If you’re a working adult in Singapore, you may have your money stored in one or more popular savings accounts offered by local banks, such as the OCBC 360 savings account, or the DBS Multiplier account.

These savings accounts are popular because they offer significantly higher interest rates than traditional accounts, in exchange for going through several hoops.

These hoops include having to credit your salary to the bank account every month, spending a certain amount on credit cards, investing through the bank, and so on.

And if you haven’t been living under a rock, you may also have noticed that the interest rates offered by these accounts have been cut.

Several times last year, in fact.

So what’s going on? Why are there so many changes at once? And should customers be concerned?

How bad are these changes? Pretty bad.

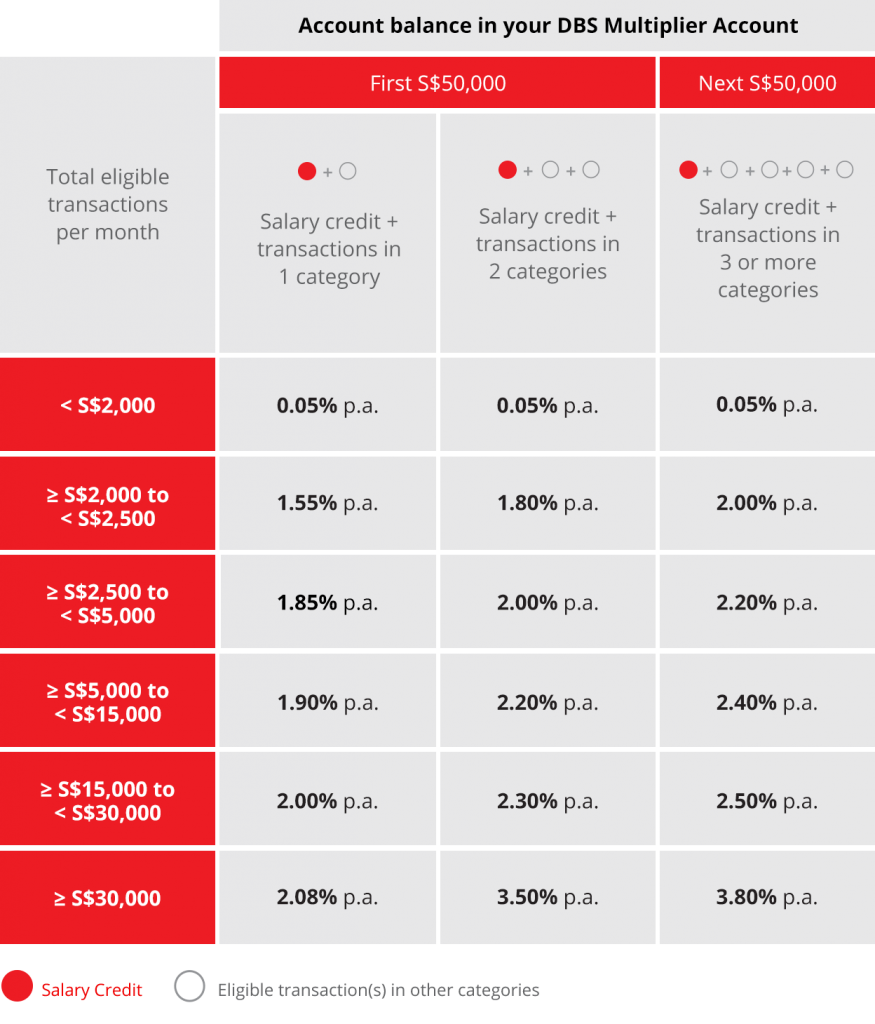

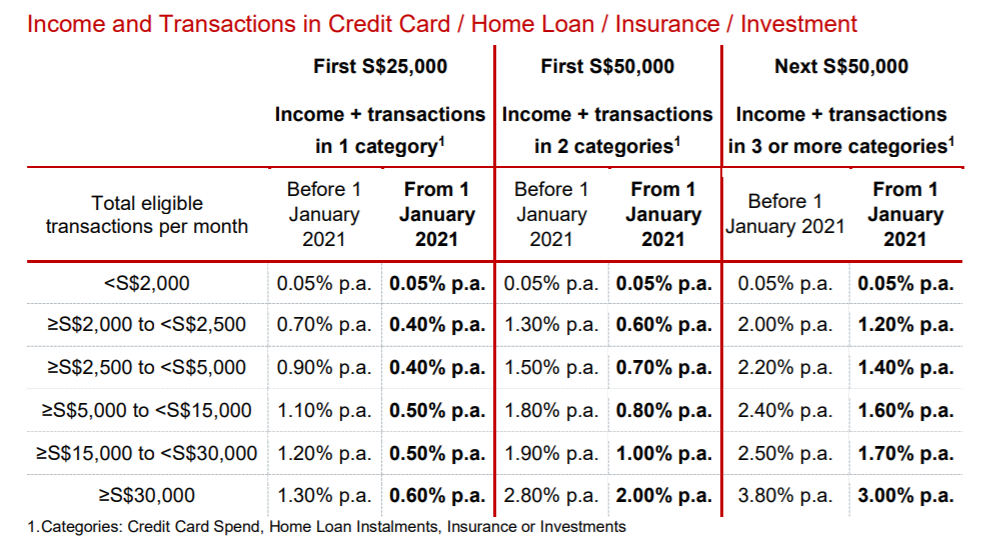

Take the DBS Multiplier account for example.

