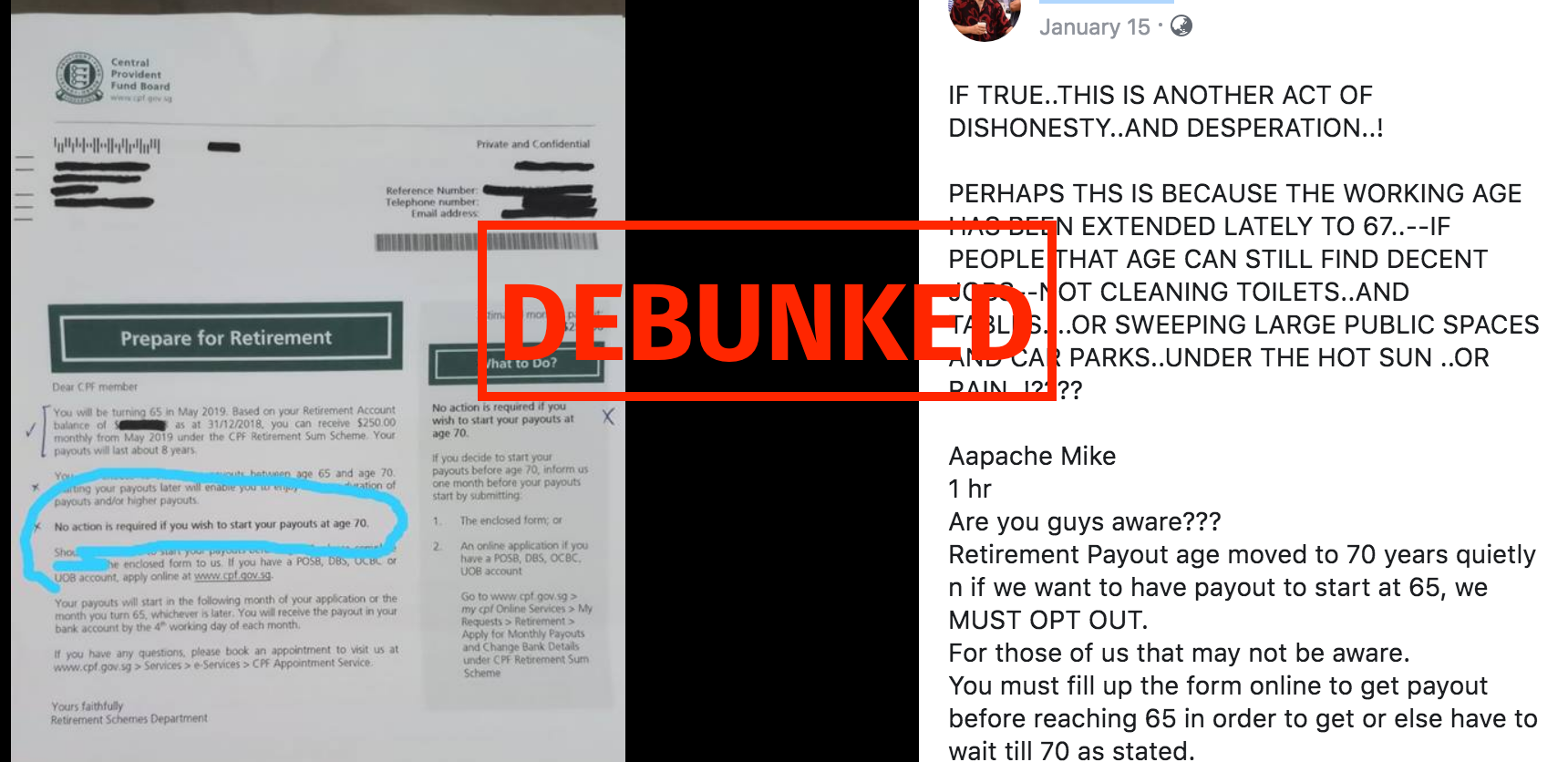

You might have seen a post circulating on Facebook since Jan. 15, 2019 mentioning something about raising the payout age.

