If you're in your twenty- or thirty-somethings in age, you might have been working for a sufficient period to have accumulated some savings in your bank account.

And if you have the vaguest of ideas about interest rates in regular savings accounts, you'll know they're so low that you're effectively losing money (when comparing to our annual inflation rates) keeping them in there.

So how to get more money? Invest.

But how? Unless you're finance-trained, the next step is to ask someone who knows what they're doing with money.

Typically, that would be a financial advisor (a.k.a. insurance agent), and with that comes the standard investment spiel:

And here's another piece of commonly-shelled-out advice:

And if you happen to be sufficiently high-SES (or perhaps came into a windfall somehow), you could hire somebody (a.k.a. a fund manager) to help you invest your money and make sure it's growing.

But what if you're not?

There are many ways one could use to invest money, and here we'll talk about two: the active investment strategy and the passive market returns strategy.

An example of a investor who has succeeded by the active investment strategy is Warren Buffett.

Much of his success stems from how he has picked out companies which are very undervalued and waited years for their growth.

Like this one:

Mothership file photo

Mothership file photo

A report from CNBC says that if you had put US$1,000 into the company when it first began its streaming service in 2007, that investment, as of May 25, 2018, would be valued at more than US$108,000 now, including the share price appreciation and dividend gains reinvested.

Not bad.

However, active strategy has mostly underperformed

Unfortunately, not everyone can invest like Warren Buffett and not every company can grow like Netflix.

In fact, as the Financial Times has reported numerous times, the active strategy has been largely underperforming.

Between 2006 and 2016, between 80 and 90 per cent of fund managers who used the active strategy failed to meet their benchmark.

[related_story]

And as of last year, the S&P Indices Versus Active (SPIVA) scorecard (basically an established index that shows how well or badly fund managers are doing with the money they manage) reflects that 84 to 91 per cent of fund managers engaged with active equity funds have underperformed over the five years leading up to 2017.

As for the remaining handful who usually succeed, the Financial Times notes that they are "not traders" but are "longer term in nature":

"They are willing to be different to the benchmark. Most importantly, they also tend to have a lot of skin in the game."

The upshot of this, therefore, is that most of the time, the fees you might pay to a fund manager are often not worthwhile for the work done, since they aren't giving you the best bang for your buck.

So what about the other way?

Instead of buying assets and constantly monitoring their activity to watch for profitable conditions, a passive market returns strategy involves buying and holding all, or a representative sample, of the securities in an investment index, to “track” the market's general growth.

Doing this means you don't need to expend time speculating how the market, or certain companies, will do.

And because you're buying all, this also means you incur less risk.

Which brings us to... robo-advisors

Source: Autowealth

Source: Autowealth

There are a few companies in Singapore now that provide the service of what is called "robo-advisory", or automated investing such as AutoWealth, Smartly and StashAway.

"Robo-advisory" is aimed at tackling the two issues of poor performance and high fees charged by fund managers.

One way by which they operate is by monitoring market conditions so as to rebalance accordingly when conditions change.

In the case of Autowealth, it places an emphasis on portfolio diversification, across the U.S., Europe, Asia-Pacific and emerging markets, spanning more than 8,000 stocks and more than 600 government bonds.