In January 2020, someone who spends — for example — S$500 on a DBS credit card and credits a S$3,000 salary to DBS monthly could earn 1.85 per cent interest on his or her savings.

1.85 per cent may not seem like much, but it's higher than Singapore's inflation rate for the last five years, so you're at least coming out ahead in that regard.

Just one year later, in January 2021, after several rounds of interest rate changes, the same person would only earn 0.40 per cent interest.

For a person who jumps through all of DBS’s hoops in order to maximise their interest rates, the situation is similar.

A person who spends S$1,000 on a DBS credit card, invests S$500, buys insurance with DBS and credits a salary of S$4,000 to DBS would have earned 2.4 per cent interest in January 2020.

Now, that same person would only earn 1.6 per cent.

And DBS was not alone in reducing interest rates in 2020. Both Standard Chartered and OCBC have also slashed interest rates, and to similar levels.

Central banks around the world lowering interest rates

So why have banks decided to collectively slash interest rates last year?

Well, the main reason is the lowering of interest rates by central banks around the world, especially the U.S. Federal Reserve (more commonly known as the Fed).

During economic downturns, the Fed cuts interest rates in order to stimulate the economy, as part of its monetary policy.

When interest rates drop, borrowing becomes more attractive not just for businesses, but also for consumers.

This helps to stimulate investing and spending, which gives the economy a boost.

How this affects Singapore

What does that have to do with interest rates for Singapore bank customers, you might ask.

Interestingly, the answer lies in the fact that Singapore’s central bank, the Monetary Authority of Singapore (MAS), is one of the few economies that chooses not to influence interest rates, relying instead on managing exchange rates.

According to MAS, since Singapore is a small and open economy, Singapore's exchange rate has a much stronger influence on inflation than the interest rate.

With the Fed slashing interest rates amid the Covid-19 pandemic, MAS also manages the strength of the Singapore dollar accordingly by increasing its supply. When there is a increase in supply of Singapore dollar, the price of it — the interest rate — goes down as well.

In practice however, says MAS, Singapore's central bank does not need to intervene much aside from announcing plans to adjust the exchange rate.

If it announces that the Singapore exchange rate will go down, demand for the Singapore dollar goes down in anticipation of the weaker Singapore dollar. When demand for the Singapore dollar goes down, the price of it, again the interest rate, goes down as well.

Individuals and companies can borrow money at lower interest rates

The low interest rate environment is why you, as a potential house buyer, can get housing loans from banks at lower rates now.

Companies, especially small and medium enterprises (SMEs), can also get loans from banks at lower interest rates because of government intervention.

In 2020, due to the Covid-19 pandemic, MAS provided a series of loans to banks, at an extremely low interest rate of 0.1 per cent per annum, in order to encourage them to loan to SMEs who need capital during the crisis.

Since banks are expected to pass these cost savings on to their clients, it means that companies borrowing money from banks can enjoy lower interest rates too.

Banks can no longer offer high interest rates on deposits

But this also means that the banks must adjust interest rates offered to consumers for their savings accounts.

After all, one of the ways that a bank traditionally earns money is by offering interest to depositors (such as you), who deposit their money in bank accounts, which the banks lend to businesses at higher interest rates.

When the economy is booming, and interest rates are high, banks can offer attractive interest rates of more than two per cent to consumers for their savings accounts, as they are able to charge even higher to businesses.

However, now that interest rates for loans have dropped significantly, banks can't afford to offer high interest rates for deposits, as it will cut into their profits.

In a nutshell, as long as the recession continues to loom over us, interest rates for savings accounts are likely to stay low.

Fortunately, interest rates are often tied to business cycles, and when the economy begins to pick up, there's a good likelihood that the interest rates offered by banks will rise correspondingly.

What are the alternatives?

So where should you keep your money instead?

For one, you can try putting your money into insurance savings plans such as Singlife, which promises up to 2 per cent returns per annum, and provides life insurance at the same time.

This is a great option because it is protected by the Singapore Deposit Insurance Corporation (SDIC), under the Policy Owners' Protection Scheme.

This scheme provides 100 per cent protection for the guaranteed benefits of your life insurance policies, subject to any applicable caps.

However, such plans are clearly very popular, and new sign-ups for the Singlife account have been placed on hold since Dec. 15, 2020.

Another option would be to invest your money, although this is a riskier option, given that investment returns are not guaranteed.

Robo-advisors such as StashAway, AutoWealth, and MoneyOwl are attractive options for beginners, as they help individuals invest using data-driven indicators.

Consumers can simply choose the risk level they are comfortable with, and the robo-advisors will do the rest.

While investing is generally a sound idea for the long term, you need to be careful with investing too much of your money, given that you may not always be able to liquidate your investments at a moment's notice without incurring loss.

And if you find all of these options too overwhelming, you can always choose to continue parking your money at the lowered interest rates in your savings account.

Given that Singapore's inflation rate is forecasted to be at around 0.34 per cent in 2021, you may still come up slightly ahead.

At the very least, it's better than keeping your money in a tin under your bed.

Follow us on LinkedIn for more stories

Mothership Explains is a series where we dig deep into the important, interesting, and confusing going-ons in our world and try to, well, explain them.

This series aims to provide in-depth, easy-to-understand explanations to keep our readers up to date on not just what is going on in the world, but also the "why's".

Top image via Jason Fan.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.