What is the latest initiative launched in Singapore?

CareShield Life has been introduced in Singapore.

It's a new universal health insurance scheme launching in 2020.

It is an enhanced version of the current ElderShield scheme.

ElderShield is a severe disability insurance scheme.

If you're struck with severe disability, you will receive a monthly payout of between S$300 to S$400 for a period of 60 to 72 months.

In the event of severe disability, CareShield Life will pay S$600 per month and the payout will be ever-increasing until the age of 67, or when you make claims, whichever is earlier.

CareShield Life payouts are for life.

What is considered severe disability?

The inability to perform three out of these six activities:

Why do people still want to be on ElderShield if CareShield Life is better?

Those born before 1970 will not automatically be enrolled in CareShield Life come 2021. They have to make the switch themselves.

But for those born in between 1970 and 1979, not severely disabled and are on the ElderShield 400 scheme, they will be automatically enrolled to CareShield Life and will be given a chance to opt-out before Dec. 31, 2023.

People born between 1980 and 1990 will automatically be enrolled to the scheme in 2020.

Is it true that one cannot opt out of CareShield Life?

To ensure CareShield Life premiums stay affordable and payouts, which start from S$600 and increases with time, last a lifetime, everyone has to participate in it.

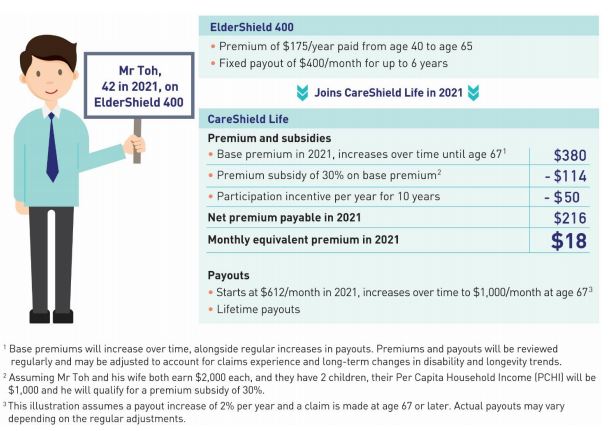

How much will CareShield Life cost?

For those born before 1979, there's a "participation incentive" to switch over.

They will receive between S$500 and S$2,500 over 10 years to help offset premiums:

There are other examples which can be found here.

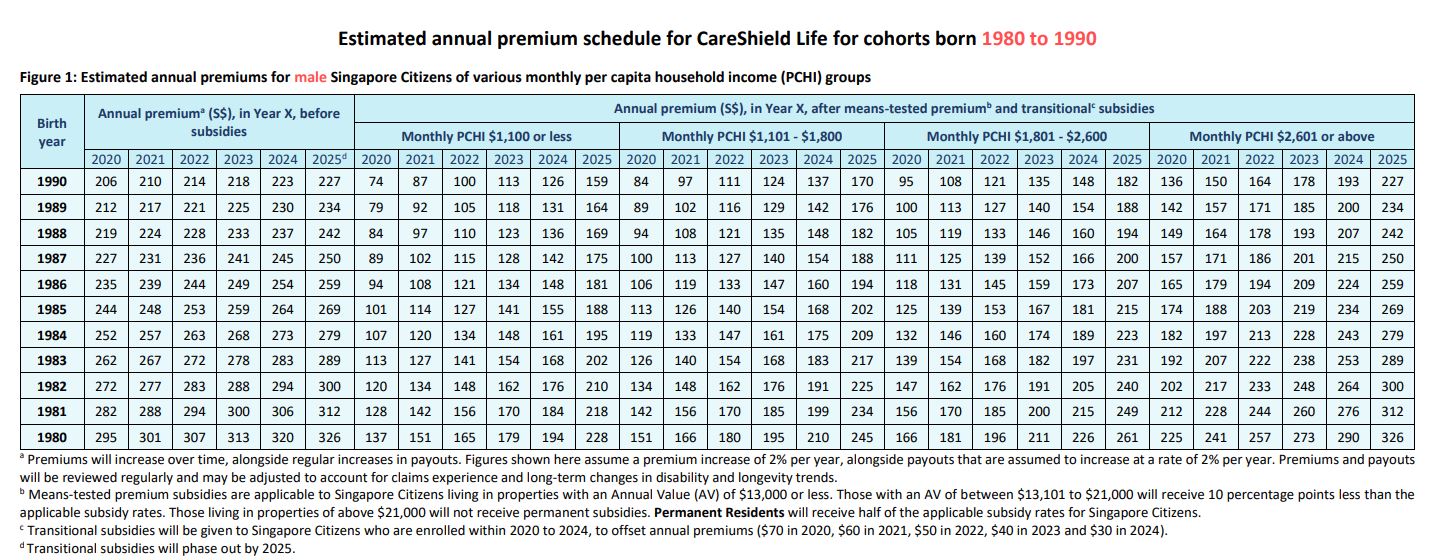

Premiums for males:

Premiums for females:

What is the latest rumour making the rounds about CareShield Life?

This is a message circulating on message apps alleging that Careshield Life was introduced to reap profits off Singaporeans.

The text message suggested that it is unlikely that policyholders will make a claim because the risk of severe disability is very low.

Has the government come out to refute the allegation?

Yes.

Factually, a government website set up in 2012 to debunk misinformation and falsehoods, has come out to address the issue by calling the allegations out to be false or uninformed.

Why doesn't the government profit from CareShield Life?

All premiums collected and returns from investments will stay within the fund.

Policyholders can benefit through higher payouts or premium rebates at a later time in their lives.

CareShield Life premiums collected will remain within the fund meant for policyholders and are not transferred to other government schemes.

What happens to premiums collected for ElderShield?

Premiums collected today under ElderShield do not become government surpluses but are set aside for future claims.

Premiums now are naturally more than the claims paid out, as most policyholders are relatively young.

When policyholders become older, more of them will make claims.

How are premiums for CareShield Life collected?

By 2020, CareShield Life will be compulsory for people aged between 30 and 40.

After 2020, Singaporeans will join automatically at the age of 30.

How much claims can be made?

CareShield Life offers lifetime cash payouts for those who are severely disabled. Payouts will start at S$600 per month in 2020 and increase over time.

What are the odds of severe disability?

The claim that the number of people who suffer from severe disability in old age is very few or close to none is not supported by statistics.

The fact is that one in two Singaporeans who is healthy at age 65 could become severely disabled in their lifetime.

The number of claims is definitely not low or zero.

What is the duration of severe disability?

Three in 10 severely disabled individuals are expected to remain in disability for 10 years or more.

The expected median duration for severely disabled individuals to remain in disability is around four years.

It is, therefore, challenging to rely solely on personal and family savings to pay for one’s long-term care needs.

How much have annual claims risen?

From 2013 to 2017, the annual claims paid out have risen more than the annual premiums collected.

Annual claims: Up by 12 percent

Annual premiums collect: Up by 3 percent

[related_story]

What is one guarantee so far?

Government subsidies will make CareShield Life more affordable, and premiums can be fully paid by Medisave.

If a person cannot pay the premiums, the coverage will not be lost.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.