In-camp training is tough.

Having to pay taxes for receiving the NS Excellence Award after doing a good job during ICT is tougher.

That is the brutal reality that one NSman recently realised.

What is the NS Excellence Award?

In April 2016, the government announced a new incentive scheme for NSmen as part of the annual Budget.

Called the NS Excellence Award, it aimed to enhance and replace the old Family Recognition Voucher scheme.

Under this new scheme, vouchers would be awarded to eligible servicemen, such as Letter of Commendation and National Day Award recipients, and NSmen of the year.

Other award recipients, such as the top 10 percent of ICT NSmen, would be awarded an increased voucher.

Then-Senior Minister of State for Defence, Ong Ye Kung, said in Parliament on April 7:

"These forms of recognition are important to let them know that their sacrifices are deeply appreciated, and for the greater good of Singapore."

For NSmen who managed to keep reasonably fit even when chained to their office desks, the NS Excellence Award is something to aim for.

Perform well enough in your ICT and NS courses to be ranked in the top 10 percent, and you'll be rewarded.

Not lavishly, but a token sum in vouchers that serve as an expression of gratitude from the nation for your service and sacrifice.

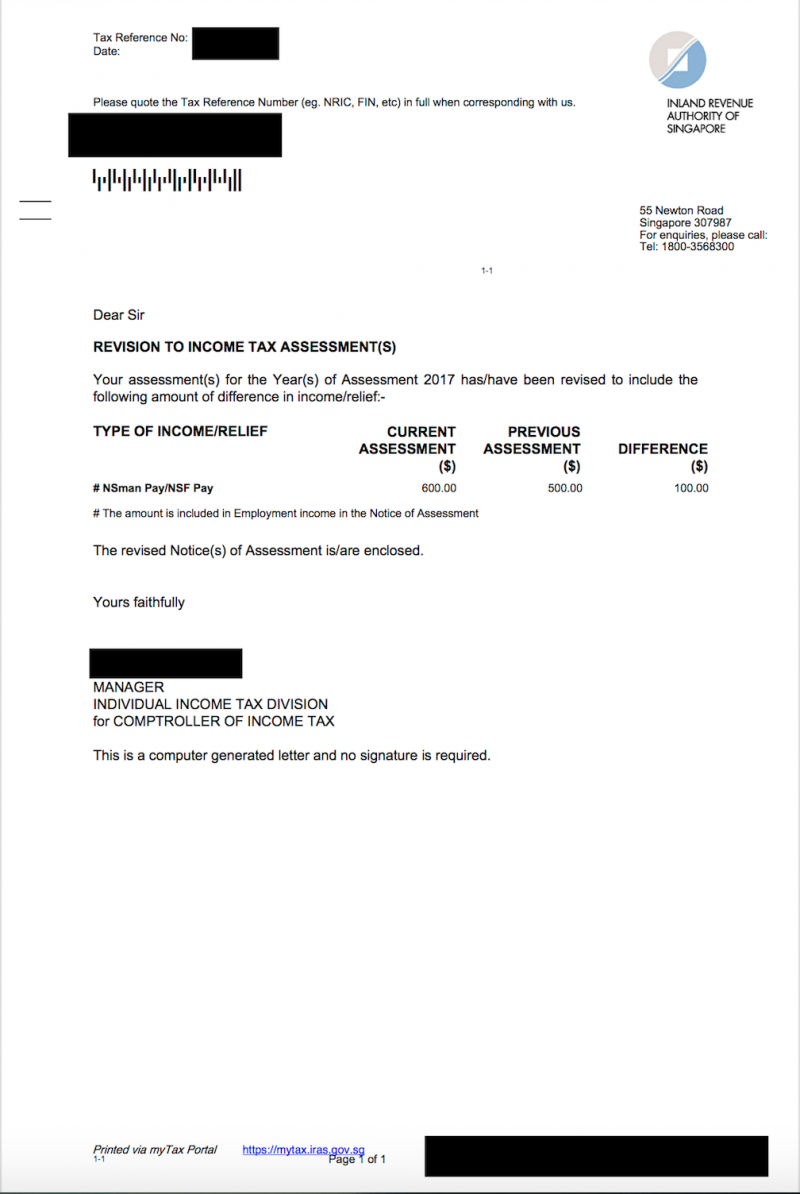

Letter from the taxman

Now imagine: After having performed well in ICT, you get a letter in the mail from the Inland Revenue Authority of Singapore stating that your Excellence Award voucher is considered taxable income, and you owe some money to the government.

