A Grab driver in Singapore has taken to Facebook to complain about having to pay taxes for the S$38,000 revenue he earned in the past six months.

6-month revenue

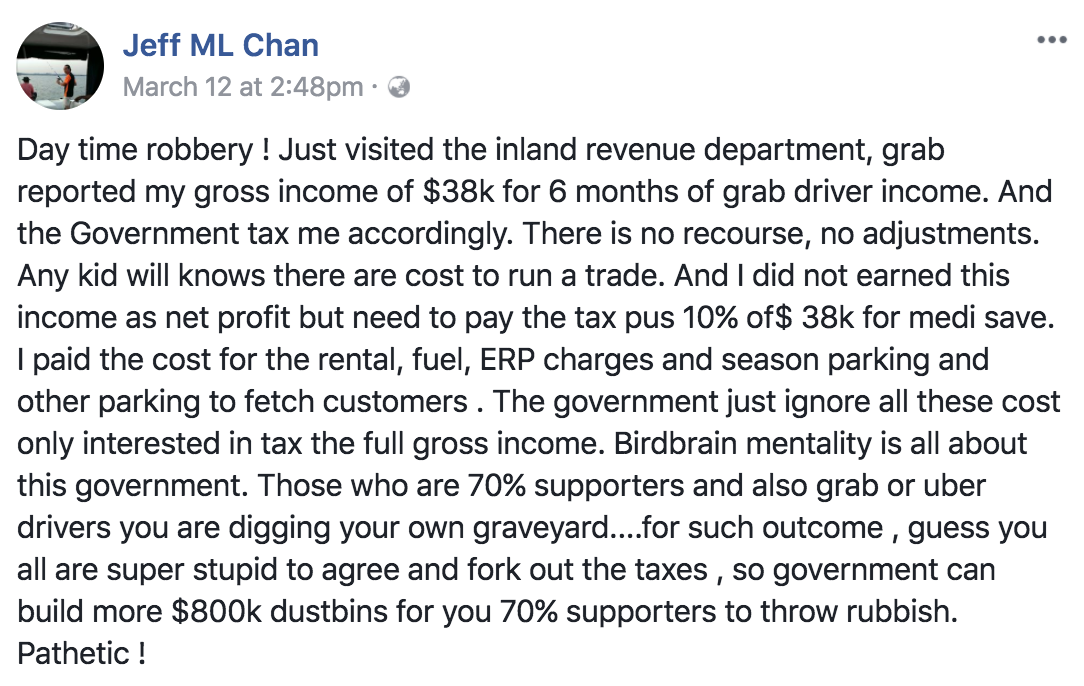

The driver, Jeff ML Chan, had to file his income tax and the amount was recorded as S$38,000, according to Grab's records of his earnings.

Chan's gripe was that this amount was the gross revenue over six months -- as opposed to income.

Chan had started work as a Grab driver only from June 2017.

Gross revenue not accurate

This means that out of the S$38,000 earned, Chan's rental, ERP fees, parking costs and a host of other expenses incurred have not been deducted, but he was still being taxed for it.

His Facebook post ranting about it can be seen here:

Chan then attached his queue number at the IRAS e-filing service centre:

[related_story]

Not surprising

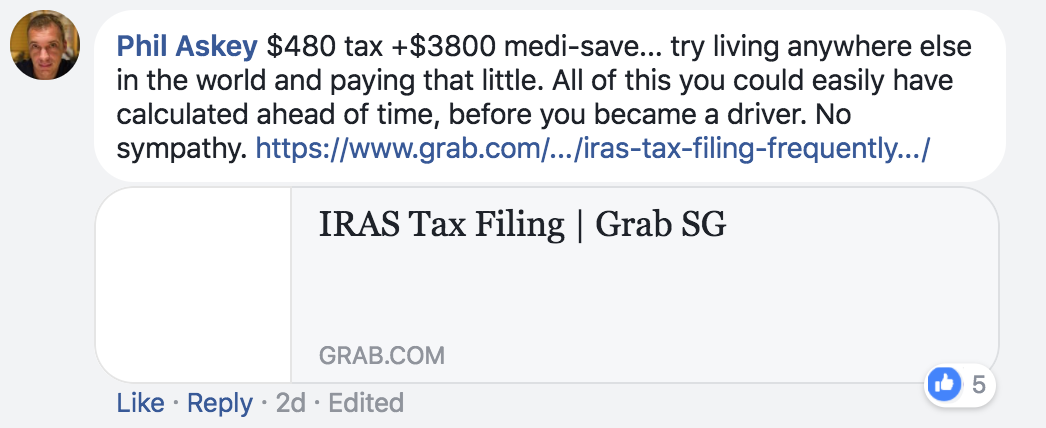

However, one response to the post went to the trouble of calculating Chan's tax and Medisave amount, and even added a link to Grab's policy on the matter:

