Follow us on Telegram for the latest updates: https://t.me/mothershipsg

Many wealthy mainland Chinese are drawn to Singapore as it has a large mandarin-speaking population.

Singapore is also seen as a place that has managed the Covid-19 pandemic well, especially compared to China.

These are the reasons why they see the city-state as a location where they can survive easily, according to Associate Professor Alfred Wu from the Lee Kuan Yew School of Public Policy (LKYSPP), who was replying to Mothership's queries about the increasing number of wealthy Chinese moving here.

Comments on Weibo also suggest that Singapore has become the top destination, ahead of other locations favoured by the wealthy, such as the U.S., Canada and Australia, Wu added.

Complaints about China's Covid-19 measures on Weibo

One Weibo post that attracted over 14,000 likes implicitly criticised the harsh zero-Covid measures in China by complimenting Singapore's management of the pandemic, pointing out that although over 70 per cent of the population in Singapore had already been infected, the majority of these infections are mild or asymptomatic. The Weibo user further suggested that by not opening up, decision makers in China still think that the price of doing so is too big for the country to handle.

Another Weibo user, which attracted over 6,000 likes for their post, said that China's major cities could also learn from Singapore's Covid-19 measures, and criticised the Chinese Communist Party for lambasting the two cities -- Shenzhen and Beijing -- when they tried to move towards opening up.

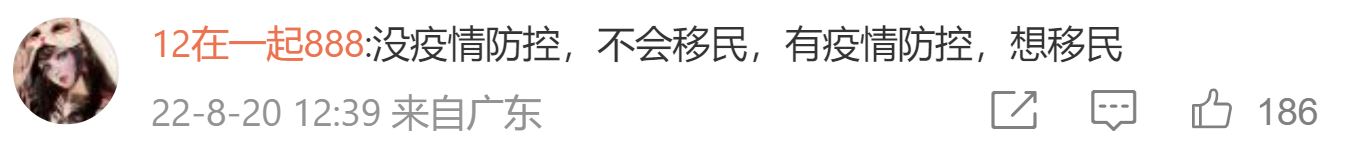

Yet another Weibo user, who was commenting on a post that pointed out the supposed reasons that make moving to Singapore an appealing move, said that China's epidemic prevention measures are why some people are thinking of immigrating to Singapore.

Screenshot from Weibo

Screenshot from Weibo

"No epidemic control and restrictions, I won't want to migrate. But with such measures, I want to migrate."

Not all voices on Weibo, however, are envious of the way Singapore has handled the pandemic. In an account by a Chinese national who is living in Singapore that has previously went viral, the mother of two described how life for her and her family had been extremely tough and even "nightmarish" since Singapore relaxed its Covid measures.

Nevertheless, not all feel the same way as her. Several comments on Weibo, in response to her post, say the overall situation in Singapore is well handled, even saying that Singapore is doing better than China.

Harsh Covid-19 measures prompting the move

Micah Lim, the senior associate director of real estate agency JKL Consultants, told Mothership that China's "tight and erratic" controls in response to the Covid-19 pandemic have contributed to the exodus.

In contrast, Singapore, according to Lim, "has handled the pandemic steadily with moderate palatable measures."

He also opined that Singapore, while "not favouring the rich", has policies that makes the ultra-rich "comfortable".

"Post-pandemic, Singapore has sealed its reputation as a safe haven for rich investors, with consistent stability and transparency. It also helps that Singapore has a Chinese-majority population with little to no racism towards foreigners."

Wu clarified that some of the wealthy Chinese arriving here are critical of Singapore's Covid-19 measures however, believing they are too lax.

Wu added that this is due to Chinese propaganda which has focused on portraying China's Covid-zero approach as the best strategy.

Such propaganda also includes criticising Singapore, he pointed out.

For these wealthy Chinese who have subscribed to such rhetoric, they would like Singapore to adopt a “zero-Covid” strategy as well, on top of it being a safe place to protect their wealth due to its laws.

Wealth crackdown prompting some to leave China

As for why wealthy Chinese are leaving the country in the first place, a report from the Financial Times claimed that China's rich are leaving the country following years of "political crackdowns, severe Covid lockdowns and unease about Beijing's global reputation".

They have also been shaken by China's growing political rhetoric about "common prosperity", which broadly means common wealth for all, instead of just a few.

In elaborating on the nature of this drive, Wu said that it has entailed the Chinese government asking rich people to donate.

Such donation requests cannot be refused as many business dealings conducted by the rich often involve a violation of government regulations, such as illegal tax avoidance.

In describing the regulations imposed on doing business as "too many", Wu said that it has resulted in many of the wealthy Chinese looking for various loopholes to increase their profits while conducting their business.

As such, many of them fear that if they refuse to donate, they will be prosecuted by the government for violating regulations, Wu pointed out.

This in turn, has spurred their desire to leave the country and shift out their assets.

In August 2021, Bloomberg reported that amidst Chinese President Xi Jinping's push for "common prosperity", seven Chinese billionaires donated a record US$5 billion (S$7 billion) to charity, exceeding the total amount donated nationally in 2020 by over 20 per cent.

Luxury property prices in Singapore will certainly rise

With regard to the impact on Singapore brought about by the wealthy's arrival, Wu highlighted that the prices of luxury properties will grow, in light of the purchases that they have made.

According to Lim, "it is only a matter of time" for the rise in prices, given the marked increase in the number of wealthy mainland Chinese clientele searching for luxury properties here.

While there have been successive rounds of cooling measures over the years, these have only managed to temporarily tame the effect that foreign property buyers has on the market.

Lim added, "Given the relatively limited options of safe haven and suitable locations now for high net worth mainland Chinese, they will ultimately still continue to invest in Singapore. This will eventually affect the market for such locations (luxury properties)."

In March, an entire floor of Suntec City Tower 2 was sold for S$38.8 million to a Singapore permanent resident that was of "Chinese descent", according to EdgeProp.

The same month also saw all 20 apartment units of an ultra-luxury condominium, Eden by Swire Properties, sold for S$293 million to a single buyer, believed to be a Chinese family.

In June 2022, a buyer from China was reported to have bought 20 units at the luxury condominium CanningHill Piers, for over S$85 million.

Why do the wealthy Chinese want to buy luxury properties here?

When Mothership asked Lim why wealthy Chinese look out for luxury properties in particular, he replied that this is due to such buyers being "image conscious" and keen on ready-to-move-into sort of property.

"Their luxury residential property needs is a means of displaying their wealth and status. They usually look out for well known exclusive enclaves for the rich with high social status," he added.

Another reason is likely the "negative state of affairs" in China's property market, he said, with property developers there running out of money to complete projects, among other things.

Earlier on Aug. 13, Nikkei Asia reported that around 20 per cent of Chinese developers are at risk of insolvency, citing a warning by American credit rating agency S&P Global Ratings.

The debt-driven growth model for the country's property developers went into reverse following a decision by China's government to impose stricter controls in 2021 on mortgages and the access that property developers had to financing.

This has resulted in many developers halting ongoing condominium projects as they are longer able to secure cash.

This has in turn triggered a mortgage strike across more than 300 construction projects, with Chinese buyers refusing to make payments.

The chief economist at Shanghai-headquartered Hang Seng Bank (China), Dan Wang, was quoted as saying:

"If tens of thousands of homebuyers really stop paying their mortgage, the real estate companies will soon collapse because they have no liquidity. There are huge risks for banks, particularly local banks, whose assets are mainly in the housing market, and there is no way that the central bank could save all of them."

Top photo by Pierpaolo Lanfrancotti via Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.