Temasek Holdings, Singapore's state investment firm held their annual report press conference on Jul 11.

Not to worry if you're not a business nor finance-savvy person, here are the main takeaways from this year's conference, to help you understand one of Singapore's most important - and misunderstood company.

1. It was a good year for Temasek.

Temasek's net portfolio value rose to a record S$275 billion for the year ended March 31, boosted by the surge in share markets both in Singapore and globally.

This is an increase of S$33 billion from in the previous financial year. It then suffered a 9 per cent decline in net portfolio value, in what was the first drop since the global financial crisis.

It posted a one-year Total Shareholder Return of 13.4 per cent for the year, reversing from the 9 per cent decline the year before.

From their investment portfolio, S$16 billion was invested and S$18 billion divested, the first time in 8 years that divestments have exceeded investments.

Their investments remain largely focused on Singapore geographically, followed by China, the rest of Asia and North America.

2. Up-and-coming investments include environmentally sustainable businesses.

These businesses do pretty cool stuff.

US company Modern Meadow produces bio-fabricated leather, which doesn't require cows at all - just science.

Another US company - The Impossible Foods produces plant-based meat burgers that replicate the taste and texture of meat - and no, it's not sub-par compared to real meat, at least in Senior Managing Director, Portfolio Strategy and Risk Group head for Australia and New Zealand Michael Buchanan's opinion. He said that even as a meat lover, the plant-based meat patties tasted great.

Photo by Tan Guan Zhen

Photo by Tan Guan Zhen

[related_story]

3. It's not all about making money at Temasek.

Temasek Holdings has 17 non-profit endowments. In Sep 2016, they were regrouped into 6 Temasek foundations, each with a different focus: International, Cares, Connects, Nurtures, Innovates, and Ecosperity.

This is to better plan and deliver community programmes and the various public good causes.

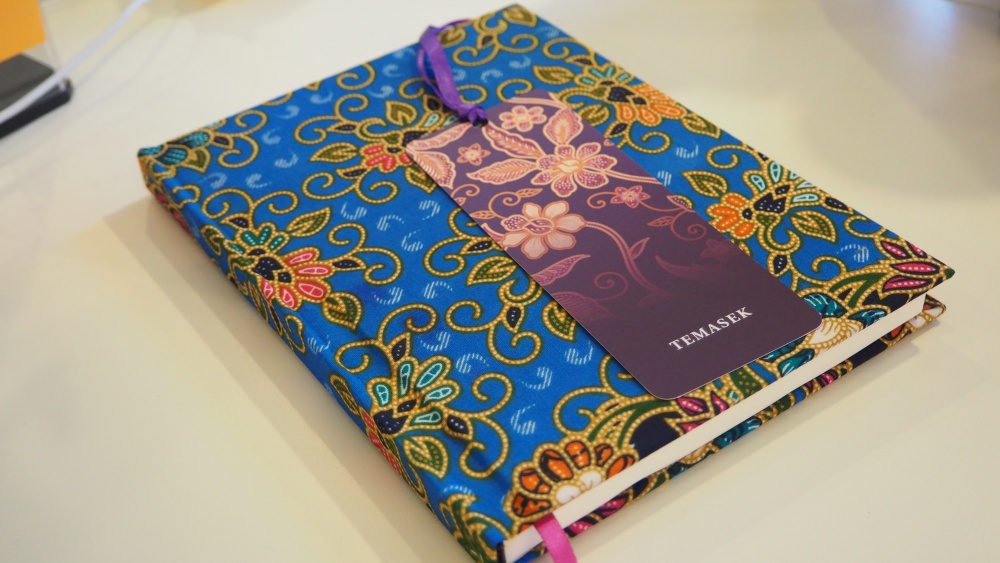

Speaking of which, this year they showcased lovely looking batik notebooks, which were made by individuals recovering from mental illnesses from Singapore Anglican Community Services.

Photo by Tan Guan Zhen

Photo by Tan Guan Zhen

4. Temasek has stepped up its game in reaching out to the public

Yes, Temasek is well aware that they may not have the best corporate image in the eyes of some Singaporeans.

Besides being scrutinized by the highly demanding Singapore public over its investment performance, they are also a lightning rod for criticisms when people talked about the government-linked companies.

In addition, you usually read about their investment activities from foreign news sources first, rather than local media, which feeds into the general perception of their lack of transparency.

This year, it has stepped up its game in public communications with animations such as the one below, that explained "The Ins & Outs Of Temasek"

While these novel story-telling attempts by Temasek reflect how it has adapted its communications approach to better educate the public about the work they do, the true test lies in whether public perception and mindset will change as a result of all these efforts.

5. There was no mention of the Lee family saga, or the name Ho Ching.

The TR 2017 press conference nearly concluded without THE question that had to be asked: leadership succession at Temasek.

It came down to one journalist who couldn't deal with the elephant in the room and posed the question, albeit with much tact, given that there was no mention of the name synonymous with Temasek for more than a decade - Ho Ching.

64-year-old Ho, wife of PM Lee Hsien Loong, and also the CEO of Temasek since 2002, was not present at the press conference. She had been harshly criticised by PM Lee's younger siblings in the highly public Oxley Road family feud that played out over the last three weeks.

The leadership succession question is another way of asking the real question everyone wanted to know: When is Ho going to retire?

Dilhan Pillay Sandrasegara (President; Joint Head, Enterprise Development Group; Joint Head, Investment Group; Joint Head, Singapore; Head, Americas), who sounded like a man tasked to answer this question he had rehearsed his answers countless times, said this:

As I said before, the board has a succession planning exercise in place for a number of years and continues to do so.

In 2015, (Lee) Theng Kiat took over all the investment activities of Temasek, while Ho Ching focused on the institutional elements of our company, of our group as well as the stewardship aspects of it. That continues, and so you know, that’s where we are today.

Photo by Tan Guan Zhen

Photo by Tan Guan Zhen

Compare this to his answer in 2016, and you will know if journalists are more enlightened on the issue after one year.

The end.

Top image by Tan Guan Zhen

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.