As mentioned in Prime Minister Lee Hsien Loong's uncharacteristically short National Day Rally, Singapore is trying to up its #SmartNation game by going cashless, fast.

Guess we all saw this coming — in recent weeks we saw the introduction of PayNow, a peer-to-peer funds transfer service available to customers of the seven participating banks in Singapore, as well as announced plans to try to make our public transport go cashless by 2020, just to name two examples.

Now, noise is being made – problems identified so far, even in execution, includes unnecessary steps to link money to device and high transaction costs add a lot of friction to what should really be a seamless process.

Too many cards

Singapore's blogfather, Lee Kin Mun, better known as mrbrown, has also stepped up to talk about another problem with going cashless: Having too many existing cards.

"You know why we haven't become #SmartNation? Because when you take a taxi, you still have to pay cash unless you are willing to pay 30 cents more for NETS. Why do we even need NETS these days?

Why do we even need CARDS? PM says, we must have a terminal that can read all cards. Terminals cost money. Which banks will charge merchants. I say start by getting RID of unnecessary cards first.

China has proven that you can do payments, even micropayments, with an app. ApplePay and Android Pay can be used without taking out your wallet. They just need your fingerprint. I've also been paying for stuff with PayLah! QR codes too.

And here we are, still juggling a gazillion cards and PIN numbers. And sticking cards that have to be topped up, into car IU readers. And using competing transit cards that need to be topped up too.

Oh and don't get me started on the annoying situation when you have more than one bank ATM card or credit/debit card that supports ezlink or Flashpay. Then you tap your wallet at the MRT gates or bus reader and the various cards conflict. So you end up SEPARATING your other cards from the one you use for public transport, into another wallet.

It's nuts."

[related_story]

Basically, Lee has identified the main problem with our struggle to adapt to a cashless solution.

Cards are a hindrance to our cashless world, as we have too many of them for different purposes — and they don't work in tandem, which creates more problems.

Seamless experience in China

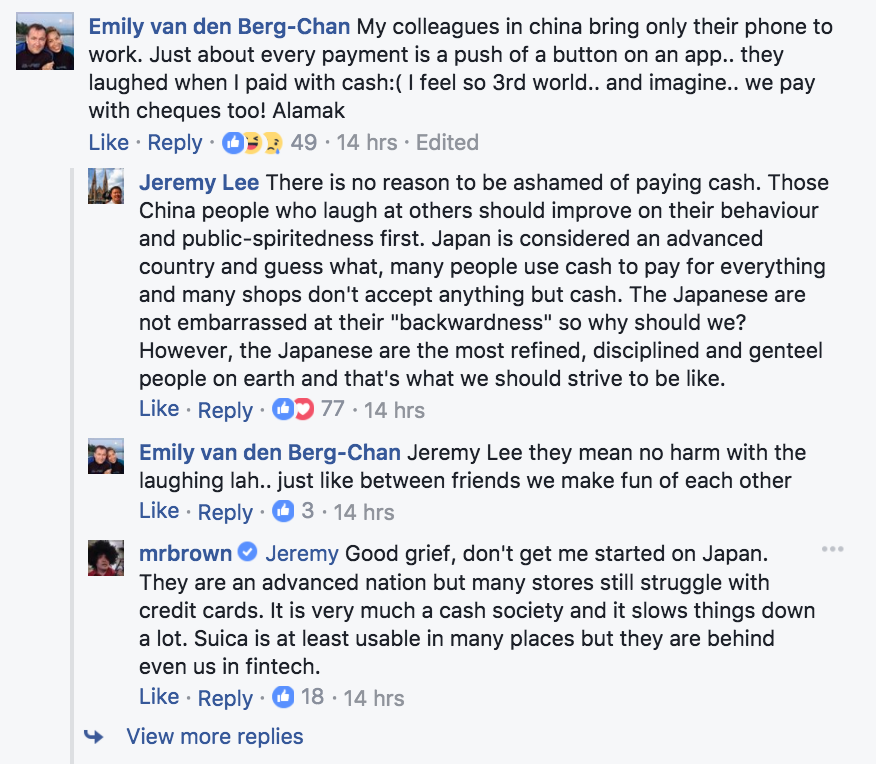

Therefore, some in Singapore feel that China is indeed blazing the trail:

