In another decade, I look forward to buying a 3-room HDB flat to call my own.

With that long-term goal in my mind, I feel motivated to save up for my dream home.

At the same time, I want to ensure that I have sufficient money saved in case of unforeseen circumstances, such as medical emergencies or accidents.

Having an emergency fund is also important, especially during uncertain times, such as the current economic situation.

According to a survey by Straits Times conducted this year, 70 per cent of working Singaporeans and Permanent Residents do not have enough savings to live off more than six months if they are laid off.

Keeping this in mind, I always ensure that I have money saved for a rainy day.

Here are five ways that have helped me save money without having to ‘restrict’ myself too much.

1) Start small with the 50-30-20 rule

In my first serious job after graduating from university, I worked in a charity that paid about S$1,700.

After CPF was deducted, my take-home pay was only about S$1,200.

While it was tempting to immediately dive into investments, I wanted to start small and inculcate the habit of saving money.

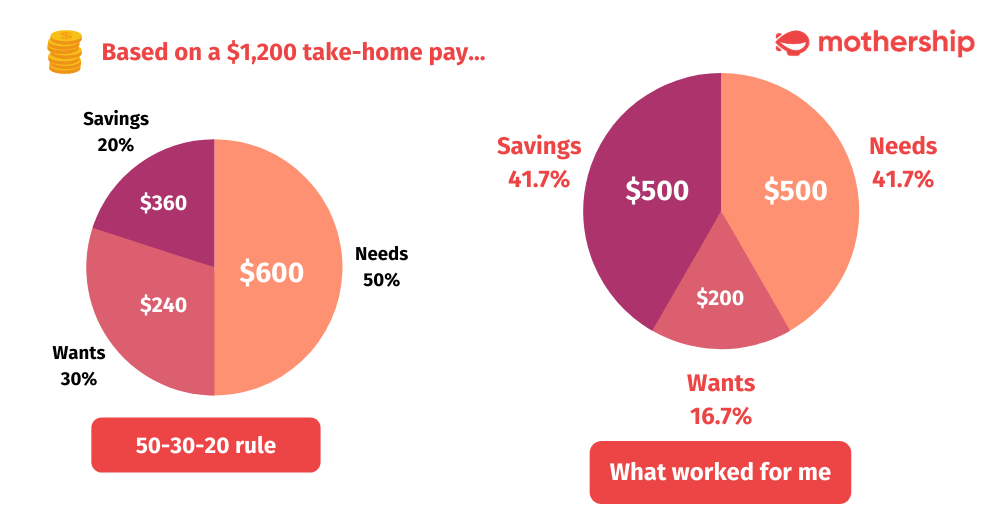

One useful financial guideline I stumbled upon while searching for ways to save money was the "50/30/20 rule”.

So what is the "50/30/20 rule"?

You basically allocate a portion of your take-home pay to spend and save up at least 20 per cent of it:

- Calculate your take-home pay after CPF deductions

- Allocate 50 per cent to needs (such as food and transport)

- Allocate 30 per cent to wants (such as shopping)

- Allocate 20 per cent to savings

I have been using this rule to guide me on my spending and saving.

Eventually, I managed to save about S$500 every month, with limited eating out and basic expenses such as paying for transport rides which costs around S$120 monthly.

It takes a fair bit of discipline to save more, as I only spent around S$100 to S$200 every month on things I wanted.

However, as you grow in your career path, your salary will likely increase and you can adjust the savings ratio to better suit your lifestyle.

