Talking about Central Provident Fund (CPF) money is always contentious. In the most recent Parliament sitting, Nee Soon GRC Member of Parliament Lee Bee Wah brought up the issue of early CPF payouts.

But first, a little context about CPF is needed.

Once you reach 55, you can withdraw your CPF savings after setting aside a stipulated sum of money in your Retirement Account. This stipulated sum is called the Retirement Sum.

As its name suggests, this is to ensure that you will have enough for your retirement and the sum required increases every year.

For instance, CPF members who turned 55 from Jan. 1, 2018 to Dec. 31, 2018 needed to set aside S$171,000 in their Retirement Account.

On the other hand, CPF members who turn 55 from Jan. 1, 2019 to Dec. 31, 2019 need to set aside S$176,000 in their Retirement Account.

For those born in the year 1954 and after, the money from your Retirement Account will be paid out to you monthly from the age of 65 until it runs out (if you're on the Retirement Sum Scheme) or until you pass on (if you're on the CPF Life scheme).

Earlier CPF payouts

Lee specifically asked the Minister for Manpower Josephine Teo the following questions about earlier payouts:

- In the past three years, what is the percentage of successful appeals for earlier withdrawal of payouts by CPF members who had to retire early in the past three years

- What are the main reasons for disallowing the appeals

- Whether the Ministry will consider another option for CPF Life payments that start payouts at the minimum retirement age (currently 62)

Minister for Manpower responds

In response, Teo said that CPF members can get their payouts earlier than age 65 under the Medical Grounds Scheme (MGS) if they are "permanently incapacitated, terminally ill, or [have] a severely impaired life expectancy due to illness".

Teo added that in the past three years alone, 65 per cent of MGS applications were successful. The other 35 per cent did not meet the eligibility criteria. The latter were referred to Workforce Singapore (WSG) and the Social Service Offices for help instead.

The minimum age of retirement in Singapore is 62. This means that employers cannot ask Singapore citizen or PR employees to retire before that. Further, employers are obliged to offer their eligible employees continued employment until 67.

This means that many Singaporeans are able to work beyond the age of 62 and in the meantime, contribute to their CPF.

Teo ended her answer by stating that the Tripartite Workgroup on Older Workers reviews the "longer term relevance of and the next moves on the retirement and re-employment ages".

Teo added that MOM does not have plans to lower the Payout Eligibility Age as it was raised to 65 only last year.

