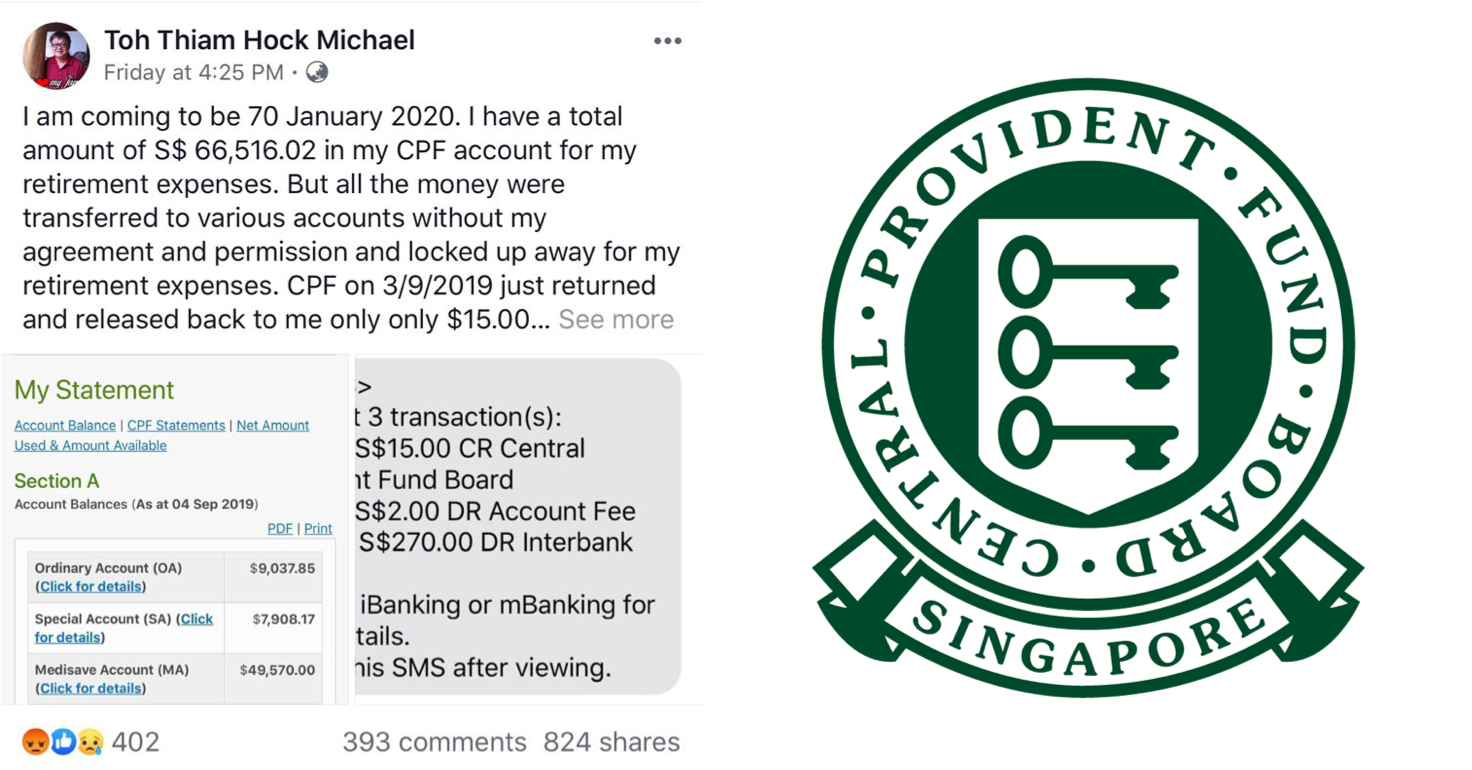

A Singapore man shared his grievances with the Central Provident Fund (CPF) scheme on Facebook, in a post that attracted more than 800 shares.

Saying he was to reach 70 years of age in January 2020, Michael Toh Thiam Hock was unhappy about the allocation of funds in his various CPF accounts.

"I have a total amount of S$66,516.02 in my CPF account for my retirement expenses. But all the money were transferred to various accounts without my agreement and permission and locked up away for my retirement expenses."

