Follow us on Telegram for the latest updates: https://t.me/mothershipsg

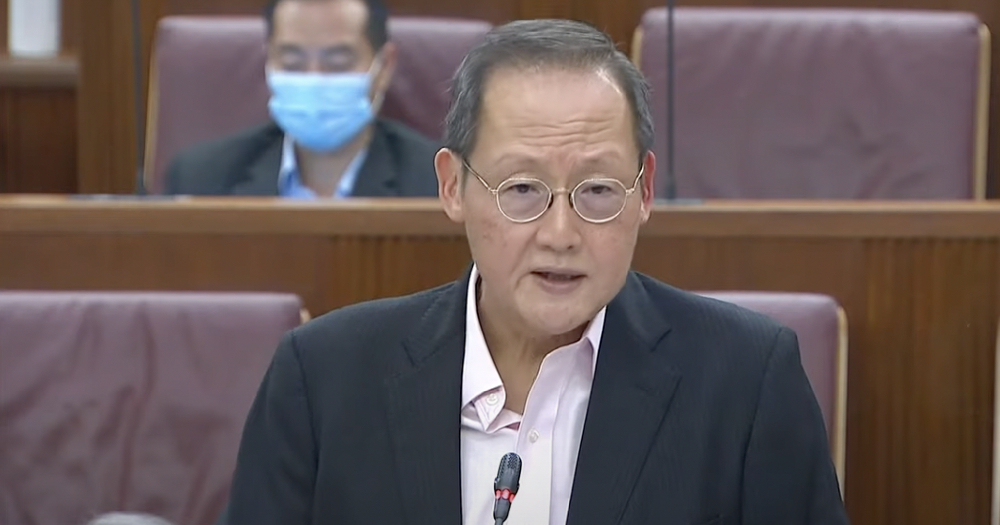

Currently, members of the Central Provident Board (CPF) below the age of 55 can earn up to 5 per cent interest on their combined CPF balances while those above the age of 55 can earn up to 6 per cent, Manpower Minister Tan See Leng said in Parliament on Aug. 2.

These rates are pegged to 10-year Singapore government securities, with the government paying an additional 1 per cent of interest on the first S$60,000 of combined CPF balances for members below the age of 55, as well as an additional 1 per cent on the first S$30,000 of members aged 55 and above, to boost their retirement savings.

Tan was responding to questions posed by Members of Parliament (MPs) as to whether the CPF interest rates will be increased for the next few years, amidst rising inflation, and if the formula for which the rates are pegged to will also be reviewed in light of banks raising their interest rates, with DBS's Multiplier account cited as an example.

Tan: Emphasis of CPF Board is on the long-term

The minister highlighted that the focus of the CPF Board is on the long-term and noted that bank and multiplier accounts were essentially "very short-term volatile instruments."

Tan also addressed the example of DBS's Multiplier account by noting that the bonus interest rates are contingent on customers fulfiling certain criteria such as a minimum amount spent on credit cards, crediting their salary to the account or making bill payments through it.

He said, "The effective interest rate, which is what would impact all of us, may be much lower, because the bonus rates are usually kept to a certain amount."

What about CPF rates?

Here, Tan said that the interest rate for the Ordinary Account (OA) is pegged to the three-month average fixed deposit and savings rates of Singapore's three major local banks which are DBS, UOB and OCBC.

"These three banks have a larger share of domestic deposits than other banks," he added.

The formula was last changed in 1999 when the ratio of fixed deposits to savings was updated from 50-50 to 80-20 to reflect the longer duration that CPF OA monies remained with the CPF Board.

Currently, for the period of July to September 2022, the local banks’ 3-month average interest rate was 0.09 per cent and continues to remain so based on the government's latest estimates, Tan pointed out.

As for the Special and MediSave, and Retirement Accounts (SMRA), their interest rates are pegged to the 12-month average yield of 10-year Singapore government securities plus 1 per cent.

Tan added that the peg was 2.72 per cent as stated by the CPF Board and is currently around 3 per cent based on the government's latest estimates.

The board will announce in September 2022 the CPF interest rates effective from October to December 2022, he said.

Tan: Interest rates for OA and SMRA are maintained at a higher level

This brought up Tan's next point that as these rates are below the effective floor rates for these accounts, the interest rates for the OA and SMRA are still maintained at 2.5 per cent and 4 per cent respectively.

"The government has maintained the floor rate of 4 per cent for SMRA since 2008 and will continue to review this annually," he elaborated.

This led to Tan's point that the government has continued to pay "generous" interest rates due to the floor rates, and despite the low interest rate environment since the 2008 Global Financial Crisis.

"If the pegged rates exceed the floor rates, members will correspondingly earn the higher interest rates on their CPF savings," he added.

In addition, members can also transfer their OA monies to the either Special and Medisave or Retirement Accounts to earn the higher risk-free rate.

Some time-lag in CPF interest rate adjustments is to be expected

The minister also said that there is some time-lag in the CPF interest rate adjustments to avoid subjecting members to unnecessary fluctuations.

Tan explained, "Members with HDB concessionary loans who pay the prevailing OA interest rate plus 0.1 per cent-point also benefit from the stability vis-à-vis market mortgage rates. This is the case when interest rates are rising, but the converse also applies when interest rates are falling."

He added:

"We will continue to review CPF interest rates periodically. The interest rates on the Ordinary Account, Special Account, and MediSave Account are reviewed quarterly, while the interest rate on the Retirement Account is reviewed annually."

Top photo via MCI/YouTube

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.