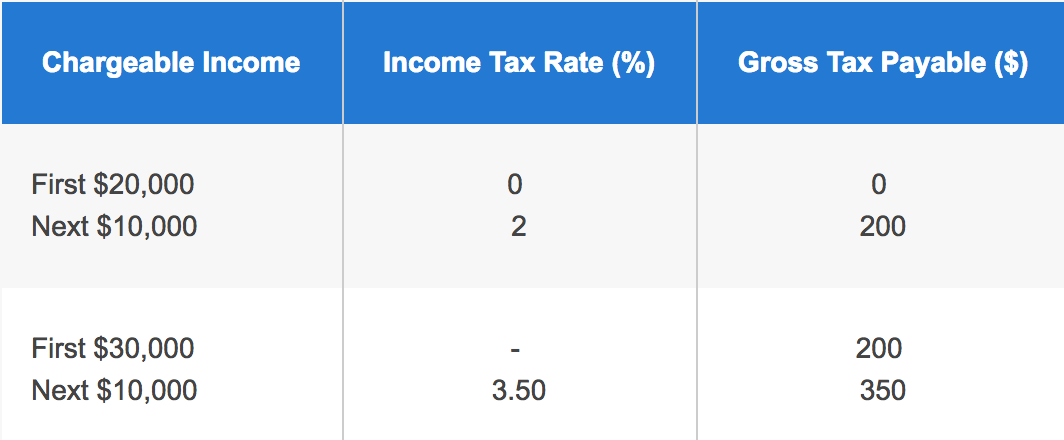

The Inland Revenue Authority of Singapore website confirms that the amount calculated (S$480 of tax + S$3,800 for Medisave) is accurate:

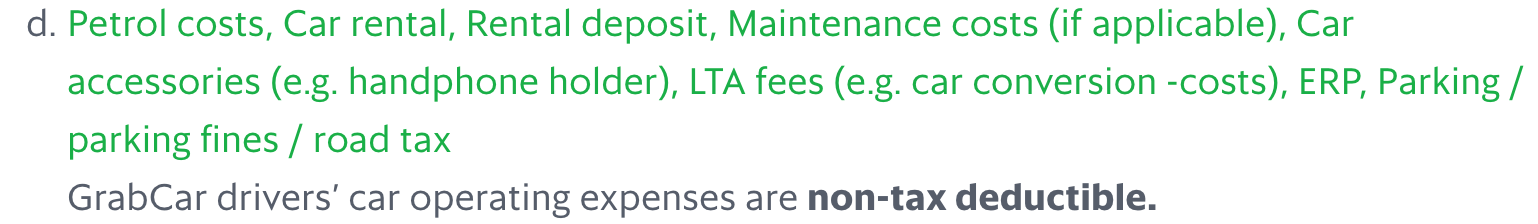

And this is Grab's policy, which states that car operating expenses are non-tax deductible:

In response, Chan acknowledged that he did not read Grab's policy beforehand, but still considers it "daytime robbery":

Another response asked about the actual amount Chan had to pay, which turned out to be S$176 (tax relief, perhaps?):

Nonetheless, Chan feels that the 10 percent he had to pay for Medisave (S$3,800) is still too much for him.

Why are car operating expenses non-tax deductible?

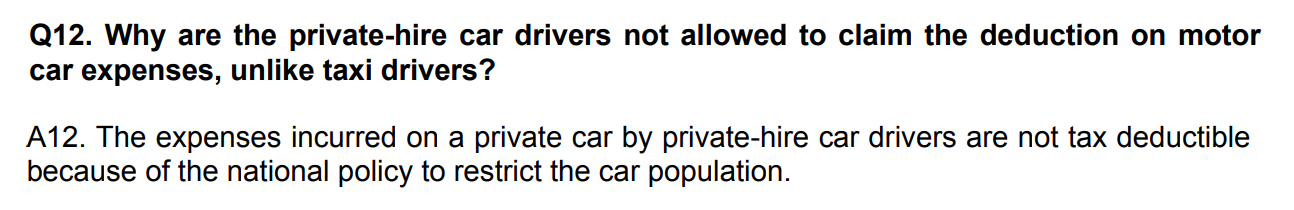

Now that Chan has raised the question, here's the explanation why expenses such as rental, petrol, and ERP are non-tax deductible.

This issue and its answers can be found in the FAQ document directed at private-hire car drivers:

"The expenses incurred on a private car by private-hire car drivers are not tax deductible because of the national policy to restrict the car population."

On the other hand, deductible expenses include mobile data plan and mobile device expenses incurred for work, and business licence renewal fees (e.g. renewal of Private-Hire Car Driver's Vocational Licence).

Now we know.

Here’s a totally unrelated but equally interesting story:

Uzbekistan is such a beautiful country it sounds like Us Back In An Instant

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.