Screenshot via mrbrown's Facebook post

Screenshot via mrbrown's Facebook post

Screenshot via mrbrown's Facebook post

Screenshot via mrbrown's Facebook post

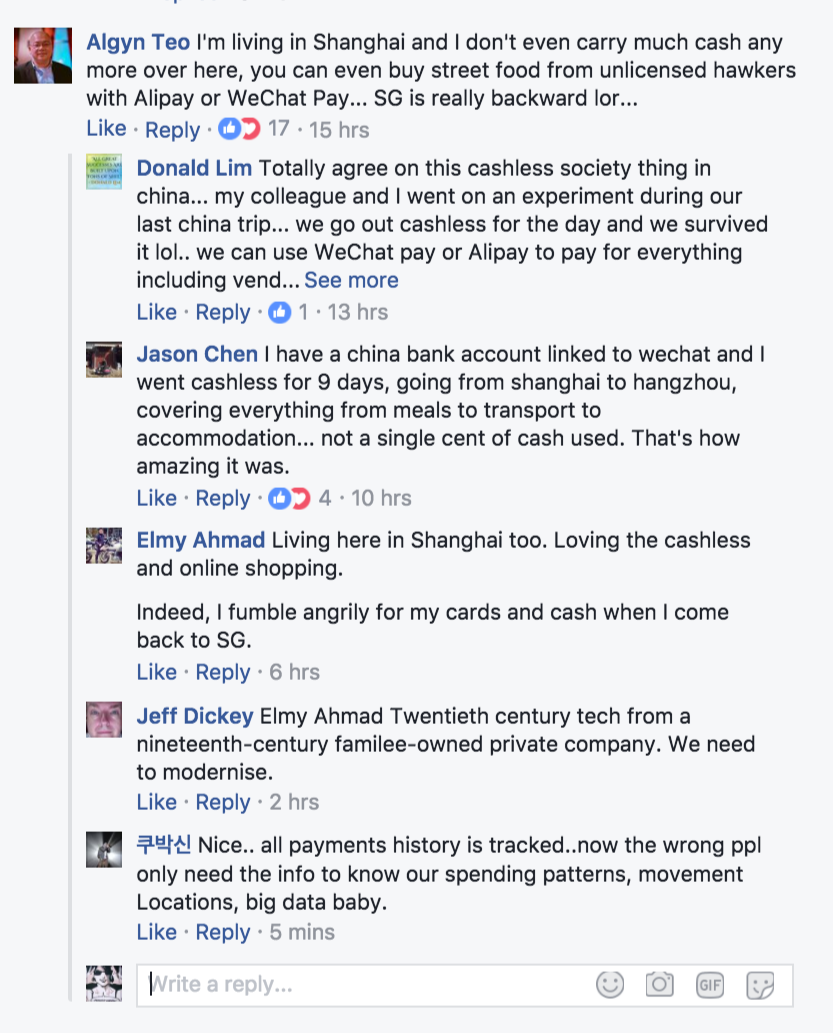

Even regular issues we worry ourselves about don't faze them:

Screenshot via mrbrown's Facebook post

Screenshot via mrbrown's Facebook post

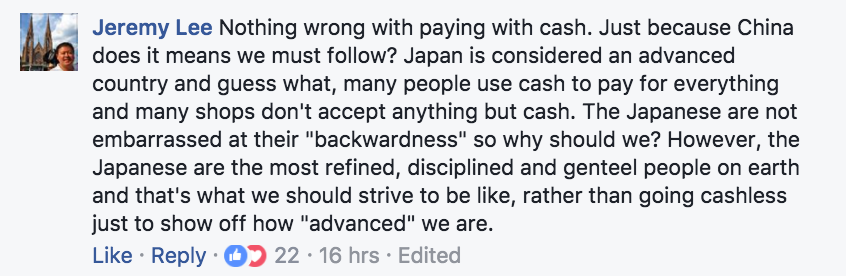

Others, however, feel that this wasn't so much of an issue to feel "suaku" (backward) about:

Screenshot via mrbrown's Facebook post

Screenshot via mrbrown's Facebook post

So what are we missing?