The post hit over 1,000 shares.

It could also have further disseminated through WhatsApp by understandably enraged aunties and uncles.

The post suggested that the Central Provident Fund (CPF) Retirement Payout age had been discreetly raised by five years.

From 65 to 70, with an opt-out required if one wanted to start the payout at the age of 65.

However, that is not true.

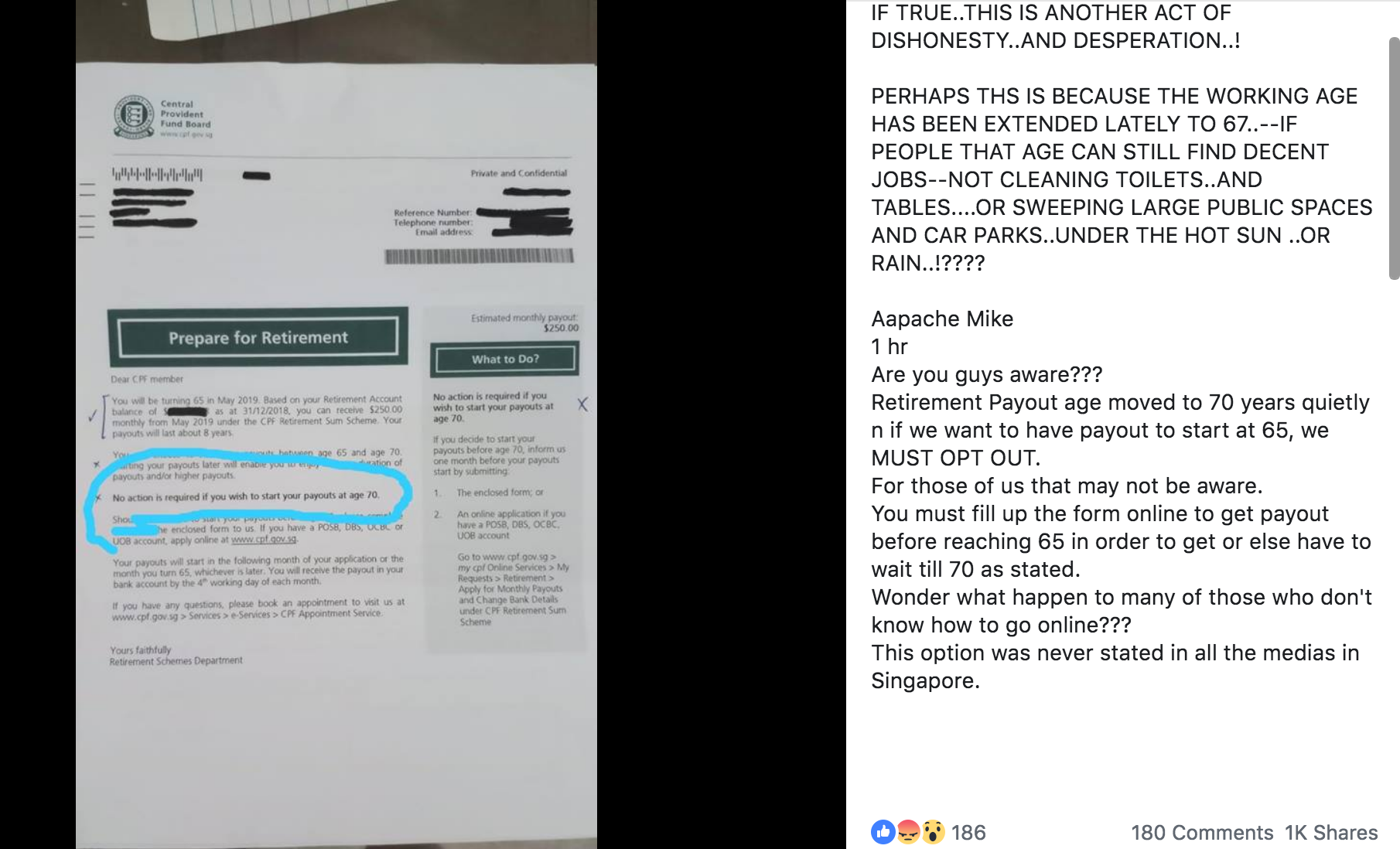

Here is a screenshot of the post from Facebook user Leslie Terh, just to provide you with some context as to what's going on:

Screenshot from Leslie Terh's Facebook post.