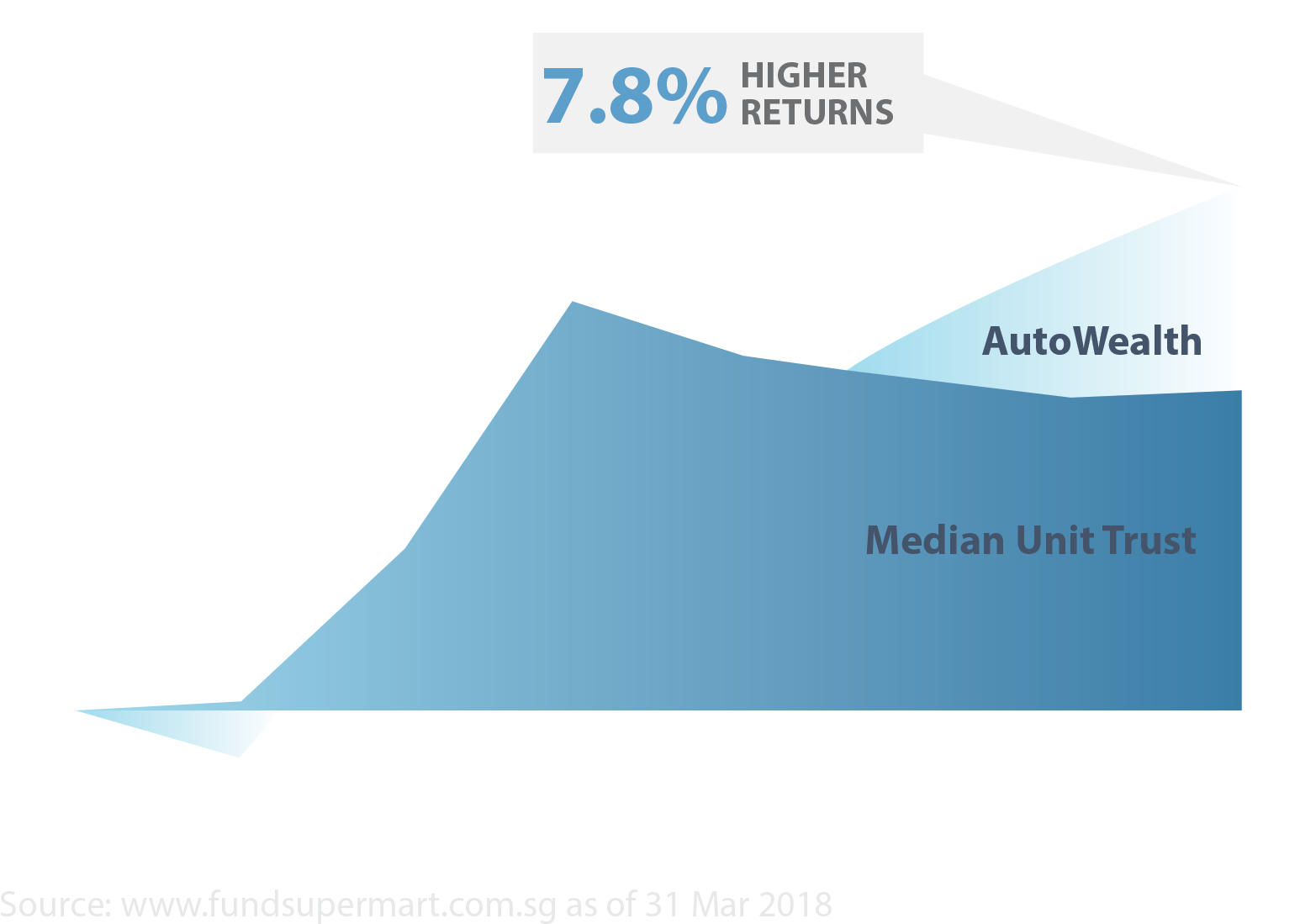

And it has shown a track record of delivering higher investment returns than human-managed wealth funds.

To ensure the highest level of security for its clients, AutoWealth segregates the custody of assets, with monies held and maintained in every client's legal name by a third-party broker, Saxo Capital Markets (the custodian). This is a practice akin to that of larger, more reputable financial institutions, that ensures unambiguity in legal ownership of clients' assets.

Graph via Autowealth.sg

Graph via Autowealth.sg

What's more, the great thing is Autowealth's approach, as reported by the SPIVA scorecard, has consistently outperformed active strategy investors 80 - 90 per cent of the time over a not just five, but also over a 10- and 15-year period since 2001.