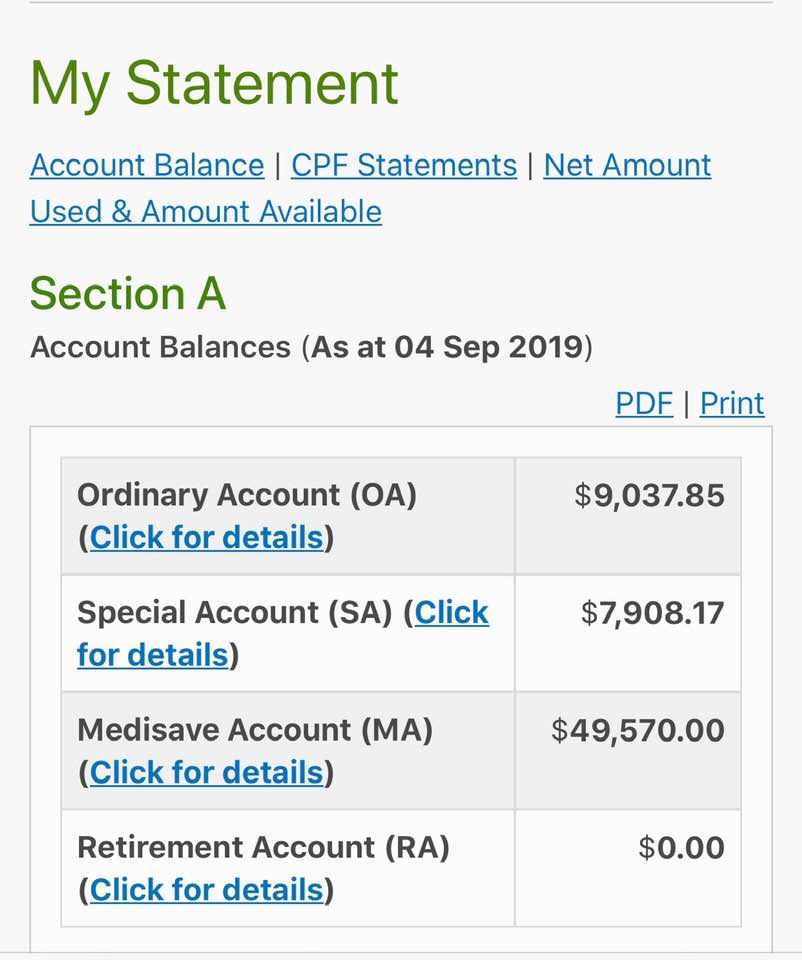

He shared what appears to be a screenshot of the breakdown of monies in his accounts.

Photo from Michael Toh.

Photo from Michael Toh.

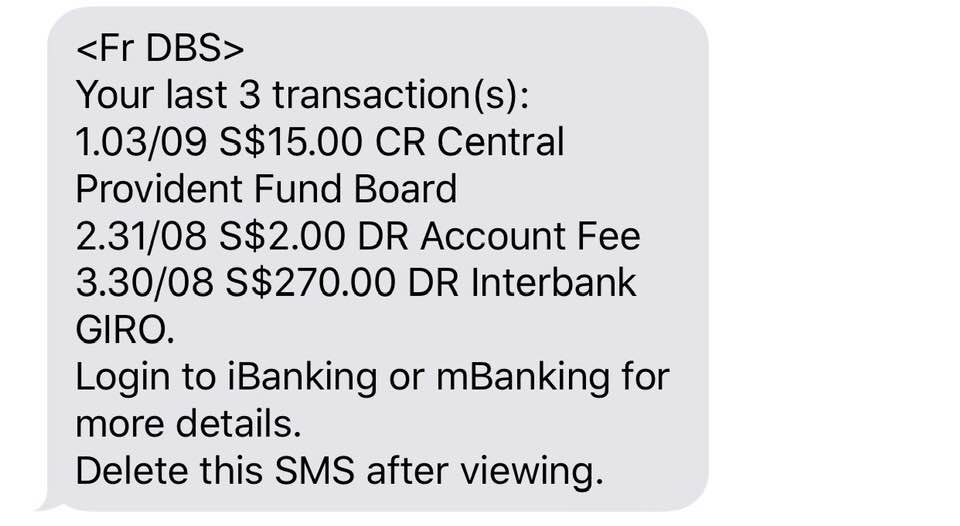

Toh also claimed that he only received S$15 for his monthly payout, and griped about having the bulk of his money stored in his MediSave account.

"CPF on 3/9/2019 just returned and released back to me only only $15.00 into my POSB bank account for my retirement expenses for the month of September. How to live and survive on just $15.00 per month.

