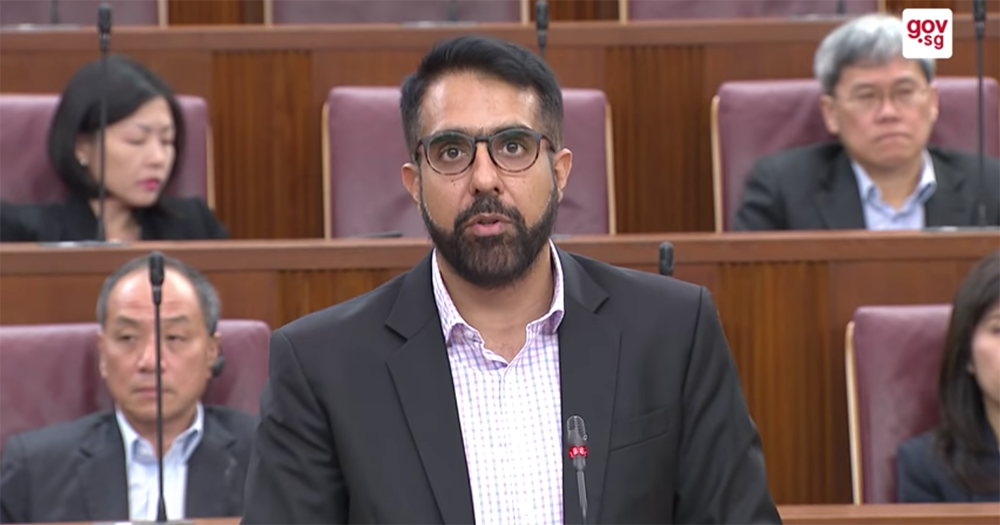

Workers' Party (WP) chief Pritam Singh said that the WP's position remained unchanged from 2018, in which it would not support a GST hike until more clarity had been provided on projections for revenue streams and expenditures.

Pritam was speaking in Parliament on Feb. 28, the third day of the Budget debate.

Until we have clarity, we can't give support

Pritam noted that the position of Deputy Prime Minister and Finance Minister Heng Swee Keat at the time had been, "that one did not need to have information on everything to make a decision on anything."

Noting Heng's announcement to not raise GST this year raised the following question:

"...it is obvious that the government relies on revenue and expenditure projections, to make these decisions. Will the government make public these projections so that Singaporeans can critically evaluate the necessity of a GST Hike?"

He added that such transparency would contribute to a more substantial conversation and a better understanding of Singapore's fiscal trade-offs.

"This can only advance and mature conversations that take place in Singapore. Until this clarity is provided, the WP position has not changed.

We cannot support a GST hike, especially since this is to be raised in advance and before the government's projections have been put to this house."

In Heng's budget wrap-up speech, Heng said that the GST is an appropriate and responsible way to pay for major societal needs like healthcare because everyone has to take responsibility for society’s needs.

Heng noted that healthcare spending will grow significantly as our population ages.

He added that healthcare spending is not just about treating the sick, but giving our seniors a better quality of life. This includes paying for procedures like cataract operations and the better management of incurable diseases like cancer.

Pritam: GST is a regressive tax

Pritam also referred to GST as a "regressive tax" that will hit seniors, retirees, and the low and middle classes "particularly hard."

He acknowledged that Heng had set aside money for offsets, amounting to S$6 billion, but said that such GST offsets will not last forever, especially for the middle class.

People from these demographics will therefore have to have manage their expenditures more frugally.

Pritam's statement was similar to one made by Singapore Democratic Party leader Chee Soon Juan, that the GST is a regressive tax.

The Progress Singapore Party also believes that no fees, including GST, should be increased in the next five years.

Deterring BEPS in Singapore

Pritam also highlighted that Heng referred to a project on base erosion and profit shifting (BEPS) in his Budget speech, which seeks to companies are taxed where substantial economic activities are performed.

According to the OECD, BEPS refers to tax planning strategies used by multinational enterprises that exploit gaps and mismatches in tax rules to avoid paying tax.

Here, Pritam noted that Heng had first raised BEPS in his 2017 Budget speech, in which Parliament was informed that "the government was in consultation with businesses on scheme refinement and implementation of the relevant standards."

Pritam then asked: "What has been the results of these consultations from three years ago?"

He added that with respect to BEPS, it was useful to recap the government's argument on proposals by Singaporeans to raise taxes on high income earners, who enjoy the country's safety and security.

As per Pritam,"The concern was that high net worth individuals would be able to structure and move their assets to avoid higher tax obligations."

This in turn raised the following two questions:

- What is the impact of BEPS on this prospect and the government's assessment of the impact of BEPS developments on our tax policies?

- Could the government consider other taxes on the ultra-rich to maintain our progressive tax system?

Some local companies still need help

Pritam then pointed out that there were still some Singaporean businesses in need of help amidst the rolling out of the Budget's stabilisation and support package.

These local businesses, who had reached out him, were private hire bus companies and drivers who have been bearing the brunt of canceled trips and tours arising from the novel coronavirus (Covid-19) outbreak.

He noted that while an industry briefing had been held on Feb. 25, by the Singapore Tourism Board, on a relief package for travel agents and tour operators, there were private bus companies which felt that the support package was not targeted enough.

Pritam added that he hoped the government would extend support to companies who have "no choice" but to hire foreign manpower, perhaps through a partial waiver of the levies on the condition that they seek to redesign their operations to increase local headcount.

He explained that such "conditional support" could provide a greater boost for these companies to make greater efforts in hiring locals, including senior citizens, even on a part-time basis.

Related story:

Top image screenshot from gov.sg YouTube

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.