A downside to PayLah! has been spotted.

On Nov. 2, Facebook user Spike Sim posted a photograph of a letter from DBS to DBS' Facebook page asking for the bank to help reverse an erroneous PayLah! transfer.

Sim explained that he had engaged the services of a carpenter who required a 50 percent down payment.

PayLah! mobile number tied to wrong account

Sim used DBS' PayLah! mobile payment service to transfer S$700 to the carpenter via the carpenter's mobile number.

Unfortunately, Sim said the carpenter did not realise that his mobile number, which was recycled, was still tied to a previous person's bank account.

Reverse payment

Sim said that the carpenter had gone to DBS branch to seek help but could not reverse the payment after two weeks.

Sim also shared a photograph of a letter from DBS, which said that it was unable to reverse the payment. DBS said it had sought the approval of the recipient to reverse the payment.

DBS said "the fund recipient account holder had responded to us and did not provide consent to reverse the credit from his/her account".

Sim said that this incident highlights "the weakness" of PayLah!.

DBS rectifies situation

Sim's post on DBS' Facebook page went viral with more than 900 shares.

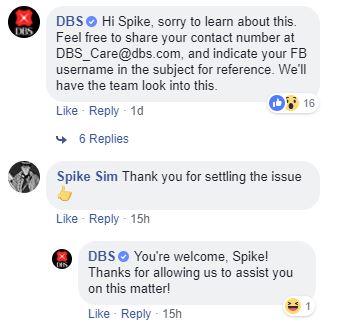

DBS first responded by asking Sim for more information regarding the case.

Half a day later, Sim responded on the Facebook post and thanked DBS for settling the issue:

Here's the full post:

Illegal to retain money not meant for you

According to The New Paper, criminal lawyer Rajan Supramaniam was reported as saying that retaining money not meant for you could be "considered as the wrongful retention of money as long as the mistake was made known to you".

The person involved will be liable for prosecution for a criminal offence, he said.

If you transferred money to a wrong account by mistake, the first step is to inform the bank to help with the reversal.

If the bank does not start an investigation, you can engage a lawyer to issue a demand notice.

Should the recipient refuse to reverse the transaction, a police report can then be made.

Rajan said that the bank "would not be able to issue a refund as it was responsible only for facilitating the transaction".

Content that keeps Mothership.sg going

??

Don't miss out on this.

?

Few things we wish you knew

???

Earn some karma points here. Say real one.

? vs ?

You're on the MRT. Do you read or surf?

Why not both??

?

Damn cheap movie tickets here.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.