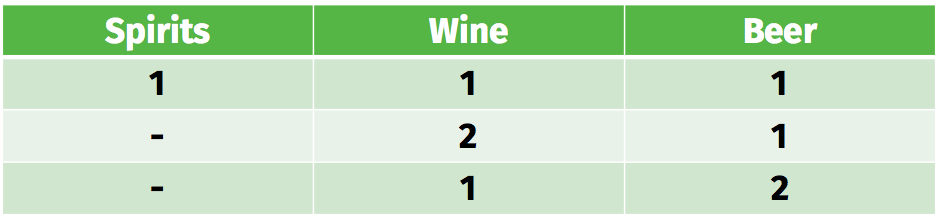

At the moment, a total of three litres of spirits, wine and beer can be purchased in the following combinations:

Table by Jeanette Tan, stats courtesy of MOF

Table by Jeanette Tan, stats courtesy of MOF

Starting April 1, 2019, though, the total allowance will be lowered to two litres, so spirits, wine and beer can be purchased in the following combinations:

Table by Jeanette Tan, stats from MOF

Table by Jeanette Tan, stats from MOF

These, as with the current arrangement, apply only if:

- The traveller is at least 18 years old,

- The traveller spent 48 hours or more overseas and is not arriving from Malaysia,

- The alcohol purchased is for the traveller's own consumption, and

- The liquor is not barred from import to Singapore.

Pay 7 per cent GST on goods bought overseas costing more than S$500

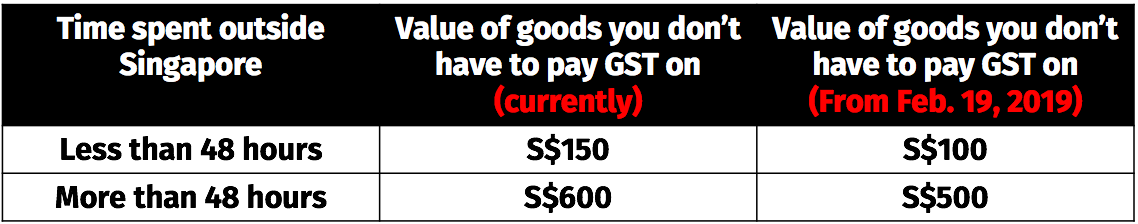

And here's another step the government is taking: they're reducing the value of allowable goods bought overseas that they'll let you avoid paying GST on.

Here's the breakdown of what it used to be and what it is now:

Table by Jeanette Tan, stats via MOF

Table by Jeanette Tan, stats via MOF

Additionally, sometime between 2021 and 2025, the GST will go up to 9 per cent.

The relief travellers enjoy applies for Singapore citizens, permanent residents and tourists, but is not applicable to crew members and holders of work permits, employment passes, student's passes, dependent's passes or long-term passes issued by the Singapore government.

It also does not apply to intoxicating liquor or tobacco, or goods imported for commercial purposes.

To find out more about GST relief and about paying GST for stuff you buy overseas, you can check out this article:

And this one too:

Other Budget 2019 stories:

Top photo via DFS Singapore

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.