2) Indulge in buying secondhand clothes

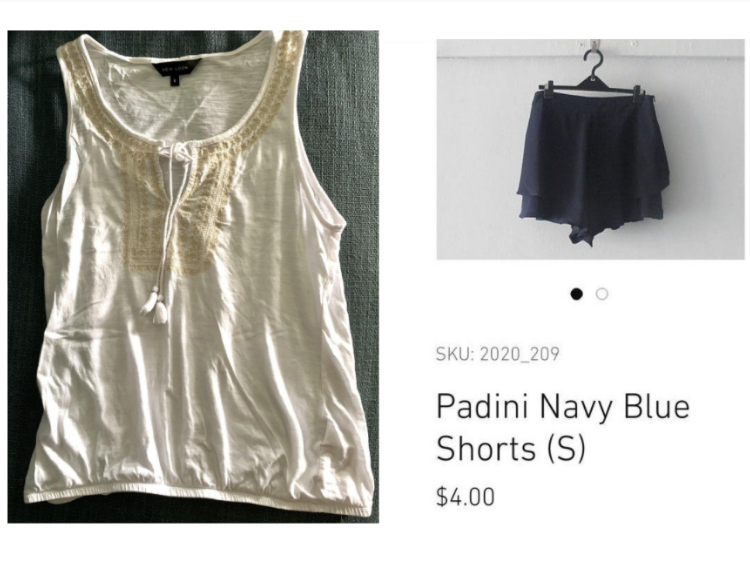

Another way I’ve learned to save money is through shopping at thrift stores, or only spending on secondhand clothes.

Currently, there are a wide variety of such options available in Singapore, providing alternatives to buying brand new clothes.

You can swap clothes with others, or even learn to repurpose your old clothes.

These are ways that help me ‘refresh’ my wardrobe without spending too much.

For example, this top and bottom that I got from a thrift store only cost me S$4 each.

What a steal!

Here’s a dress that I found at a clothes swapping store where I got eight pieces of clothing and an accessory for S$35.

Contrary to what some might think, preloved clothes can look as good as brand new ones.

In my years of shopping for secondhand clothes in Singapore, I’ve realised that most of the clothing items are very lightly used and are almost as good as new.

3) Finding free or low-cost activities to do for fun

Another source of spending is recreational activities.

Spending time with loved ones is definitely important, but it does not have to come at a cost.

Instead of going to attractions or shopping malls, I usually spend some quality time in nature or at parks with my family and friends.

This natural hot spring in Sembawang Hot Spring Park is free to use, for example. (Photo taken before circuit breaker):

Gym memberships? No thanks. Instead, I enjoy running, hiking or cycling in the sun which helps me work up a sweat and enjoy some scenic views along the way.

There are many nature parks and reserves that you can explore in Singapore. For example, Sungei Buloh Wetland Reserve, which you can get to from Kranji MRT station via a public bus:

Sometimes if you look hard enough or ask help from photographers at Sungei Buloh, you might be able to see a wild crocodile or two:

Other activities I enjoy include gardening, which can be low cost if you exchange plant cuttings with friends.

These are some photos of the leafy greens (in this case, xiao bai cai) and cucumber grown from the free seeds given by NParks.

I usually make my own compost at home from organic food waste, such as vegetables and fruits, and this helps to reduce the need to buy soil from shops.

At the same time, I sometimes grow plants from seeds of some vegetables and fruits I consume, such as these pumpkin seedlings, which were from pumpkin seeds from the kitchen:

4) Reduce food waste & consider rescuing food

Another major way to save money is to look at your expenses on food and reduce dining out.

While I was unemployed for five months last year, I turned to rescuing food with a local initiative, called SG Food Rescue.

Here’s a photo of fresh produce I brought back from a food rescue session after volunteering my time with the group:

That means I mainly lived off fruits and vegetables that would otherwise get thrown away because they do not look aesthetically pleasing.

It helped me save about S$200 a month that I would have spent on groceries at the supermarket.

According to a survey conducted by NEA in 2014, it was found that 26 per cent of consumers in Singapore buy more food than required.

To avoid spending more on food, I learnt to buy the right portions of food, even when I feel very hungry.

If I have any leftovers from cooking at home or eating out, I save it for my next meal and that helps me reduce my spending on food.

At the same time, I learnt to turn leftover food into new dishes for the next day.

Besides saving money, I also reduce the amount of food waste.