Singaporeans living longer

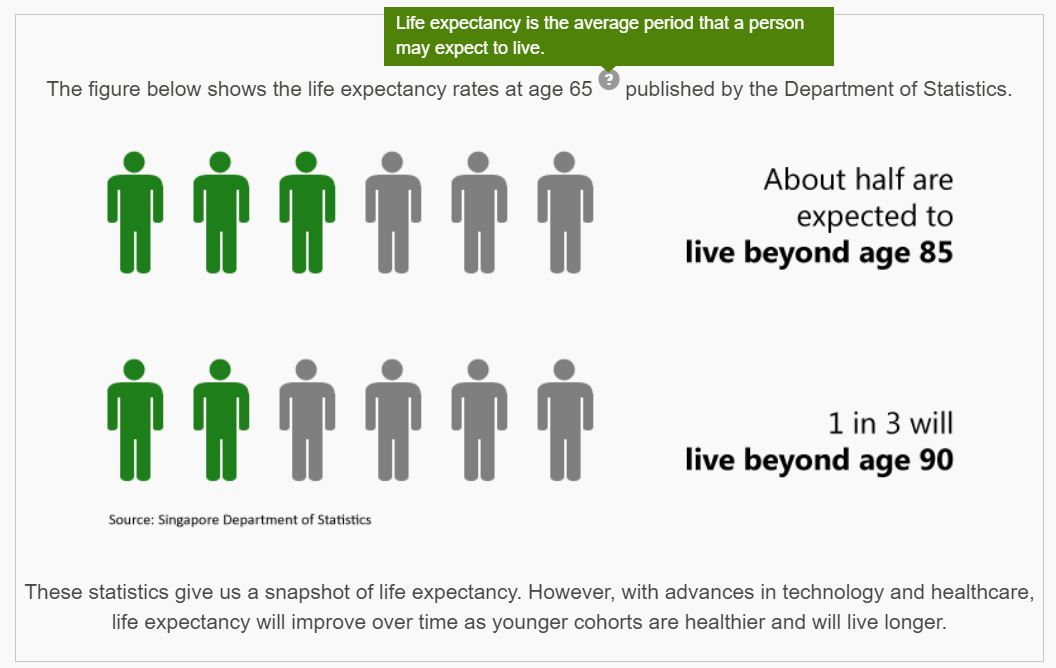

On CPF's website it shared that half of Singaporeans aged 65 are expected to live to 85 and a third will leave beyond 90.

It then explained that there was a "real possibility that we may not be adequately prepared for a longer retirement, and risk outliving our retirement savings" against the backdrop of rising longevity.

