Tuesday, July 10, saw the announcement of state investment vehicle Temasek's latest financial results for the fiscal year ending March 31, 2018.

Temasek reported a record net investment portfolio value of S$308 billion, a growth of S$33 billion from FY2017:

But so what, you might ask? What do these numbers actually mean? And how does Temasek's performance impact me, the average Singaporean?

We answer these questions and a little more here, but let's get one initial thing out of the way:

1) Does Temasek invest our money?

Screenshot via Temasek Review overview

Screenshot via Temasek Review overview

No. Not our CPF savings, not the government's reserves, or our foreign reserves.

Temasek was initially formed by the government, which put together 35 companies worth a total of S$354 million in 1974, and its sole shareholder is the Minister for Finance (not just Heng Swee Keat [the dude], though — it's actually a corporate body).

Since it's owned by the government, Temasek pays dividends to the government from what it earns through its investments.

[related_story]

And over the years, it derives and has derived, its funds from:

a. Dividends paid out from the companies it invests in as they grow

b. The money it gets from selling its stakes in various places

c. The money it gets from funds it invests in when they mature

d. Money it borrows from investors when it issues bonds, banks and such, as well as

e. The capital or assets it gets from the Minister for Finance.

2. So how do we know if Temasek makes money or not?

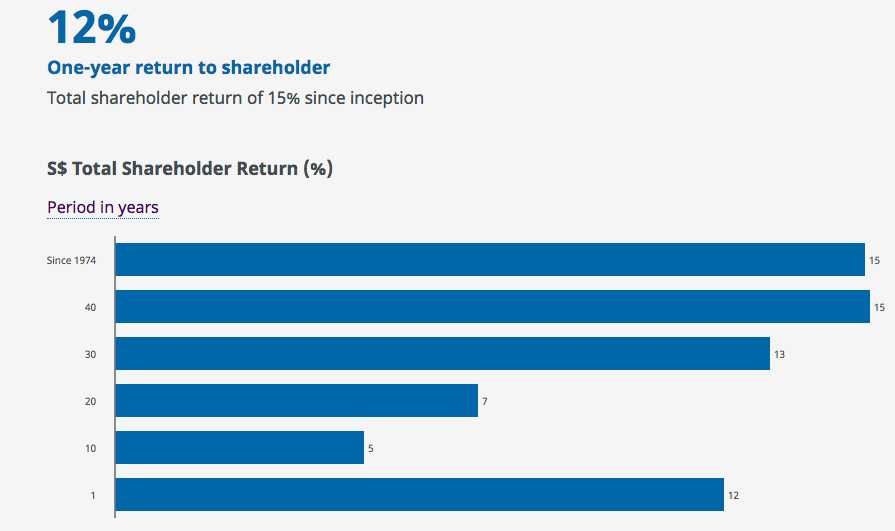

Screenshot via Temasek Review

Screenshot via Temasek Review

There are a couple of ways to see how Temasek is doing — one is through how much its portfolio grows over the years, and another by a concept called Total Shareholder Return.

For the financial year ended 2018, Temasek reported a total shareholder return rate of 12.2 per cent. Generally speaking, here's how it's calculated:

The TSR is calculated as a rate so it measures the extent of how well an investor's holdings or portfolio is doing, rather than the absolute quantum of money that's been made.

And as a long-term investor, Temasek focuses more on long-term performance as compared to its year-on-year TSR. That's why, it says, it shows us its TSR calculated as an average from when it first started work in 1974 — that being 15 per cent.

Why not the net portfolio value from this year versus last year, for instance? The reason you can't take the S$308 billion it has in this year's net portfolio value as an accurate measure of how well it's doing is because its portfolio keeps changing — it can become bigger or smaller as market conditions go up or down, which in turn can affect how Temasek's holdings are performing, as well as what they choose to hold onto or sell.

3. Okay. So where does the money Temasek earns from its investments go?

Chiefly to the government, actually.

Of course, when Temasek gets money back from places it invests in, a good amount of it goes back into further investments elsewhere.

But as an investment vehicle, it pays dividends to its shareholder (the Minister of Finance) — so those dividends return to the government.

Between 2000 and 2015, the government was allowed to use up to half these dividends paid for spending, i.e. in its annual budget.

And what happened after that? From 2016 onwards, Temasek's dividends paid back to the government have been, and still are, locked up in the government's Past Reserves, and can no longer be tapped on for spending.

By the way, the government isn't the only place Temasek pays money to — it also pays taxes in the countries it invests and earns money from. This includes Singapore, where the taxes it pays, just like the taxes we pay, go to public services like defence, education, healthcare and social services.

Additionally, it started various endowment funds — 18 so far — that fuel programmes to serve various communities, groups and causes.

4. And why should Singaporeans care how it's doing?

Well, because of something called the Net Investment Return Contribution (NIRC).

If this is the first you're hearing about this, read the section with the poorly PhotoShopped oranges in this article:

In its simplest terms, the NIRC is worked out by forecasting how much folks like Temasek and GIC (the other state investment vehicle) can make in returns in the future, and then taking half of that predicted amount to spend in the annual government budget.

Anyhoo, the better Temasek performs, the higher the NIRC can be, and therefore, technically, the more the government will be able to spend on us — Singaporeans — in its budget. So if you think about it, it's certainly in our interest that Temasek performs well, that its portfolio value grows, and in turn, its wealth added too.

Also bear in mind that Temasek's dividends are still being added to the government's past reserves, which will help us out in the future when the money is needed — like in a potential future economic crisis.

Bonus question 5: How is Ho Ching involved in Temasek?

Ho is still the Executive Director and CEO of Temasek.

And while she wasn't part of the panel of Temasek management who shared their financial results with us on Tuesday, she gave this analysis on an advance Reuters report that predicts with pretty decent accuracy their eventual performance:

A pretty good snapshot of how Temasek's performance has trended over the years, by our limited standards.Related articles:

Top photo courtesy of Temasek

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.