5) MyMoneySense

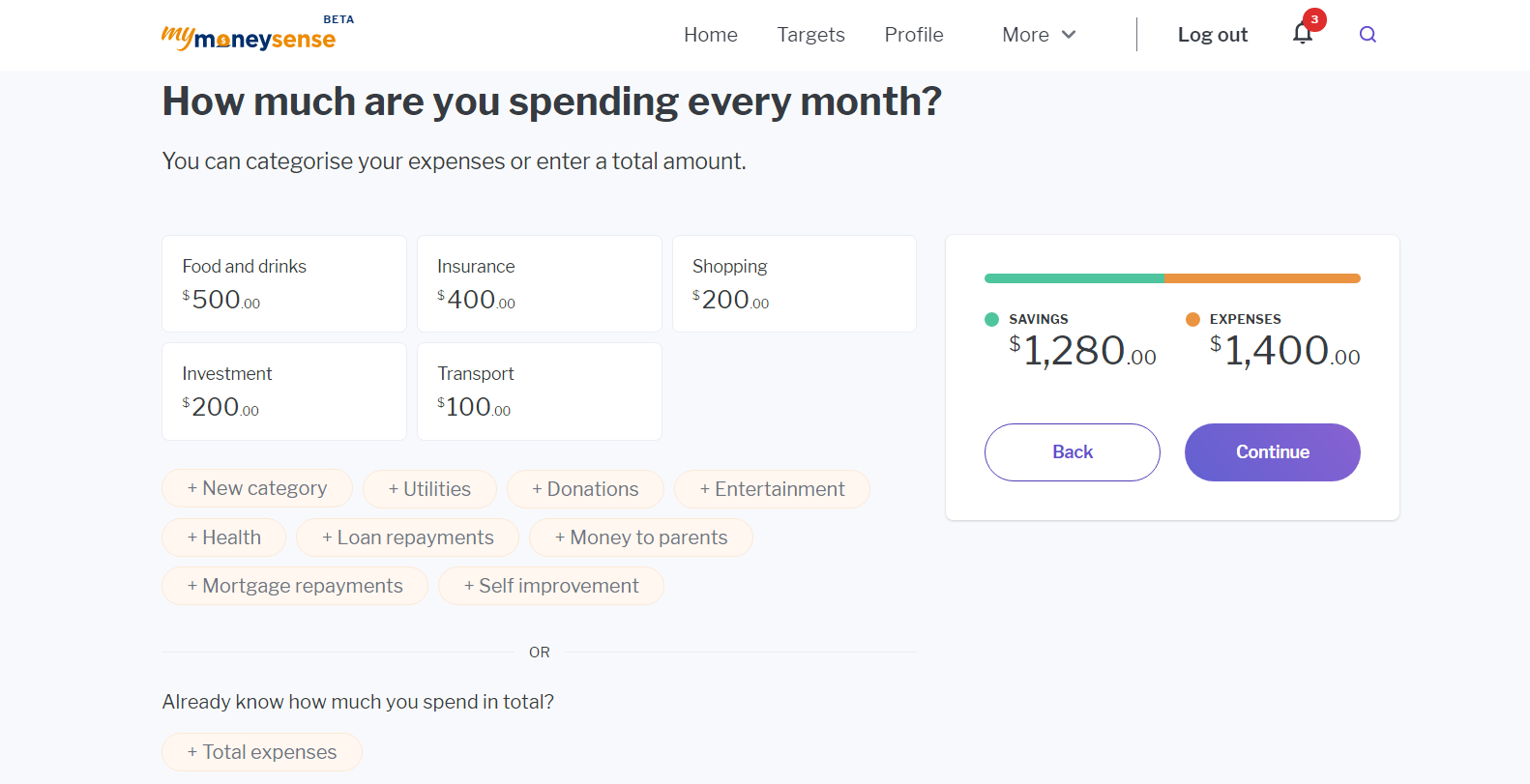

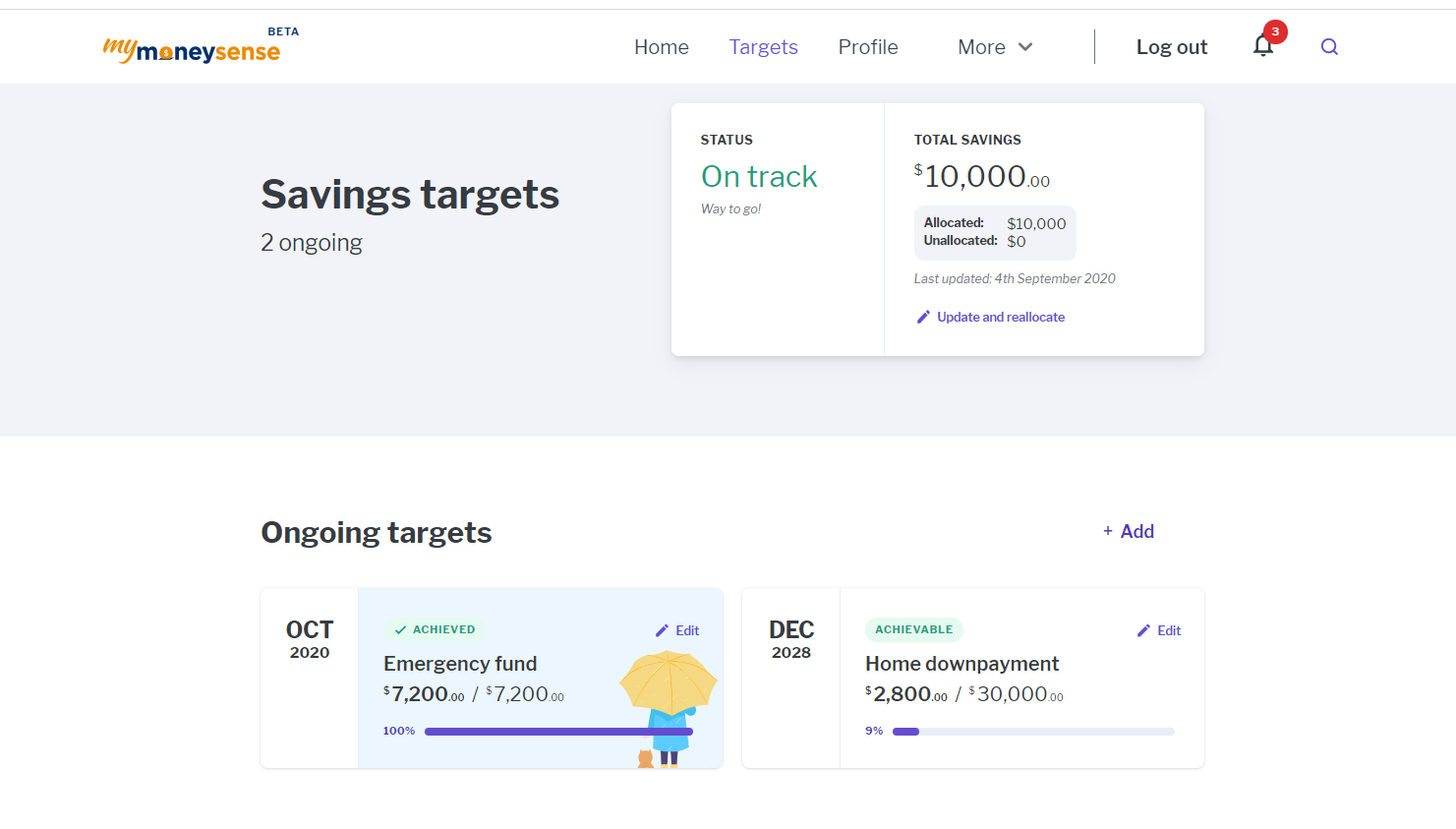

Lastly, MyMoneySense developed by the Ministry of Manpower and Government Technology Agency has helped me to monitor my short-term and long-term saving goals.

The application is easy to use, and you can use your SingPass to log in.

After logging in, the application asks you questions about your take-home pay and expenses to help you to sort your finances first.

