A new policy brief from the Institute of Policy Studies (IPS) recommends that older workers in Singapore aged 55 to 65 should increase their Central Provident Fund (CPF) contribution rates to ensure they have enough for retirement.

The authors of the paper, IPS researchers Damien Huang and Christopher Gee, believe that it will also help to encourage older workers to remain employed.

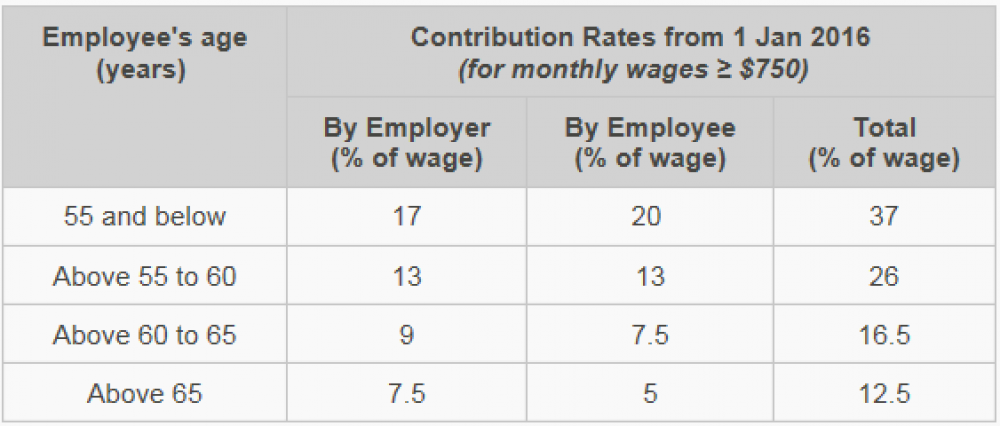

Current contribution rates

As it stands, private sector and non-pensionable public sector employees contribute the following percentage of their wages to CPF.

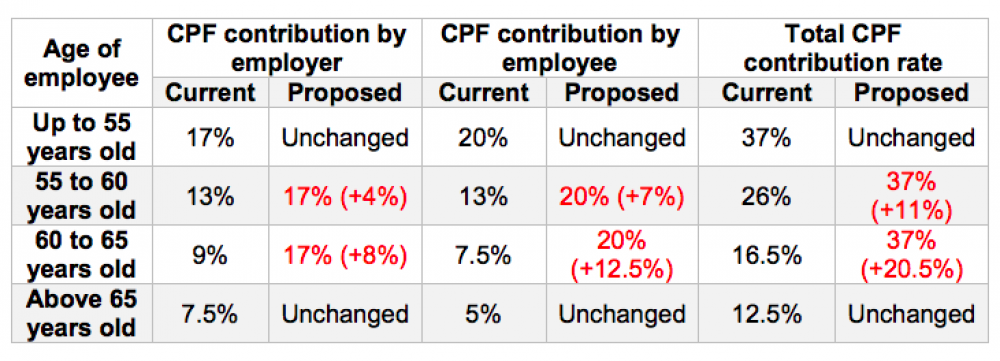

But under Huang and Gee's recommendations, they propose that the contribution rates and more wages should be contributed to CPF, at these following rates:

Under this scheme, workers from 55 to 65 will contribute 20 percent of their wages towards CPF.

Meanwhile, their employers will increase their contributions by 4 to 8 percent and contribute 17 percent towards CPF, for a total contribution of 37 percent.

Why the change in rates?

According to Huang and Gee, worker CPF contribution rates were cut at various points in the 1990s to improve the likelihood of older workers getting hired:

"Contribution rates for workers above 55 years old first decreased in 1988, subsequently in 1993 and in 1999.

It has since been kept low in the hopes that the lower relative cost of hiring older workers makes them more attractive to employers."

They added that CPF was also used as a "tool to manage labour demand", pointing out that contributions from employers were reduced in 1999 and 2003, as a response to the Asian Financial Crisis and the SARS health scare.

But Huang and Gee propose restoring those rates.

Pros and cons

The brief lays out both the disadvantages and advantages of their proposal.

The most obvious drawbacks are an increase in wage costs for employers, and a reduction in disposable income for workers.

To mitigate this, Huang and Gee recommend a "phased" change to the system, whether it involves increasing the contribution rate or reducing subsidies.

However, they believe the proposal will encourage older workers to remain employed, with employers "forced" to turn to older workers due to a tight labour market.

Help with housing

They also believe it will help "younger cohorts" to save more for retirement, as CPF allocations skewed towards the Ordinary Account are mostly used for housing:

"Any increase in CPF contributions, especially if allocated to the SA, will more than double retirement payouts."

They added that due to longer housing loan tenures, a rise in CPF contribution rates means that homeowners older than 55 don't have to pay additional cash out of pocket, should they still have mortgages to service.

Older workers in the future stand to benefit more

According to Huang and Gee, their proposals will help older workers benefit more from their CPF Life Payouts, and help more workers to reach their full retirement sum.

"Our simulations show that a 55-year-old in 2018 can save between $31,000 and $145,000 more if full rates were restored in the 10-year time frame from age 55 to 64, more than doubling their eventual CPF Life Payouts.

A full restoration, which we recommend, translates to an additional 21,790 individuals (or 10 percent of each 5-year cohort) reaching their full retirement sum."

The researchers concluded that while the proposal may be of little benefit for workers currently aged 55 and above, it should improve the "retirement adequacy" of future workers aged 55 to 64 for years to come.

You can check out the full proposal for yourself at this link.

(Update: June 26, 7:00 pm)

Here's what the Ministry of Manpower had to say about the proposal. A spokesperson said:

"We note the recommendations by the Institute of Policy Studies to restore CPF contribution rates for older workers. The Tripartite Workgroup on Older Workers has been examining issues concerning older workers, including the CPF contribution rates for workers aged 55 and above.

The workgroup has been consulting widely and building a tripartite consensus, while balancing the need to strengthen retirement adequacy and sustain employability for our older workers. The workgroup will provide its detailed recommendations later this year."

Top image from Unsplash.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.