Screenshot from Leslie Terh's Facebook post.

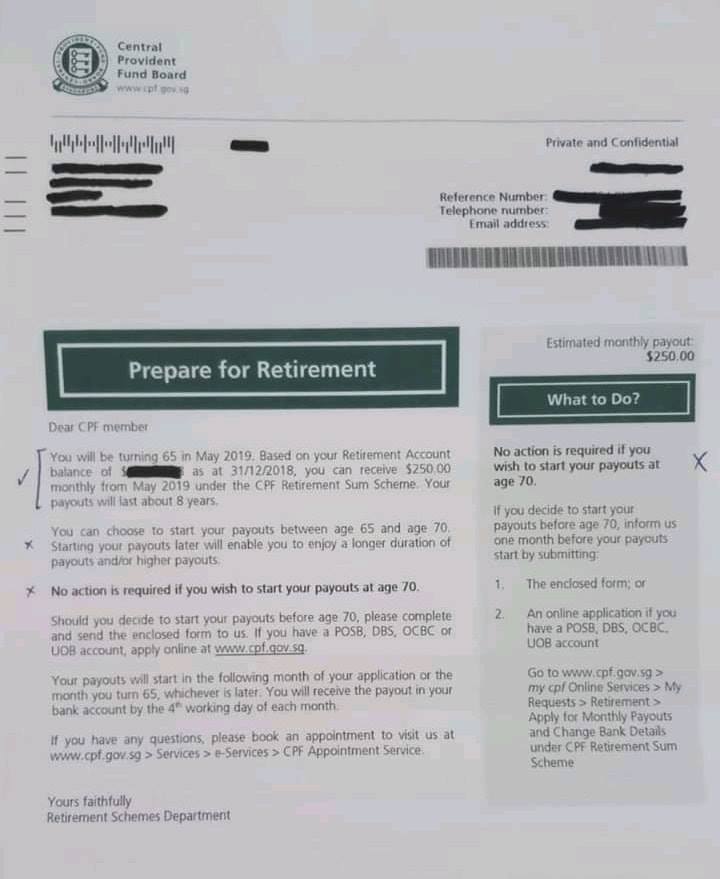

What the letter is about

This is a letter every Singaporean receives when they turn 65.

The letter serves as a reminder that you can start applying for monthly payouts using the application form attached to the letter or through an online application.

Here's a close-up of the letter:

As you can see from Terh's post, the misunderstanding probably stemmed from the third point.

"No action is required if you wish to start your payouts at age 70"

This basically means that eligible payout remains at 65, while automatic payout begins at 70.

A point which the post took to mean, eligible payouts being delayed till you were 70.

So can I receive my retirement payout at 65?

Yes, if you apply for it.

Yes, all Singaporeans can start receiving their retirement payout at 65, although one must apply for it in order to kickstart the process.

As CPF Board clarified in a Facebook post on Jan. 19, the application for payout has always been the procedure to activate the process.

Prior to 2018, one would not receive the payout at all if he or she did not apply.

This resulted in some elderly folks not receiving their payouts even after they turned 70.

This prompted CPF Board to implement the automatic payout scheme on Jan. 1, 2018 to ensure everyone received monthly payouts by a certain age.

Why the 5-year gap before automatic payout?

What probably baffles people is the five year gap between eligible payout and the automatic payout.

One probable reason for people to defer the payout is to accumulate more money in their CPF account by earning more interest.

Simply put, some people might want to get a higher payout by leaving money in their CPF account till they're 70.

Other stories about CPF here:

Don't believe everything you read online

Top photo from the screenshot of Leslie Terh Facebook post

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.