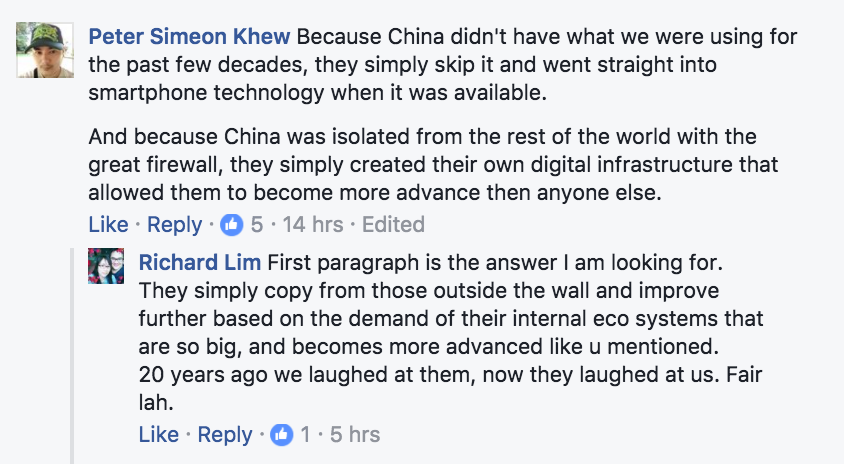

As mentioned, China's system has allowed them to skip one step ahead, but it wasn't necessarily because of a positive situation.

The use of phone payments became prevalent as a result of the cellular network bypassing the weaker ones used by credit card terminals.

Furthermore, traditionally, the Chinese didn't like using credit cards, since it felt like they were constantly owing money.

Phone payments, connected to a debit account, became a cashless solution that Chinese commerce supported and used widely.

Singapore, naturally, has different circumstances which facilitated the wide usage of cards as a method of payment as well.

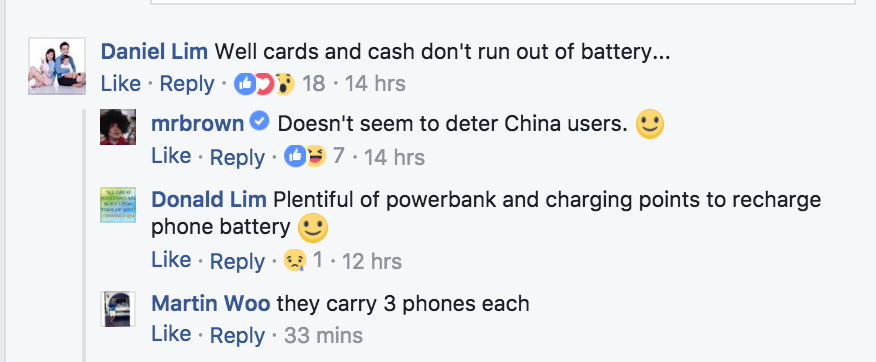

As at least one guy pointed out:

Screenshot via mrbrown's Facebook post

Screenshot via mrbrown's Facebook post

But of course, it doesn't take away the issues of relatively expensive transaction charges and the cumbersome lump of different payment options.

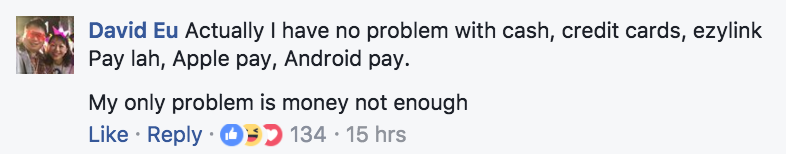

Regardless, whether you prefer to go cashless or otherwise, you might find yourself agreeing with this one guy:

Screenshot via mrbrown's Facebook post

Screenshot via mrbrown's Facebook post

We suppose money solves everything.

Top image adapted via Pixabay and mrbrown's Facebook post

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.