If you’re a Grab driver-partner, here’s some good news.

If you fall sick, or get injured and can’t work, you can now claim for the earnings you would otherwise have had -- without paying a single cent on premiums.

This new benefit offered by Grab, which covers driver-partners for medical leave and hospitalisation, is called Prolonged Medical Leave (PML) insurance.

Huh, you sure anot?

Yes. Part of the gig economy, Grab driver-partners are considered self-employed -- you have flexible work hours, but lack the welfare benefits that salarymen enjoy.

According to Grab, this initiative is aimed at supporting driver-partners and protecting you against lost earnings when you are out sick.

Simi gig economy?

You are in the gig economy because organisations (like Grab) contract with independent workers (you), and are considered self-employed.

Do I need to pay money?

Nooope. It’s a group insurance plan. Does it sound too good to be true? Maybe. But it’s true.

How does it work???

Since this is for driver-partners who are on prolonged medical leave, there are some conditions.

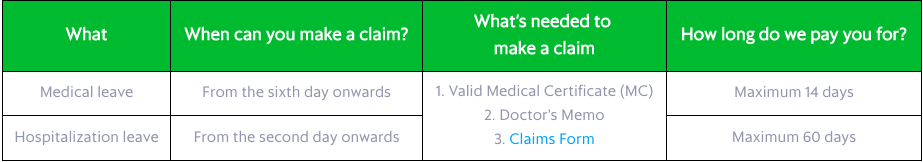

With a valid

1. medical certificate and

2. doctor’s memo,

you can file a claim for your lost earnings from the 6th day onwards. You can be covered for up to 14 days of medical leave.

If you are hospitalised, you can file a claim from the 2nd day onwards, and can be covered for 60 days maximum.

Wah, okay then I will switch to Grab right now for the coverage.

