Evasion of Goods and Services Tax (GST) payment for items bought overseas but brought back into Singapore is in the spotlight again:

This was after a 25-year-old Singaporean woman was arrested for failing to declare for GST payment the S$11,000 worth of branded handbags and accessories she had purchased from Paris.

She had attempted to exit Changi Airport through the Customs Green Channel without making the declaration.

Unaware or confused Singaporeans

And it appears many Singaporeans are still unaware of or confused by this requirement to declare goods bought overseas and the need to pay GST on them.

So, here are all your frequently asked questions about this issue to clear up the air:

1. What type of goods are subjected to GST?

All goods brought into Singapore are subjected to 7 percent GST. (Unless it is an exempt import.)

GST is, therefore, a tax on local consumption.

2. Are there methods of importing goods into Singapore that will be exempt from GST?

The method of goods being brought into Singapore does not matter.

They can be imported through commercial shipments or hand-carried by travellers arriving on commercial flights for their own personal use.

3. Is GST the norm?

GST was first implemented in Singapore beginning April 1, 1994.

In other countries, the equivalent of GST is Value Added Tax (VAT).

There is no GST relief for liquor, tobacco products, petroleum and goods imported for commercial purposes.

4. What is GST relief?

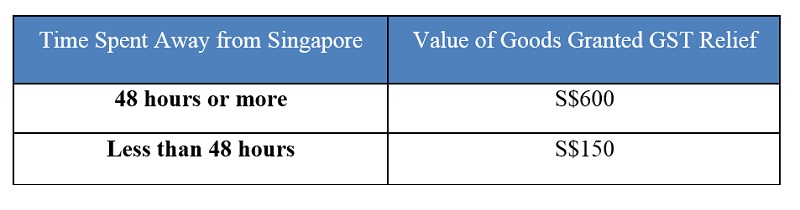

GST for goods valued below S$150 is not applicable for travellers who are out of Singapore for less than 48 hours.

For those who are away for more than 48 hours, GST is exempt for goods valued up to S$600.

5. Is there a GST relief example?

For example, if you have been away from Singapore for a week and purchased S$500 worth of goods, you would not need to pay GST since you are eligible for GST relief of up to S$600 in purchases.

However, if you purchased S$800 worth of goods on that week-long trip, you would be required to pay GST on the excess S$200 (i.e. S$800 minus the S$600 for which you are eligible for GST relief).

6. Is everyone eligible for GST relief?

Holders of a work permit, employment pass, student pass, dependent pass or long-term pass issued by the Singapore government and crew members are not eligible for GST relief.

7. What if I don't have receipts to show the value of my purchases?

If the receipts are not available, the value of the goods will be assessed based on the values of identical or similar goods when computing the GST payable.

[related_story]

8. What happens if a traveller is caught for not declaring goods purchased abroad?

Travellers who are stopped at the checkpoints for not declaring goods purchased abroad for GST payment will be referred to Singapore Customs.

The GST due is collected from the travellers.

A failure to declare the value of your purchases is an offence under the Customs Act and the GST Act.

Under the Customs Act, any person found guilty of fraudulent evasion of GST will be liable to a fine up to 20 times the amount of tax evaded and/ or be jailed for up to two years.

9. If a traveller buys a bag from a duty-free shop in Changi Airport and departs from Singapore, will the bag be taxed upon arrival back to Singapore?

The newly purchased bag is subject to GST if it exceeds the traveller's GST relief amount.

10. Is the item subject to GST if the price tag and packaging is removed?

These items are considered still considered new articles and are subject to GST -- as long as the traveller's GST relief amount is exceeded when the new items are brought into Singapore.

11. If you have already paid sales tax for an item overseas and did not claim tax rebate, do you have to pay GST?

GST is applicable for items imported into Singapore regardless of whether foreign sales tax was paid for the items overseas, as the items will be consumed in Singapore.

12. Are items shipped into Singapore subjected to GST?

For goods imported by post, a GST relief amount of up to S$400 per shipment is granted.

GST is payable on the total value of the shipment, if the total value exceeds S$400.

13. When do I have to declare and pay GST?

Travellers should declare and pay the GST for their goods at the Singapore Customs Tax Payment office at the checkpoints.

An advance declaration through the Customs@SG mobile app is also available for travellers who wish to declare and pay taxes before arriving in Singapore.

The app will generate an e-receipt that can be stored in the traveller’s mobile phone as a proof of your declaration and tax payment.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.