Of course it would happen — Finance Minister Heng Swee Keat's 2018 Budget was passed in Parliament on Thursday, March 1.

This would otherwise be largely a non-issue.

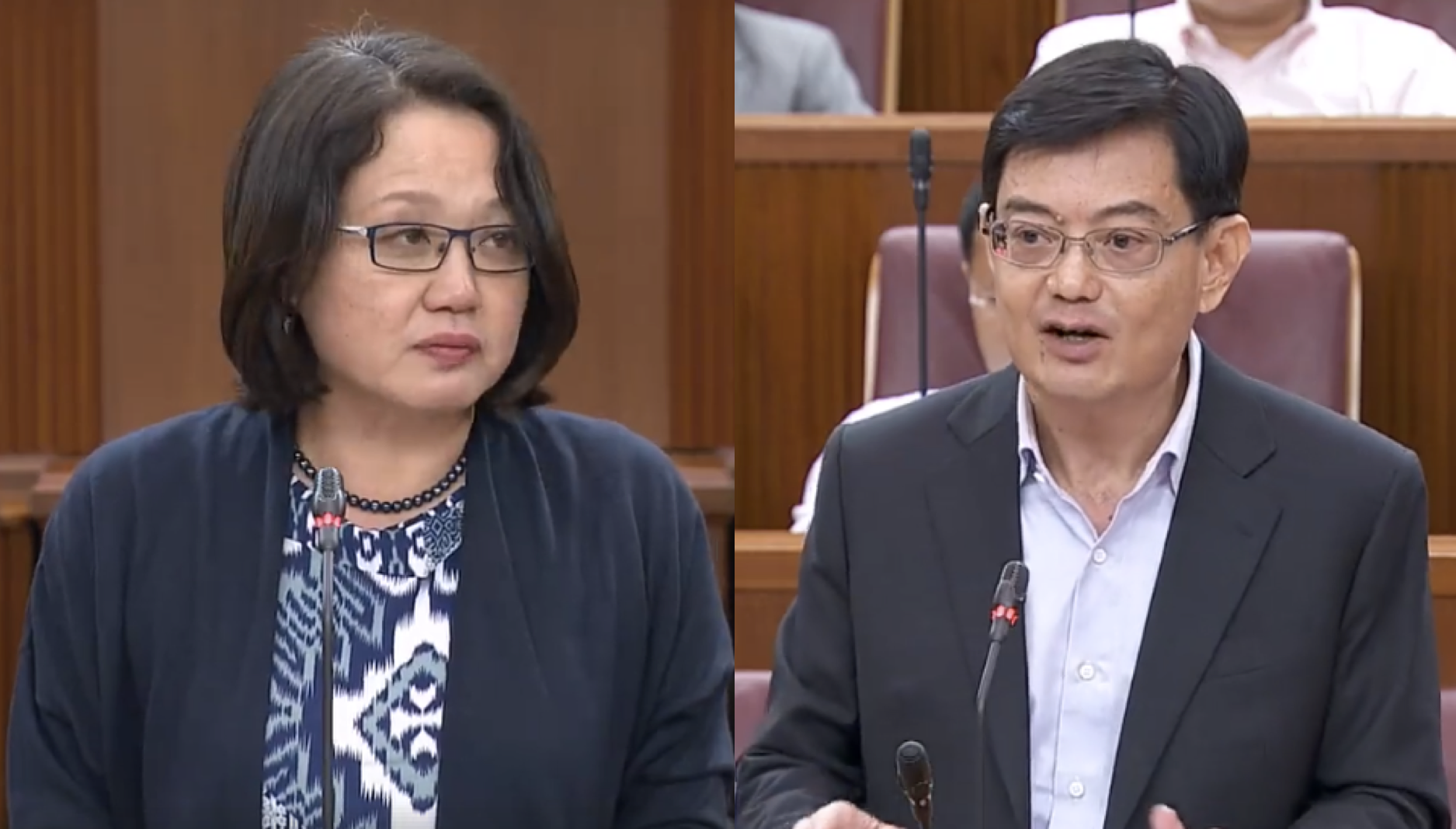

Dissenting voice

However, the Workers' Party MPs present voted against it. The reason?

While they supported the Budget's measures, they could not support the proposed hike in the Goods and Services Tax.

Party chairman and Aljunied GRC MP Sylvia Lim noted that the government had yet to set a specific date for the implementation of the hike to 9 per cent.

Therefore, she said, the WP is not in a position to take a stand (to support or oppose the tax hike) as they did not have a "crystal ball".

[related_story]

Call for a division

In response, Heng said that the vote was on the government's overall financial policy, and called for a division.

This is a procedure whereby MPs in Parliament record their vote through a device on their seats, instead of saying "Aye" or "No", so that how every MP votes will be made known and clear.

Other than party chief Low, who was not present at the time the vote was held, the following MPs and NCMPs voted "no". They're all from WP:

- Sylvia Lim

- Pritam Singh

- Muhamad Faisal bin Abdul Manap

- Chen Show Mao

- Png Eng Huat

- Daniel Goh

- Leon Perera

- Dennis Tan

Would have voted yes, but...

In a short statement posted on their website on March 1, the Workers' Party outlined the reasons for their opposing votes. The bolded parts are ours:

"The Workers’ Party MPs voted “no” to the motion that Parliament “approves the financial policy of the Government for the financial year 1st April 2018 to 31st March 2019” for the sole reason that WP is unable to support the announcement of a GST hike from 7% to 9% in 2021-2025 at this point in time.

We support the Government’s budget strategy and measures for the coming Financial Year, as presented to Parliament. However, the future GST hike is an announcement and not a budget measure. We are unable to support the announcement for three reasons:

1. the lack of clarity on long-term projected Government income and spending;

2. the lack of consideration of alternative revenue streams and whether there is scope for the reserves to better support and invest in Singaporeans;

3. the lack in details on the effect of the future GST hike on low-income and middle-income Singaporeans and the Government’s permanent GST offset packages.

We asked the Government to consider other options for raising revenue to meet increased spending. These options included raising the NIRC cap and using a small, capped fraction of land sales proceeds for Budgets. However, the latter was brushed off by the Government.

WP MPs intended to vote “yes” on the budget measures for the Financial Year 2018/2019. However, Minister Heng insisted that voting “yes” would mean WP supports the announced GST hike in the next term of Government in 2021-2025 and called for a division. It is unreasonable for us to vote for a drastic future tax hike that will financially affect Singaporeans based on inadequate information and justifications on the need for the hike. We therefore voted NO."

Economy and society are linked

In his wrap-up speech earlier in the day, Heng vigorously defended the provisions and overall thrust of his Budget.

He said that the government's aim was to build a caring society, one in which social stratification and inequality could not threaten social harmony, and that their economic strategy was "inextricably linked" to this aim.

Said Heng:

"Singapore must continue to be a society where everyone, regardless of background, has the opportunity to do well based on personal efforts and talent."

Heng also said that his Budget would better prepare Singapore to adapt to a fast-changing global economy, with rapid advances in technology. These include:

- Tax deductions for research and development

- Tax deductions for intellectual property registration

- Productivity Solutions Grant for SMEs who want to adopt certain new technologies

Said Heng of his Budget aims:

"Growing our economy is not only the best way of ensuring strong and sustainable revenues, it is also the most important way for our people to realise their aspirations."

The Committee of Supply debates are scheduled to continue until March 8.

Top image adapted via screen shot from Channel NewsAsia.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.