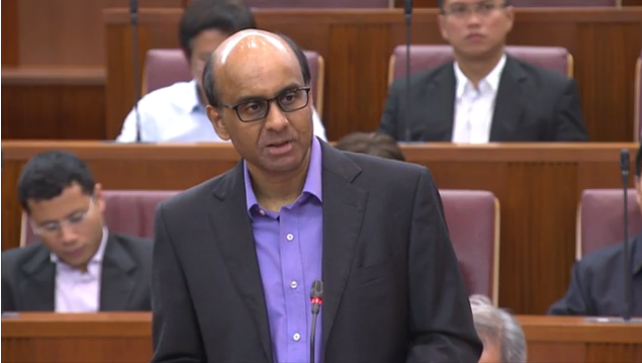

Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam delivered the Budget statement 2014 at 3.30pm in Parliament.

The Budget is expected to record an overall surplus of $3.9 billion (or 1.1% of GDP) for FY2013. This is higher than the surplus of $2.4 billion (or 0.7% of GDP) budgeted a year ago. Revenues were boosted by higher vehicle quota premiums and stamp duty collections.

The overall Budget balance is a deficit of $1.2 billion for FY2014, or about 0.3% of GDP.

Here are 8 key points of his Budget Statement:

1. Transforming our economy means changing our social norms.

Raising productivity continues to be at the centre of Singapore's economic agenda. However, the transforming of Singapore's economy means changing our social norms.

i) Singapore needs a workplace culture where employees are engaged and empowered.

ii) Singaporeans have to seek not just competence but excellence in every vocation.

iii) We have to change our habits as consumers in appreciating quality service.

2. Incentives will be provided to support efforts to transform and upgrade businesses.

i) Productivity and Innovation Credit (PIC) scheme extended, introduction of a “PIC+” scheme for SMEs, to help firms that are making more substantial investments to transform their businesses.

ii) A stronger and more specific push to the piloting and scaling-up of ICT solutions that can help to transform whole sectors.

iii) Support companies in their efforts to internationalise and grow their brands in the global market;

iv) Put in place a series of measures to help players in the construction sector meet the challenge of raising construction productivity.

3. Three key components to Pioneer Generation Package.

i) Outpatient Care: Pioneer Generation will be given a further 50% off their subsidised bills at Specialist Outpatient Clinics. They will receive an additional 50% off their subsidised bills at polyclinics. For those with disabilities, they or their nominated caregivers will receive cash assistance of $1,200 a year.

ii) Medisave Top-ups: Annual top-ups of $200 to $800 for the Pioneer Generation.

iii) MediShield Life subsidies: Under MediShield Life, the government will fully cover MediShield Life premiums of those aged 80 and above this year and about half of the current premiums for the rest.

They will receive a subsidy for their premiums starting from 40% at age 65, rising to 60% at age 90.

4. CPF contribution rates will be raised for older Singaporeans.

i) Singaporeans aged above 50 to 55: CPF rates will be raised by 1.5 percentage points (1 percentage point from the employer and 0.5 percentage points from the employee).

ii) Singaporeans aged above 55 to 65: The employer contribution rate will be raised by 0.5 percentage points.

5. Subsidies for the Early Intervention Programme for Infants and Children (EIPIC)

Those earning above median household income will now benefit from a further 20% to 50% subsidy, on top of an enhanced $500 base subsidy that benefits all Singaporeans children enrolled in EIPIC.

6. GST Vouchers and Rebates for Singaporeans.

About 675,000 Singaporeans aged 55 and above in 2014 will benefit from a special GST Voucher.

Approximately 800,000 HDB households will benefit from a one-off GST Voucher (U-Save Special Payment) this year.

One to three months of Service & Conservancy Charges (S&CC) rebates will be provided for HDB households (ranging from 1-room to 5-room flats).

7. Other financial support for Singaporeans.

Parent and handicapped parent relief will be increased by up to $3000, with those individuals who are staying with their elderly dependants enjoying a higher relief quantum.

For university undergraduates, those from the lowest one-third of households will see bursaries increase to $3,600 a year. Middle income students will see an increase of $450 to $2,600 a year. Similarly, polytechnic and ITE students from middle income households will receive increased support.

8. Duties to be raised for liquor and tobacco products.

Excise duty rate of all liquor types will be raised by 25%, while excise duties for cigarettes and manufactured tobacco products will be raised by 10%. This is expected to yield additional revenue of about S$120 million and $70million a year respectively.

Tired of poring through the papers to know more about Budget 2014? Read what young Singaporeans learn from the social media without watching DPM Tharman on TV.

Top photo screenshot from here.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.