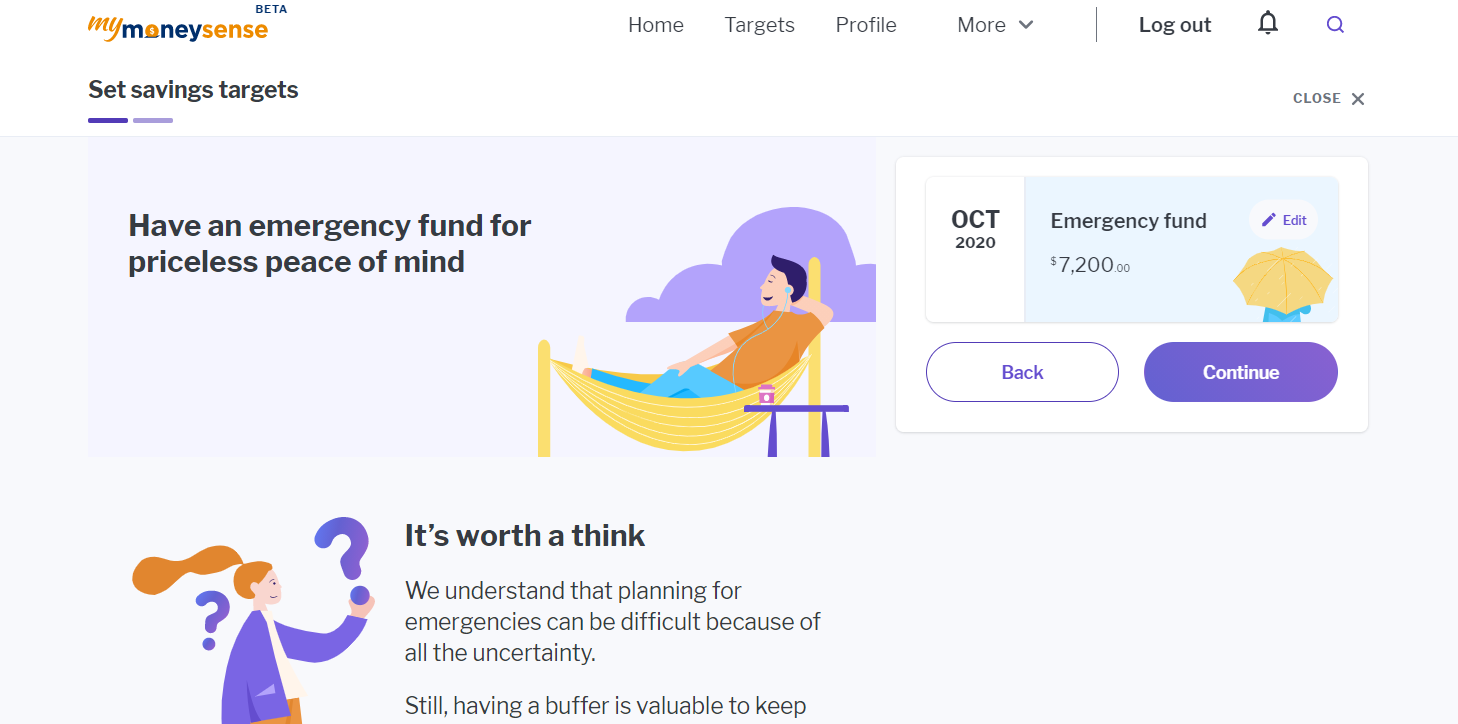

The online application then helps to plan how much to save for my emergency fund and dream home so that I can achieve them by the due date that I set.

For example, I set a target of setting aside 6 months of expenses by next month as an emergency fund, in the case that I might be unemployed.

I chose October as I am close to hitting my target for the emergency fund, but you can choose any date that suits you and your savings target best.

You can add as many savings targets as you like.

For now, I’ve added two of my main goals, which is to have a backup fund in case of an emergency and to save enough money for downpayment on my future home:

With the MyMoneySense tool and the above-mentioned tips to save money, I feel less anxious about my personal financial stability and achieving peace of mind.

The writer of this sponsored article by MyMoneySense can’t wait to get her own HDB flat in 2029.

Top image by writer.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.