Singaporeans who love to go on shopping sprees in Malaysia for bigger ticket items, take note.

What happened?

A Facebook post by the Singapore Customs on April 6 announced that a woman was issued a composition sum, tantamount to a fine, for under-declaring the value of items that she bought from overseas.

As she declared the value of three sets of curtains and one set of blinds by more than half of the actual value, she was issued with a composition sum of S$2,055.She had tried to pass through a checkpoint land crossing back into Singapore.

GST reminder

The fabric of Singapore society is partly dependent on the payment of taxes that act as revenue for the country, or else, society might fray at the seams.

Goods entering Singapore are subjected to 7 percent of Goods & Services Tax (GST).

Yes, that includes grocery and shopping purchases from Johor Bahru, for example.

There is a GST relief of S$100 per person out of Singapore for less than 48 hours.

But upon returning to Singapore, one is supposed to declare that the value of purchases that he or she is bringing back to the country does not exceed the amount of GST relief.

Curtains are popular items

In fact, curtains and blinds are said to be common household items that travellers under-declare the GST payment when at Woodlands and Tuas Checkpoints, said the Singapore Customs.

Pulling up the shades and shedding some light on the issue, the Singapore Customs also said that offenders usually under-declare such goods to maximise their profit margins when they resell the items in Singapore.

This is the statement from the Singapore Customs:

'It is the responsibility of travellers to make accurate and complete declarations of all taxable items brought into Singapore. Under the Customs Act, any person who fails to declare or makes an incorrect declaration of taxable goods may be issued with a composition sum of up to 10 times the amount of duty and/or GST evaded, or charged in Court.'

Revision to GST relief

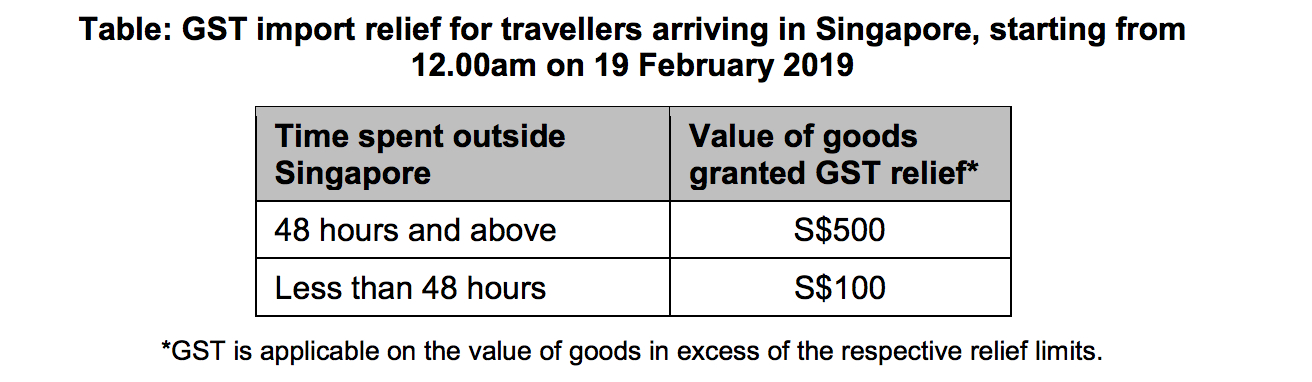

The GST relief has been revised recently in February 2019.

Travellers who have been out of Singapore for less than 48 hours will be granted GST relief for the first S$100 of the value of new items you bring into the country, instead of S$150.

For those who come back after more than 48 hours, the first S$500 of the value of the goods will be exempted from GST relief instead of S$600 previously.

[caption id="" align="alignnone" width="1312"] Screenshot from press release by IRAS and Singapore Custom.[/caption]

Screenshot from press release by IRAS and Singapore Custom.[/caption]

Top photo collage from Singapore Custom Facebook

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.