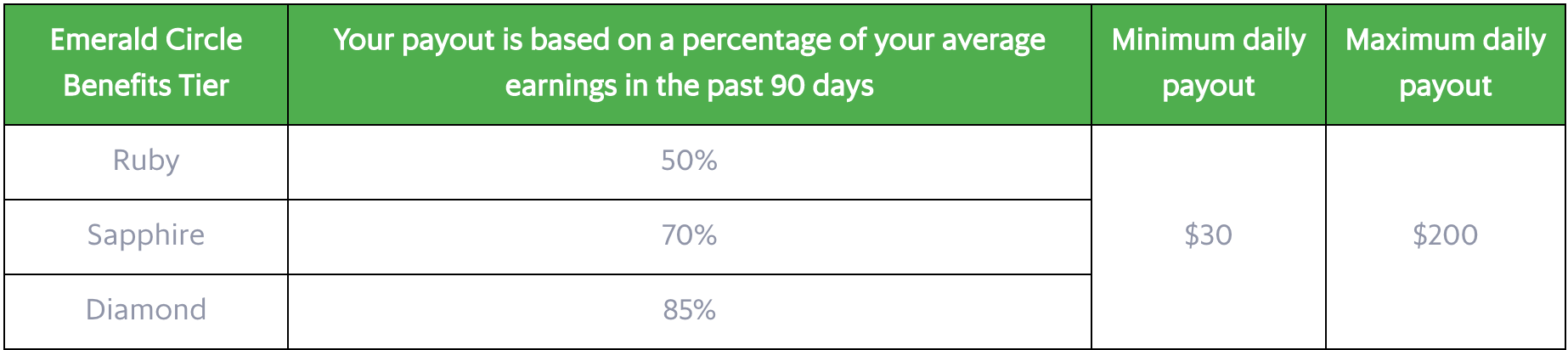

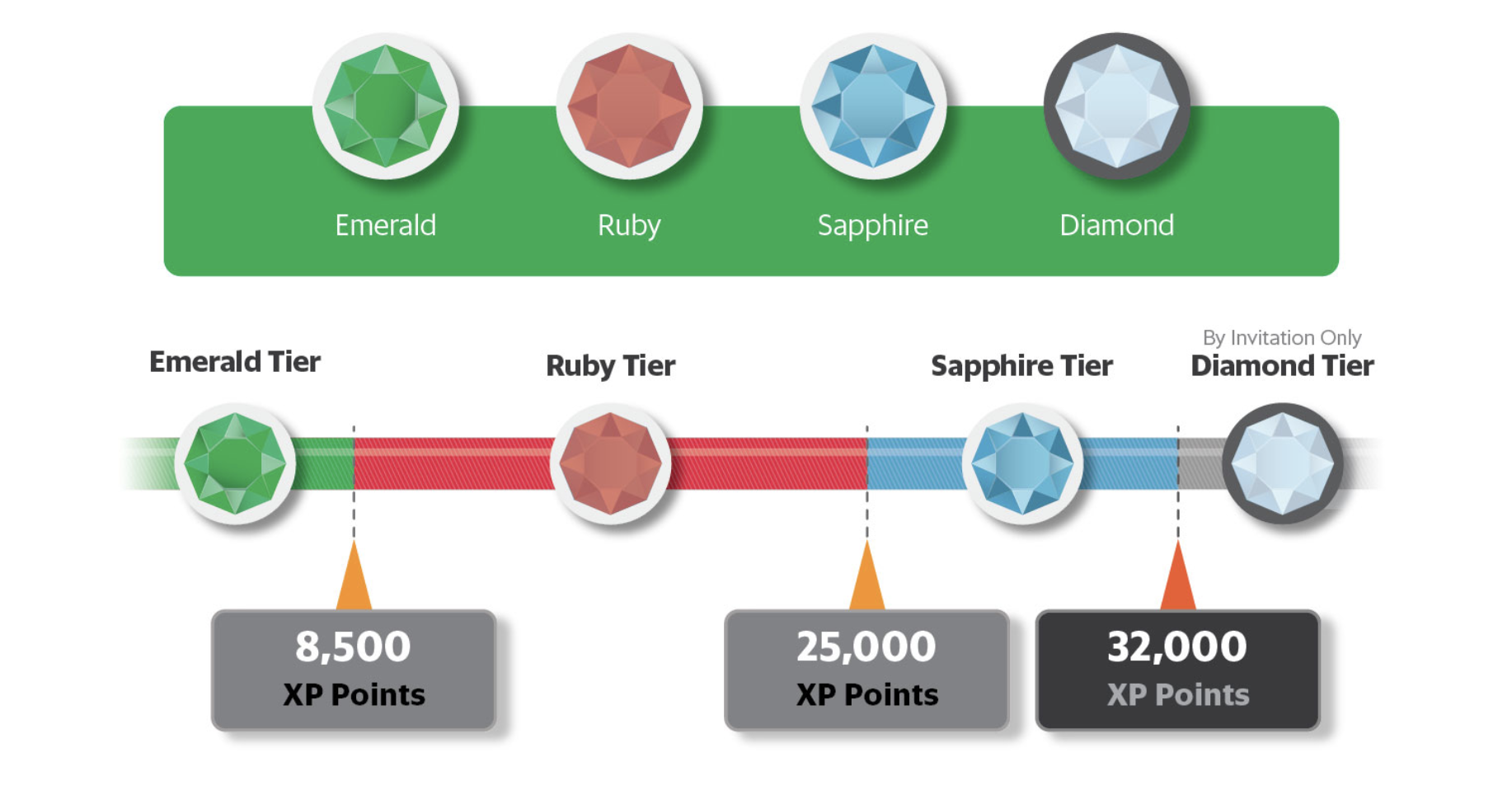

Hold on, hold on. You have be a Ruby, Sapphire or Diamond driver-partner to be covered by this insurance.

Depending on the tier status, you will be paid a percentage of your average earnings in the past 90 days. There’s also a daily minimum payout of $30 and daily maximum payout of $200.

Yes. That means you’d have to drive enough to become at least a Ruby tier driver-partner, before this scheme will be applicable to you.

You’ll get 7XP points for every $1 commission you earn.

You’ll get 7XP points for every $1 commission you earn.

Huh? Why is it not 100%??? I only can claim from 6th day leh!

Wait wait. Remember, this is a group insurance plan, and you don’t have to pay premiums. For such insurance benefits, the co-payment system is common.

This PML is meant to cover your earnings when you are out sick for an extended period.

So don’t abuse the system lah. This one meant to help driver-partners who are really sick or injured one.

Orh… so what’s the coverage like ah?

Good question. You are covered 24 hours a day, worldwide. This means if you get injured outside of work, you will still be covered.

Yay.

_________

Find out more about the Prolonged Medical Leave insurance for Grab driver-partners here.

Prolonged Medical Leave insurance is underwritten by Chubb Insurance Singapore Limited.

This sponsored article by Grab is sponsored.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.