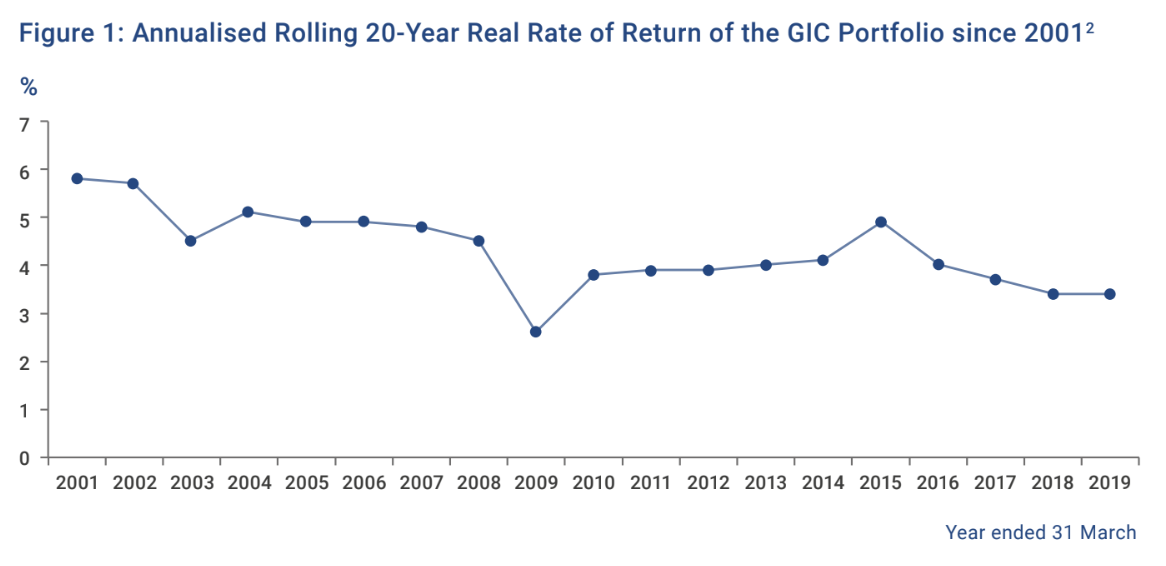

3.4 per cent.

This is the figure GIC announced for its portfolio’s 20-year annualised real rate of return leading up to 31 March 2019, according to its annual report on July 3.

GIC added the figure is above the global inflation rate and this meant the international purchasing power of the reserves has nearly doubled between April 1999 and March 2019.

It was also the same figure that GIC previously announced for its 2017/18 report.

Wait, what does 20 years and real rate of return mean?

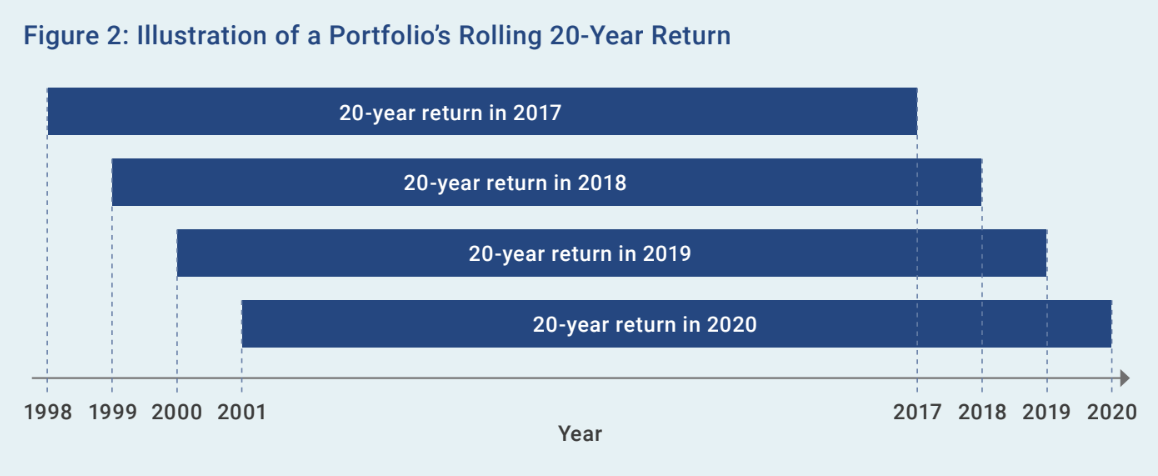

Here's a key thing to note -- GIC does not report investment returns in yearly blocks. Rather, it reports its performance as an annualised 20-year real return.

Here's a visual to help you understand.

Source: GIC

Source: GIC

As such, for 2019, the 3.4% real rate of return measures investment performance between April 1999 and March 2019.

As for the term "real", this refers to the rate of interest above global inflation. For GIC's case, it takes into account global inflation.

The real rate of return has been consistently below 4 per cent for the past three years

In its report, GIC noted that the 20-year real rate of return has been below four per cent for the last three years.

Source: GIC

Source: GIC

In explaining why this was the case, GIC stated:

"This was essentially due to the exceptionally high returns of the tech bubble period in the late 1990s dropping out of the 20-year window, while the post bubble declines remained."

It further added that such an effect was expected to remain for a few more years, thereby dampening the rolling 20-year return.

What does the tech bubble and its "returns" and "declines" refer to?

To give some context, the NASDAQ Composite Index, which tracks mostly technology stocks, reached a milestone of 4,000 points by the end of 1999.

It then reached a high of 5,049 points in March 2000, whereupon it began sharply declining, signalling what is known as the dot-com bubble burst.

As such, it is the tail end of the high returns and the subsequent burst of the tech bubble that GIC's 20-year annualised rate for 2019 currently captures.

Maintaining a cautious stance

In a press release, GIC said that it maintained a cautious stance in investments due to a challenging environment.

It added that this environment was the result of of high asset valuations, weak growth, and heightened political uncertainties.

Lim Chow Kiat, the CEO of GIC stated:

"The investment environment today is low-growth and highly uncertain, with risks tilted to the downside. In this context, GIC remains cautious, given our mandate to first preserve and then enhance the value of the reserves."

Cautious stance is also informed by the trade war

Lim further acknowledged that concerns about the ongoing trade war between U.S. and China also informed the cautious stance that GIC was adopting.

He added that GIC expects the issue to be around for a while, given that it was not a short-term problem.

Lim pointed out however, that in adopting a more defensive portfolio position, GIC will be better prepared in facing the environment with greater abilities to take risks and wait for future opportunities.

Top photo by Matthias Ang

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.