Bike-sharing company GBike will stop operating on July 7.

It is the same day the new licensing regime for bike-sharing comes into effect.

The one-year-old business is the latest victim in the overcrowded bike-sharing market here.

Coupled with the new licensing framework (more on that below), the sheer amount of competition in the market is forcing bike-sharing companies to haemorrhage money.

Stiff competition

Take the recent ofo bicycle warehouse sale:

Brand new ofo bicycles were being sold off for about S$50 or more, which is at 30 percent less than estimated cost price.

While an unnamed source from the company leaked that the company is deliberately downsizing its fleet, ofo itself said that the bicycles were being sold as collateral by its freight company after failing to pay for freight and logistic fees.

According to another tip-off, ofo has also slashed half of its 60-member team in Singapore, although that bit of information is unverified by the company.

Elsewhere, oBike recently got into the news when some of its users had their S$49 deposit converted into payment for a Super VIP programme or had issue receiving refunds for the deposit.

In response to Mothership queries, oBike said that the switch was the result of a "technical lapse".

However, oBike's terms of service was updated in March 2018 to include a clause that allows for the company to convert its riders' deposit to annual membership subscription.

On Mobike's end, the company sneakily hiked the price of its pass in March 2018.

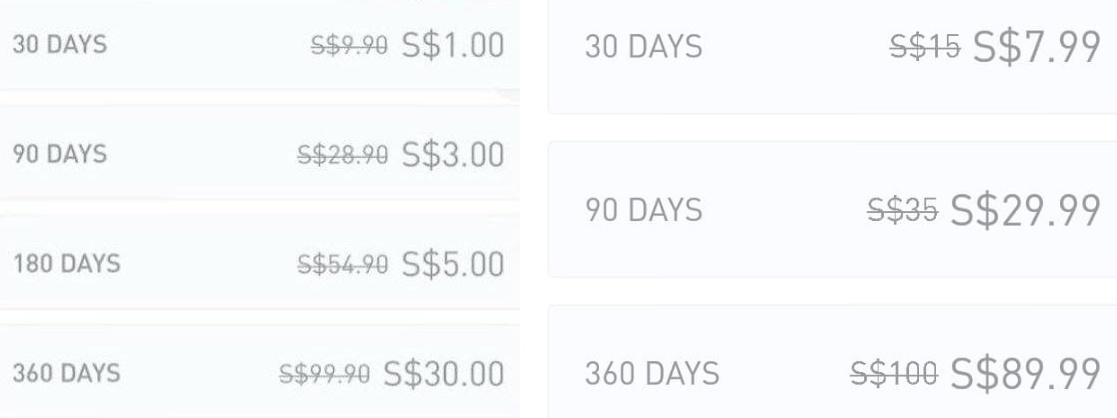

What was initially a S$5 pass for 180 days of usage (less than 3 cents per day) shot up to S$35 for 90 days (S$3.80 per day) or S$100 for 360 days (20 cents per day)

Mobike's old pricing on the left and new pricing on the right.

Mobike's old pricing on the left and new pricing on the right.

When asked about the price increase, Mobike said that the original pricing was introduced in 2017 as a "discounted introductory price".

Channelnews Asia also reported that the price of ofo's 60-day pass jumped 10 times from S$1.50 to S$15 around the same time.

These are indications that the main bike-sharing players are desperate to recoup their losses after their price wars have bled them dry.

Competition woes aside, bike-sharing companies in Singapore also have to contend with a new licensing framework designed to whip them into submission.

[related_story]

Licensing framework

All bike-sharing operators have until July 7 to register for a license from the Land Transport Authority (LTA).

The licensing framework, which kicks in on July 7, 2018, is designed to combat unsightly indiscriminate parking.

To see how this plays out, we only need to look to Melbourne, the market which oBike is exiting after being forced out by the Environment Protection Authority's new rules, which were enacted to eliminate indiscriminate parking.

Bike-sharing companies in Melbourne would have to pay A$3,000 (S$3,040) to the city council for every bike found abandoned and blocking a street for two hours.

In comparison, the new licensing rules by LTA enables the authority to fine bike-sharing companies up to S$100,000 or revocation of their licence if they flout any of the licensing conditions.

Licensing conditions include making sure bicycles are in working condition, parked properly, and enforcing a blanket ban on recalcitrant users.

One such measure would include getting bike-sharing companies to downsize their fleet.

According to the Land Transport Authority, there are about 100,000 dockless bicycles in Singapore but only half of that is in use at any one time.

What is clear is that this licensing framework will force bike-sharing companies to devote more resources into tackling indiscriminate parking and ensuring their bicycles are properly maintained all the time, further depleting their finances.

Perhaps GBikes won't be the last victim in the bike-sharing fight.

Top image by Joshua Lee

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.