On Oct. 9, UK-based charity Oxfam released its annual Commitment to Reducing Inequality Index (CRI).

Among countries that saw the biggest decreases in terms of reducing inequality was Singapore.

This was after Singapore dropped a total of 63 places, from 86 in 2017, to 149 in 2018.

This result puts Singapore as one of the bottom 10 countries in tackling inequality.

Source: Screenshot from Oxfam

Source: Screenshot from Oxfam

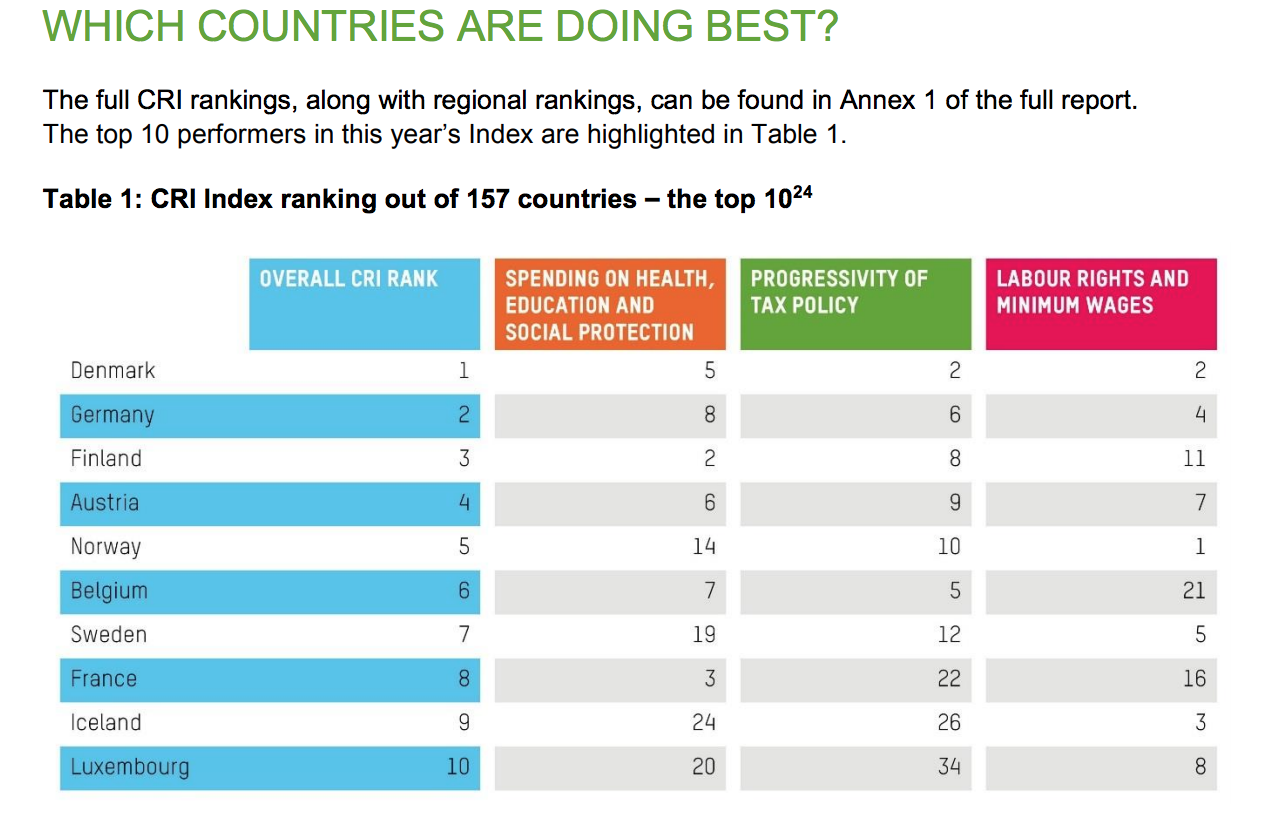

Top 10 best

Conversely, these are the top 10 countries in tackling inequality, with Denmark coming in first.

Source: Screenshot from Oxfam

Source: Screenshot from Oxfam

What are the reasons for the decrease?

According to Oxfam's report, the decrease "is partly because of the introduction of the new indicator on harmful tax practices".

Singapore, according to the report, has a number of these harmful tax practices.

The report also singled out what it saw as inadequacies in policies and expenditure by the government in tackling inequality.

Breakdown of the report

As shown in the methodology, here's the breakdown of the score calculation for the overall CRI rank:

Spending on health, education and social protection:

- Government spending on progressive sectors as a percentage of total spending

- Incidence of spending on the Gini coefficient -- this is essentially the identification of the the impact that extra spending on education, health and social protection has collectively on reducing/ increasing the Gini coefficient produced by the ‘market’.

According to Oxfam, Singapore's score in this rank is 91.

This is "due to a relatively low level of public social spending -- only 39 percent of the budget goes to education, health and social protection combined (way behind South Korea and Thailand at 50 percent)."

With regard to the Gini coefficient, according to The Straits Times, the Ministry of Finance reported that prior to accounting for taxes and transfer, Singapore's Gini coefficient was 0.417, which was lower than most developed countries.

The lower the Gini coefficient, the more egalitarian is a country.

However, after accounting for taxes and transfer, Singapore's figure dropped to 0.356, but was still higher than other developed countries.

Minister of Finance Heng Swee Keat noted that this difference between Singapore and other developed countries was due to these countries imposing "higher overall taxes on the working population", in particular on the middle-income group, in order to finance large social transfers.

Progressivity of tax policy:

- Progressivity of tax structure

- Incidence of tax on inequality

- Tax collection

- Harmful tax practices

Singapore's score in this rank is 157 -- the bottom of the list for progressivity of tax policy.

Part of this has to do with the personal income tax rate for Singapore.

As Oxfam states: "It has increased its personal income tax (PIT) by 2 percent, but the maximum rate remains a very low at 22 percent for the highest earners."

[related_story]

Moreover, another reason for Singapore's poor ranking is its encouragement of tax avoidance and evasion:

"Avoidance (often legal) and evasion (by definition illegal) of taxes by corporates and individuals... in having very low tax rates [and] providing tax havens for avoidance and evasion."

As such, this "sharply [reduces] the revenues available to spend on tackling inequality".

Labour rights and minimum wages

- Workers' and labour union rights

- Women's legal rights at work

- Minimum wage

Singapore scored better in this aspect, relative to the other two sections, at 71.

Even so, Oxfam criticised Singapore for having insufficient and inadequate labour and gender laws in place:

"On labour, it has no equal pay or non-discrimination laws for women; its laws on both rape and sexual harassment are inadequate; and there is no minimum wage, except for cleaners and security guards."

Why introduce the harmful tax practices indicator?

As stated by Oxfam, the introduction of this particular indicator was to address a concern raised in 2017 that:

"... we[Oxfam] had not considered the extent to which a country was enabling companies to dodge tax. This meant that countries like Luxembourg or the Netherlands were getting higher scores than they should."

The full report by Oxfam can be read here while the methodology for the report can be read here.

Top image screenshot from The Online Citizen

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.