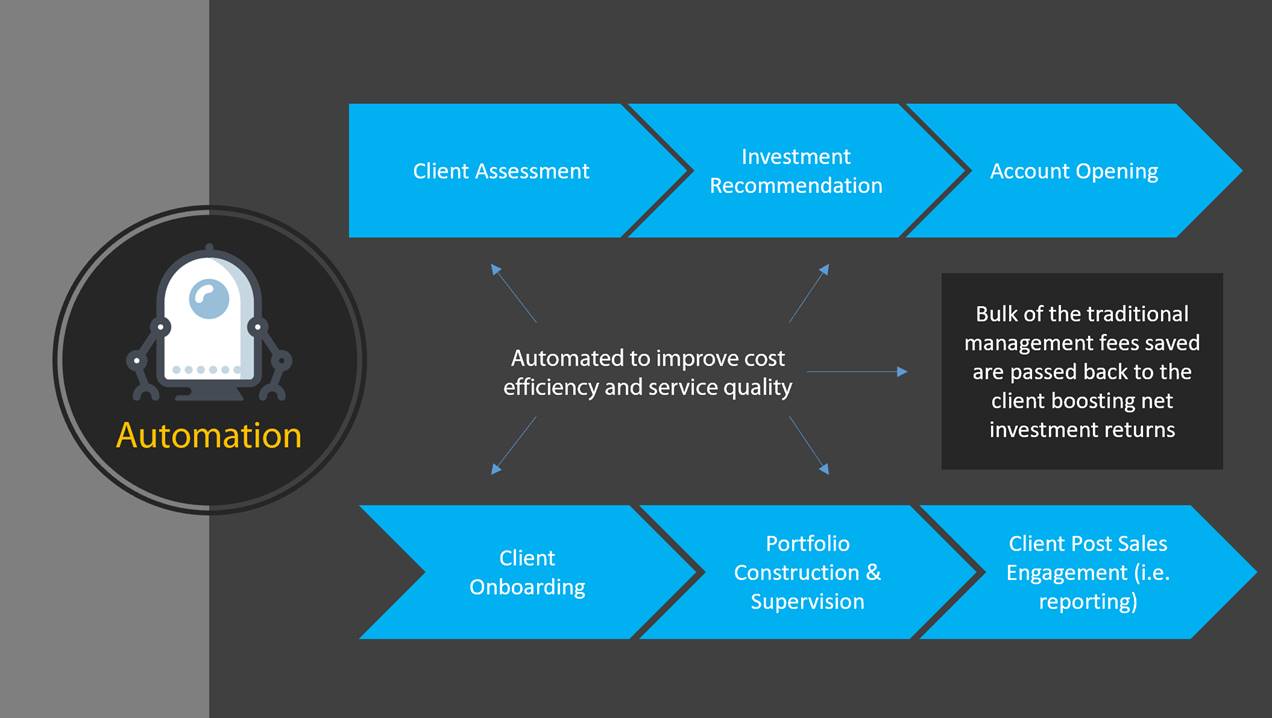

Reducing fees and increasing efficiency

By automating many of the processes involved in investing, platforms like Autowealth also cut down most of their associated fees and costs, especially in getting started.

There are many conveniences that come with automated investing — all of the following can be done anytime, round the clock and on your phone:

Source: Autowealth

Source: Autowealth

This significantly reduces the fees you'll need to pay, because it cuts out the middle man — who, as we pointed out earlier, has been shown to be more prone to error anyway.

In the case of AutoWealth, only 0.5 per cent of the money they manage for you will be charged each year as a management fee, with an additional US$18 charged as an annual flat fee to cover any transaction fees incurred in top-ups or withdrawals – great if you are looking to top-up your investments regularly.

In contrast, a typical financial services will charge anywhere from 1-4% of the money they manage for you once you include set up fees, transaction fees, distribution fees etc.

All that being said, Autowealth has not done away with human advisors completely a la Skynet -- every client is still assigned a human advisor in the event they might require assistance.

Not bad, by our reckoning. If all this sounds good to you, you can check them out here.

Top photo by Goh Wei Choon

This article was paid for by Autowealth because they feel so strongly that good things must share that it's worth paying us to tell you how much you can save on fund managers by investing with platforms like theirs.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.