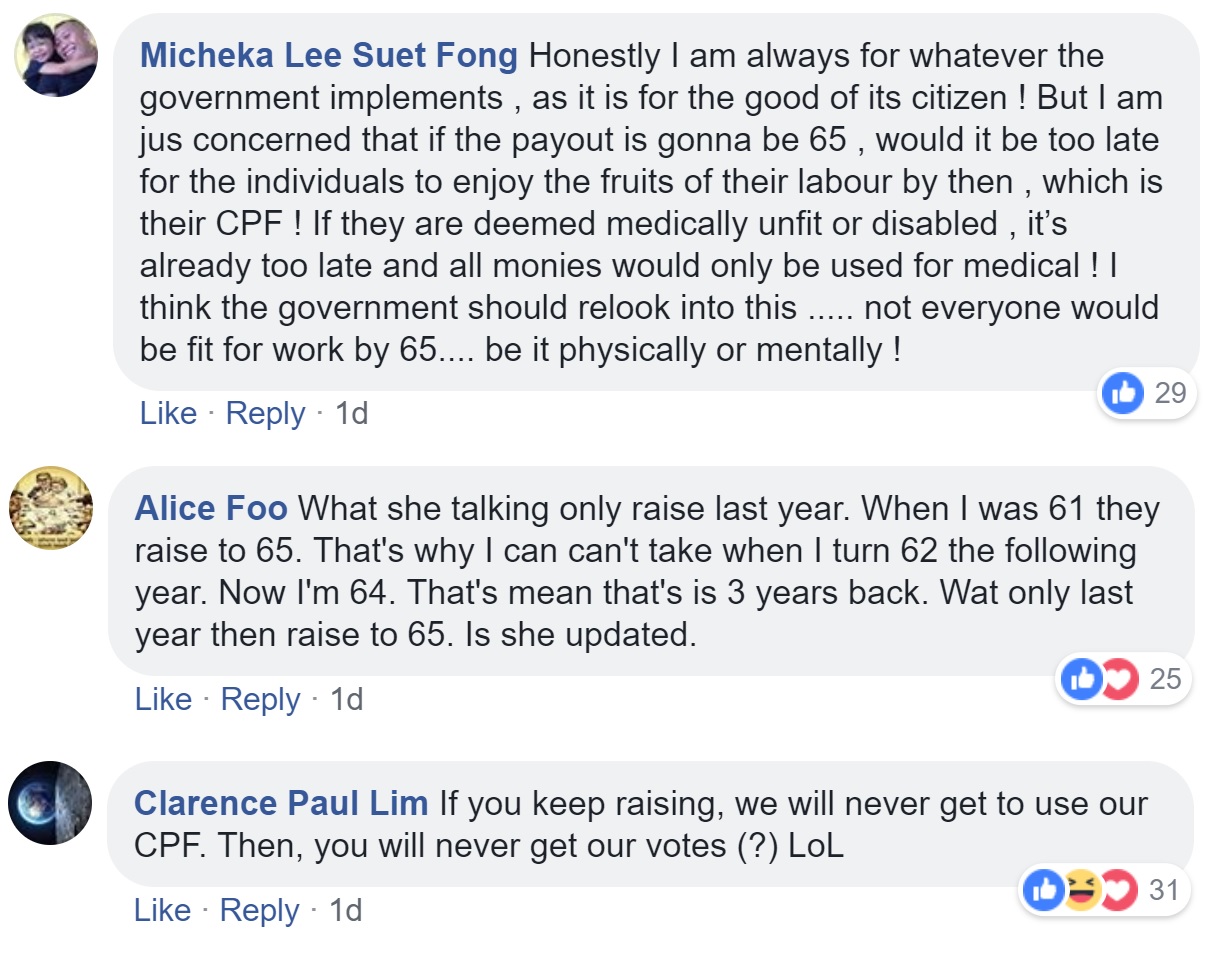

Netizens concerned about 65

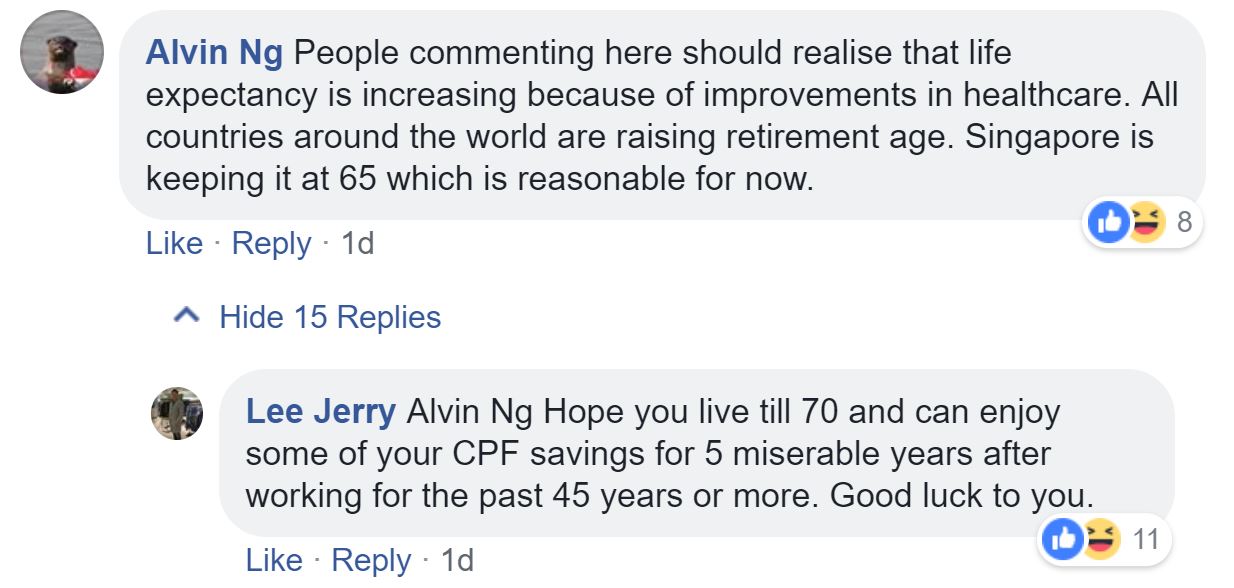

Teo's remarks were reported in the Straits Times, and netizens took to the Facebook comments to voice their concerns with the payout age with CPF:

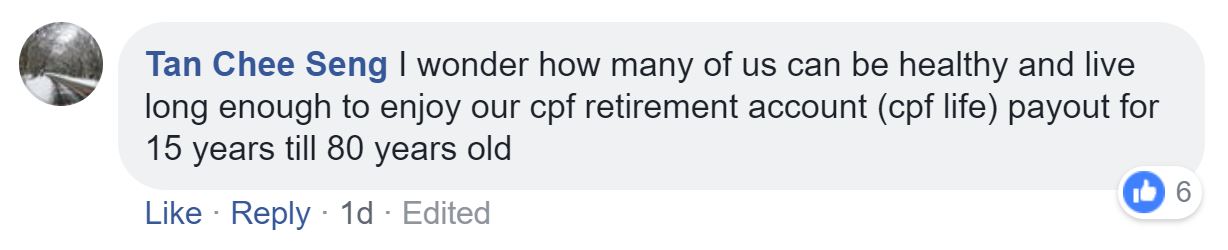

At least one person echoed CPF half of Singaporeans aged 65 will live till 85:

Top image by Joshua Lee.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.