Why transferred most of my money to my MediSave account? I will die of hunger before I have the chance of being sick by then."

He shared a screenshot of an SMS appearing to show his S$15 payout from CPF.

Photo from Michael Toh's Facebook page.

Photo from Michael Toh's Facebook page.

Toh added that he still had conservancy charges and utility bills to pay, and that he is "still waiting" for a lump sum payment "of all the money with accumulated interest" that he should have received at age 55.

You can see his full post below:

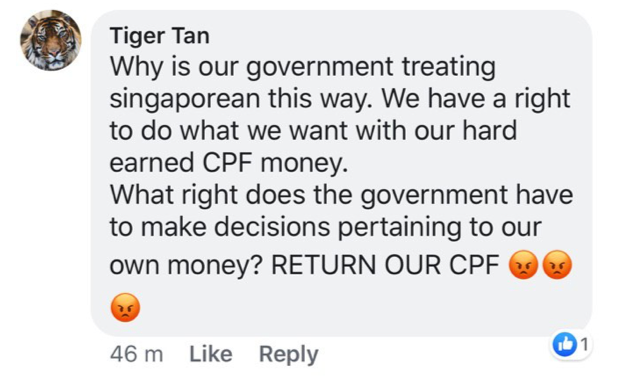

Some were angered

This inspired some angry comments from other Facebook users:

Screen shot from Michael Toh's Facebook page.

Screen shot from Michael Toh's Facebook page.

Screen shot from Michael Toh's Facebook page.

Screen shot from Michael Toh's Facebook page.

Some were sceptical

However, Toh's story also prompted some commenters to raise objections:

Screen shot from Michael Toh's Facebook post.

Screen shot from Michael Toh's Facebook post.

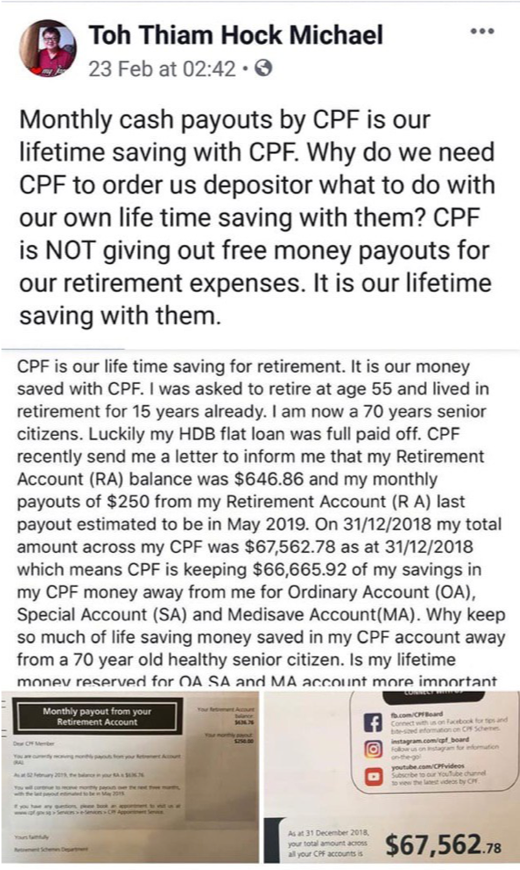

And someone else dug up a post, supposedly shared by Toh himself in February 2019, which suggested that he had been receiving payouts from his Retirement Account back then:

Screen shot from Michael Toh's Facebook post.

Screen shot from Michael Toh's Facebook post.

This photo appeared to show that Toh had actually indeed been receiving monthly payouts from his Retirement Account, which had a little over S$600 then.

