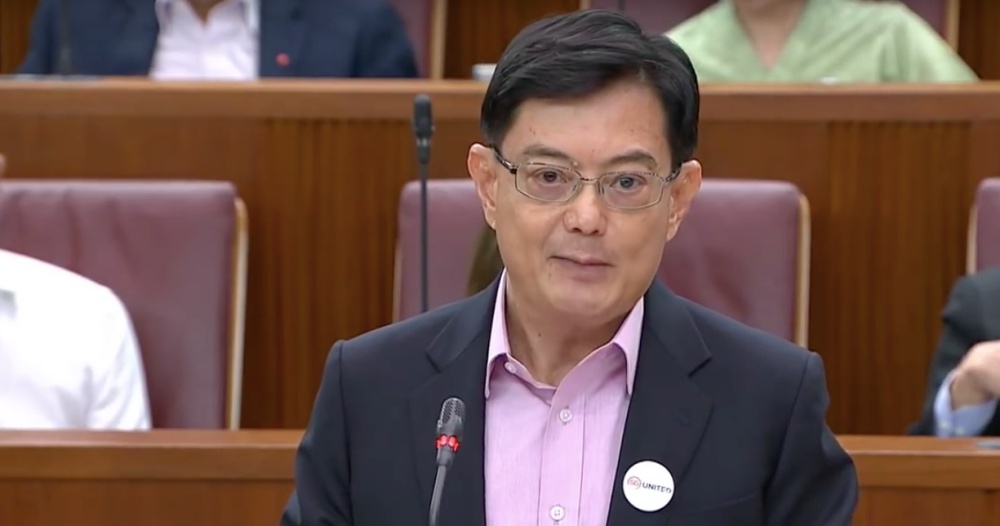

Deputy Prime Minister and Finance Minister Heng Swee Keat delivered his wrap-up speech at the 2020 Budget debates in Parliament on Friday (Feb. 28), in which he revealed some big announcements like across-the-board one-month pay cuts for political office holders, including President Halimah Yacob:

But he also addressed a number of issues that came up in the Budget debates over the past three days.

Here's a rundown of what he covered:

1. On the government's Covid-19 measures

Heng started by explaining that this year's budget is appropriate and timely.

Specifically, the Stabilisation and Support Package serves to preserve and enhance jobs, which Heng said, is the government's priority.

Small and Medium Enterprises (SMEs) in particular, are a key focus of the Wage Credit Scheme and the Joint Support Scheme, he said:

"As a percentage of revenue, SMEs will receive payouts that are on average five times as much as the average for all enterprises. This is on top of the help they will also receive through the Corporate Income Tax Rebate and other measures."

Sectors which are most impacted by Covid-19 -- tourism, accommodation, and aviation -- are receiving extra support.

These sectors will receive over S$400 million, in addition to the benefits from the Joint Support Scheme, the Wage Credit Scheme, and Corporate Income Tax Rebate, Heng said.

Another S$200 million will used to support self-employed person such as taxi and private hire car drivers, hawkers, tourist guides, and operators of F&B and retail outlets, Heng added. This is on top of other broad-based support for them.

Heng also revealed that the government has also decided to expedite the payment for the Joint Support Scheme on the advice of several Members of Parliament such as Saktiandi Supaat, Seah Kian Peng, and Gan Thiam Poh.

One-off bonus for frontline healthcare staff

Speaking about healthcare workers who have shown "outstanding courage and dedication", Heng announced that the government will award public health officers on the frontlline who are directly battling with the Covid-19 disease up to one additional month of special bonus.

This includes healthcare workers at the Ministry of Health, restructured hospitals and some officers at other frontline agencies who have been directly involved.

Heng added that other public officers have have "contributed significantly" will also be recognised in "appropriate ways".

Public Health Preparedness Clinics will also receive support via a one-off Covid-19 grant. This is to support these clinics in their active role caring for patients with respiratory symptoms, said Heng.

"This gesture plus the many words of encouragement and acts of consideration and kindness is our way to express to you, we salute you."

Political office holders, MPs, senior public service officers taking pay cuts

Heng also said that Singapore has been able to respond strongly and effectively to Covid-19 because there is strong trust and solidarity between the people and the government.

"The political leadership will do our part to show solidarity with fellow Singaporeans," he said, announcing that all political holders will take a one-month pay cut.

Additionally, all Members of Parliament will take a one-month cut in their allowance.

President Halimah Yacob has also agreed to take a one-month pay cut, said Heng.

2. On the impending GST hike

Heng then went on to talk about the impending 2 per cent Goods and Services Tax (GST) hike. It was announced earlier this week that the hike will not be happening in 2021.

"In designing our fiscal system, we have always sought to achieve a fair and progressive balance," said Heng.

"Where the better-off contribute more, and the lower-income receive more support," he said.

He dropped the following statistics to illustrate his point:

The top 10 per cent of taxpayers in Singapore pay about 80 per cent of the country's personal income tax revenue.

Foreigners residing in Singapore, tourists, and the top 20 per cent of resident households account for over 60 per cent of the net GST borne by all households and individuals.

This, said Heng, is partly because foreigners do not benefit from the GST Voucher and offsets, which are available to Singaporean households.

Moreover, Heng said that when GST is increased eventually, foreigners pay the higher rate immediately.

In contrast, Singaporeans receive offsets to cushion the impact.

This is why there is no conflict in logic between raising GST and funnelling back some of the revenue via a a $6 billion Assurance Package for GST, said the Finance Minister.

The GST is an appropriate and responsible way to pay for major societal needs like healthcare because everyone has to take responsibility for society's needs, he said.

Can't raise wealth and income tax too much

On suggestions to raise income tax and wealth tax, Heng said that this has been done in recent years.

Singapore's property tax was made progressive in 2010, and enhanced in 2013. The Buyer's Stamp Duty rate was raised for residential properties in excess of S$1 million in 2018.

The government also raised the top marginal personal income tax rate to 22 per cent in 2015.

However Heng cautioned that raising the income tax will eventually hurt middle-class Singaporeans who currently pay very low income taxes.

High income taxes will also deter foreign talent which Singapore needs a critical mass of to create jobs and economic vibrancy.

Having said that, Heng added that Singapore will continue to adjust its income and wealth tax rates because the 2 per cent GST increase alone will not be able to cover the increase in annual government spending.

Reserves should be kept for future generations

But why Singapore tap on her reserves instead of raising the GST?

Heng said that Singapore has to safeguard the use of her reserves because it gives her confidence as a small country with no natural resources of any kind to deal with the ups and downs in the world.

It is because of past leaders' prudence, said Heng, that the reserves could generate substantial returns which keep taxes low today.

He added that Singapore has a duty to future generation:

"They are not here today to represent their interests – because they are not born yet! But we have a responsibility to them, and to take decisions which are difficult for us, but which will safeguard [their] interests."

Top image via YouTube screen grab.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.