How does a huge and established institution like the Development Bank of Singapore (DBS) make sure it stays competitive in today’s technological era?

By disrupting itself, of course.

Disruption, a word that’s almost becoming overused these days, refers to fundamental shifts in how consumers think, behave and go about their daily lives. Disruptive products, therefore, address a market that previously could not be served.

And now, announcing its plans for its 50th birthday (DBS50) to the media on May 15, DBS boldly declares that it has disrupted itself in the banking industry — unveiling a slew of all-rounded initiatives aimed at redefining how Singaporeans do banking.

Survival in the digital age

In 2017, The Business Times reported that “Singapore banks that do not fend against fintech disruption could stand to lose more than 5 per cent of their operating income.”

At the DBS50 media event, DBS CEO Piyush Gupta also noted that the “nature of the (banking) industry’s changing,” and adaptation was necessary.

In order to survive, DBS has been displacing obsolete ways of banking with digital transformations in recent years.

By tapping on digital technologies, DBS has reimagined banking in the 21st century with different platforms such as digibank, iWealth and POSB Smart Buddy.

Their digital strategies have also earned them praise from other banks like CIMB and JP Morgan.

Delivering “simple, seamless and invisible” banking

What exactly does “live more, bank less” mean — considering intuitively, one would expect a bank to strive to get its customers banking more with them?

DBS says this bold new goal —

“...reflects the belief that in the digital era, it needs to deliver banking that is so simple, seamless and invisible, that customers have more time to spend on the people or things they care about.”

Some features of the campaign include launching car, property, and electricity marketplaces over the last nine months — all of which provide seamless inclusion of the necessary banking processes into the daily lives and big-ticket purchase decisions made by Singaporeans.

“Live more, Bank less” will also enable customers to gain access to better investment insights with a new app called iWealth, better cash management with Treasury Prism as well as networking opportunities for SMEs.

Moving forward, the bank also aims to help social entrepreneurs with mentorship opportunities, banking services and other types of support under the DBS Foundation as well as addressing sustainability issues through Unleash and DBS-NUS Social Venture Challenge Asia.

[related_story]

The OG industry disruptors

DBS was established in Singapore in 1968, three years after Singapore’s independence. At that time, its primary function was to finance Singapore’s industrialisation and urban development.

And according to Piyush, DBS was a disruptor in the banking industry when they first began.

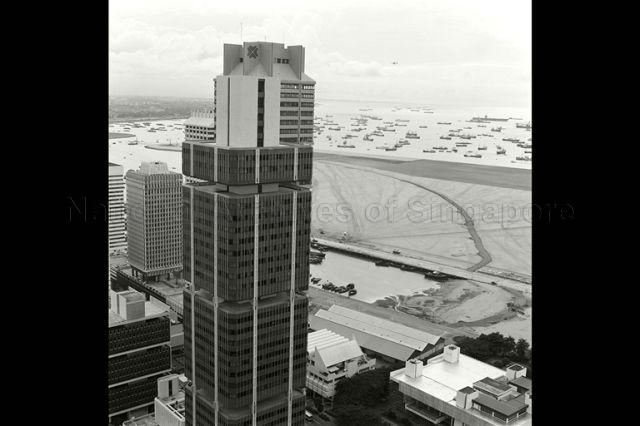

Photo of DBS building (1980s), from NAS.

Photo of DBS building (1980s), from NAS.

Since 1968, DBS has pioneered many firsts in the Singapore banking landscape - introducing Saturday afternoon banking in 1975 and industry-first package for social enterprises in 2008, for instance.

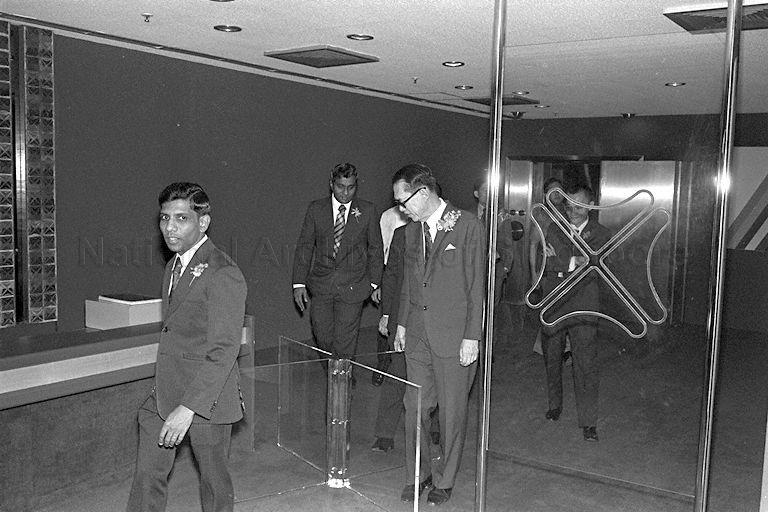

Minister for Finance Hon Sui Sen visiting Development Bank of Singapore (DBS) branch at Plaza Singapura in 1975. Photo from NAS.

Minister for Finance Hon Sui Sen visiting Development Bank of Singapore (DBS) branch at Plaza Singapura in 1975. Photo from NAS.

With the digital revolution, the bank (once again!) finds itself in a position to remain at the forefront of change.

“Live more, Bank less” may be DBS’s newest initiative in disruption, but the uprooting of old ways is not a strategy that DBS is unfamiliar with.

Top photo screengrab from DBS video "Play More."

This post is sponsored by DBS to celebrate their 50th Anniversary.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.