Deputy Prime Minister and Minister of Finance Tharman Shanmugaratnam delivered his Budget 2014 statement last Friday.

He announced a slew of measures and tax changes which will be taking place in the year ahead. Of these, young Singaporeans will be most impacted in these five areas.

1. Education

DPM Tharman said that up to $147 million more will be spent per year in bursaries for higher education.

The per capita monthly household income threshold to qualify for bursaries at our Institutes of Higher Learning will be raised from $1,700 to $1,900. This means that more students – in fact, students from two-thirds of all Singaporean households – will be able to qualify for and benefit from these bursaries.

Furthermore, polytechnic and ITE students from middle-income households will receive increased support from the government. At the same time, students from lower-income households will continue to receive ITE bursaries which are significantly higher to help them cope with living costs.

Similarly, university undergraduates from the lowest one-third of households will see their bursaries increase to $3,600 a year. Middle-income students will also see an increase to $2,600, up from the current $2,150.

This is good news for higher education students from low-income family. In the long term, this will help reduce income inequality in Singapore.

2. Friends with disability

The government announced earlier this year a new government-funded fare concession scheme for persons with disabilities to enjoy a 25% of adult bus and train fares. The government will now further introduce subsidies of up to 80% for those who require dedicated transport services to access special education and care services. For those who need to rely on taxis to travel and are from the lower-half of households, the government will now subsidise up to 50% of their transport cost.

This is overdue good news for people with disabilities. The government had been criticised in the past for neglecting the needs of the most vulnerable people in our society, but are now showing signs that they are trying to make amends. As the saying goes, better late than never!

3. Jobs and opportunities

Young people who start up new businesses often face obstacles to financing. Due to their lack of a track record, these business ventures are often viewed by banks as being more risky, which makes loans more difficult to obtain.

To encourage banks to lend to these businesses, the government had previously launched the Micro-Loan Programme to take on some of the risks for loans below $100,000. The government will now take on more of the risks to further encourage lending to these entrepreneurs. The government is also studying the potential for equity crowdfunding as an alternative source of financing for start-ups. If implemented, young entrepreneurs will face less barriers when starting up their businesses. This is very positive news for young people who are harbouring ambitions to be entrepreneurs.

The government also recognises the need of developing quality people for the social sector. These include nurses, doctors and allied healthcare professionals; early childhood professionals and learning support specialists; social workers and counsellors. In the future, more will be invested in these professions to deepen their expertise and give them the recognition they thoroughly deserve.

Young people with a passion for helping others are often deterred previously from pursuing a career in the social sector. Maybe the government had not given enough recognition to these jobs in the past. This had resulted in wider stigmatisation of these career paths. Further investment in the social sector will encourage more young people to pursue these deeply challenging but fulfilling occupations.

4. Saving for the future

The CPF employer contribution rate will be raised by 1 percentage point for all workers. This increase will be channelled to the Medisave Account.

This will benefit workers of all ages, although young people will likely benefit the most.

5. Smoking, drinking, and gambling

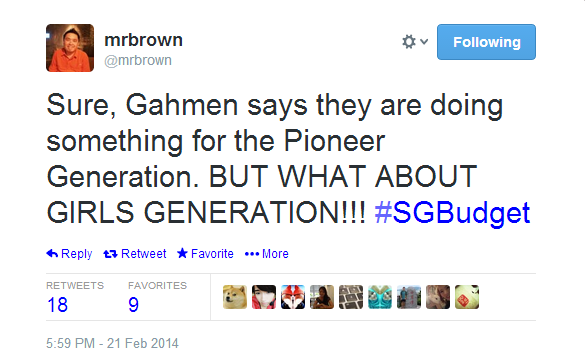

Social media has been set ablaze with the announcement that taxes will be raised on tobacco products (10%), all types of liquor including beer, wines and spirits (25%) and betting (from 25% to 30%).

Young people are upset with these tax increases. But there are plenty of reasons not to be.

Smoking, drinking alcohol and betting are vices which should not be encouraged. Of course everyone should be free to smoke or drink or gamble as they wish. Yet there are disturbing signs that young people are becoming more prone – and dangerously addicted – to these bad habits, especially smoking and drinking. The increase in taxes will help to reduce the incidence of these vices among young people.

Second, the tax increases do not amount to much. For example, an increase of 25% excise duties will basically just mean that each 330ml bottle of beer will cost retailers just 20 cents more. Hence, if any drinking outlet is increasing their beer prices by more than 20 cents, they are simply using the Budget as an excuse to rip you off!

Top photo from Mr Brown Twitter.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.