A Mothership reader, who wishes to remain anonymous, informed us of the taxable nature of the NS Excellence Award -- after it came as a rude shock to him.

He went for ICT in Oct. 2016, where he performed well and was ranked in the top 20 percent of his batch. This entitled him to a S$100 voucher under the Excellence Award.

However, Iras duly sent him a letter.

The letter is reproduced below:

Screenshot from a contributor.

Screenshot from a contributor.

As seen above, the S$500 was his make-up pay, while his Excellence Award was worth S$100.

Upon calling the Iras hotline to clarify matters, he was informed that the Excellence Award was taxable and he had to pay income tax on it.

[related_story]

What does Iras say?

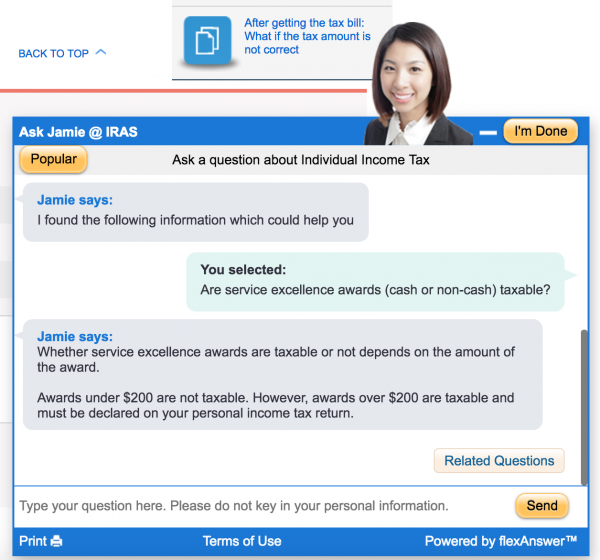

The Iras' website states that service awards are not taxable if they are less than S$200.

Screenshot from Iras website.

Screenshot from Iras website.

However, this relates to service excellence awards given by employers and may not count for NS awards.

Okay to tax a reward?

Although the amount in question is relatively small, there is a question of principle.

It appears counter-intuitive to offer incentives for NSmen to perform well during their disruptive ICTs, but then expect them to pay a tax on the received supplementary award.

If an NSman went above and beyond his call of duty to serve his country, shouldn't his reward be above and beyond the taxman's reach? Reciprocal, no?

There will also be cases where NSmen received the voucher, but inadvertently, did not use it. But they will still be taxed as long as the voucher has been disbursed to them.

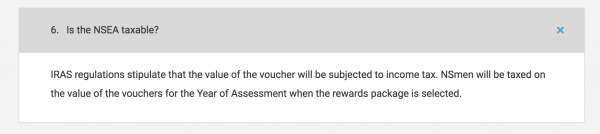

Official reply

Mothership reached out to both Mindef and Iras for comment.

Mindef directed us to this section of their FAQs, which you can see at this link.

Screen shot from Mindef.

Screen shot from Mindef.

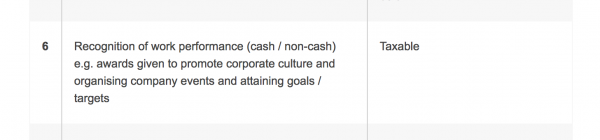

Iras directed us to this section of their FAQs, which you can see at this link.

Screen shot from Iras.

Screen shot from Iras.

It seems that the key distinction is that the definition of the NS Excellence Award falls under work performance, and not service excellence (ironically, given the name).

This means that any amount awarded under the NSEA will be taxable.

However, neither Mindef nor Iras elaborated on what steps have been taken to communicate this information to NSmen, who might not be aware of the taxable nature of the award, which they would assume was given out of goodwill.

So, is a taxable something better than nothing?

That's up to every Singaporean son to decide.

Here are some totally unrelated but equally interesting stories:

Amos Yee granted US asylum: What it means for him, S’poreans & America

Top image via Cyberpioneer

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.