Withdrawal from CPF at 55

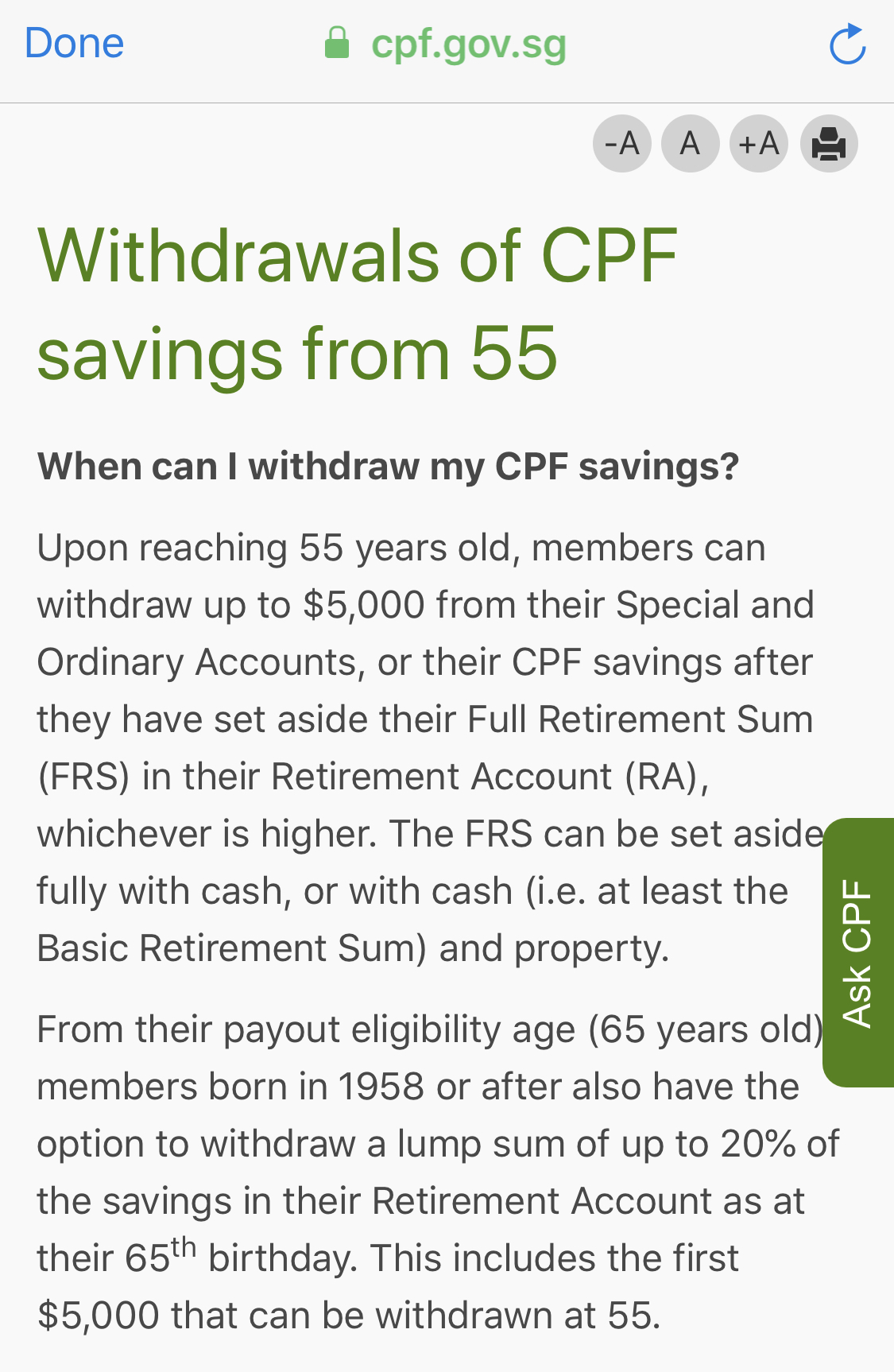

Toh's post suggested that he expected to withdraw everything in his CPF accounts at age 55 in a lump sum.

However, the CPF Board's website states that Singaporeans turning 55 can only withdraw S$5,000 OR whatever additional money is available after setting aside their full retirement sum or basic retirement sum:

Screenshot via CPF website

Screenshot via CPF website

Why so much in MediSave?

Also with reference to the CPF website, the Basic Healthcare Sum in MediSave is an estimated amount necessary for medical expenses in old age.

Any additional money saved beyond this Sum will "flow over" into the Retirement Account or Special Account.

If Toh really is turning 70 years old next year, he will need a minimum sum of $49,800 in MediSave.

Unfortunately, if that screenshot of his accounts is legitimate, he appears to have just under that amount, at S$49,570, so there isn't any extra left over for his Retirement Account.

As Toh did not share his full CPF statement on his monthly payouts, it's impossible to draw a conclusion, save for the fact that MediSave appears to be working as publicly stated.

Top image from Michael Toh and CPF Board's Facebook pages.

Content that keeps Mothership.sg going

??

Do you remember the last time you used a passbook?

??

Learn the secrets behind magic tricks. Spoiler alert: it's science.

?

Adulting 101: We teach you how to pour beer properly. The kind with a lot of foam on top.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.