DBS has revised the interest rates for the DBS Multiplier account.

Changes w.e.f. Jan. 1, 2021

In a notice, the bank said that they will make the changes with effect from Jan. 1, 2021.

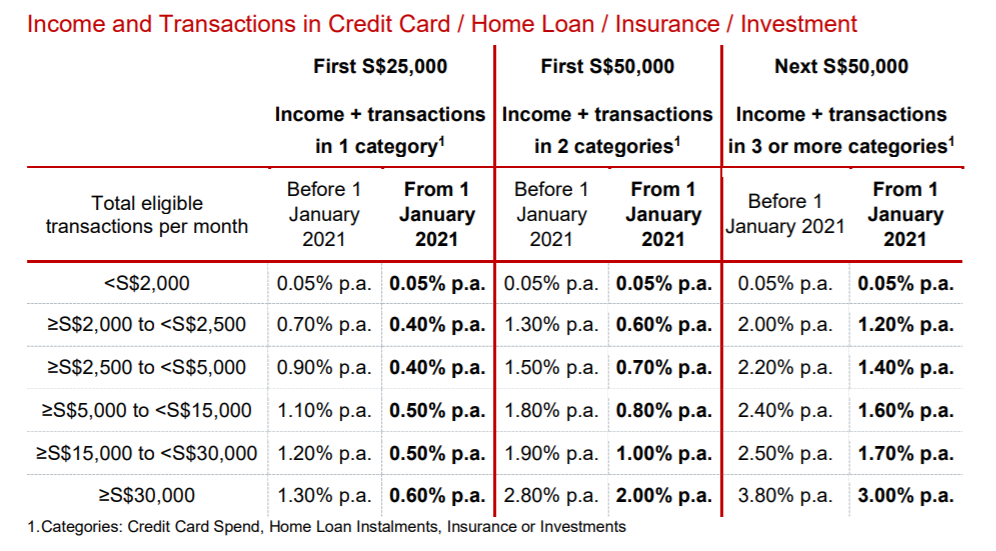

For this account, interest rates are higher when customers have a greater amount of eligible transactions in a month. This includes credit card spend and investments.

Interest rates across the different transaction amount categories have been reduced, with the highest reduction being 1 per cent.

You can see the full table for the changes:

How it works is that a customer who credits his/her salary plus has transactions in two eligible categories amounting to a total value of S$5,000 will now only earn 0.8 per cent interest, as compared to the previous 1.8 per cent, on the first S$50,000.

Interest rates on income and/or PayLah! retail spend remain unchanged.

This is the third time the bank's Multiplier interest rates have been slashed since May this year, Straits Times reported.

Other banks have also reduced interest rates

DBS is not the only bank to have slashed its interest rates on its accounts this year.

OCBC had also made changes to its interest rates for the 360 savings account in October this year, which was the third cut in 2020, ST reported.

The UOB One account and Standard Chartered JumpStart savings account also saw reductions in their interest rates.

Top photo via T T Teo/Google Maps.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.