According to Minister for Finance Heng Swee Keat, Singapore recorded a Budget surplus of $9.61 billion for FY2017.

This figure was revealed in the budget statement delivered in Parliament today. It is significantly larger than the previously estimated figure of $1.91 billion.

The surplus represented 2.1 per cent of GDP, and was a marked increase over the $6.12 billion surplus recorded for FY2016.

There were two reasons for this surplus.

1. Higher-than-expected revenue

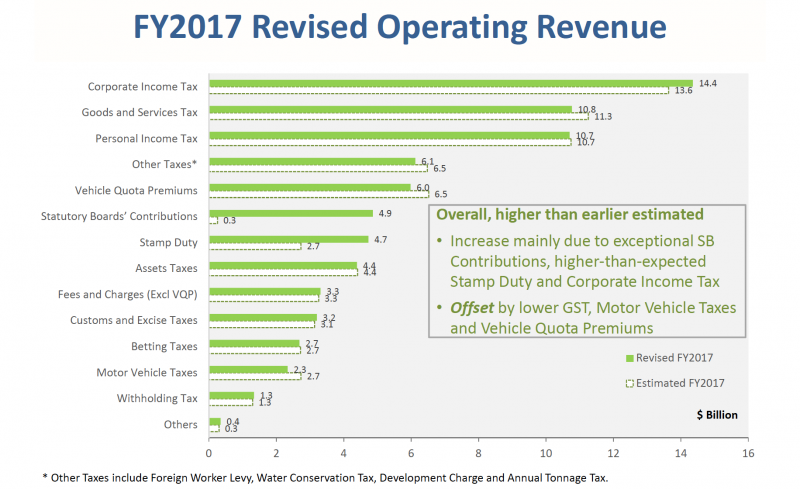

The first was higher-than-estimated revenue streams.

Screenshot from MOF.

Screenshot from MOF.

Statutory Boards, particularly the Monetary Authority of Singapore (MAS), contributed more than expected. MAS's contribution was an eye-catching $4.6 billion.

It might not be as well-known as Temasek Holdings or GIC Pte Ltd, but MAS is also an investment entity. According to its website:

"Being a central bank, MAS is the most conservative of the three investment entities, with a significant proportion of its portfolio invested in liquid financial market instruments."

There were also increased collections from the Stamp Duty, $2 billion, due to a high volume of property transfers.

[related_story]

2. Lower-than-expected expenditure

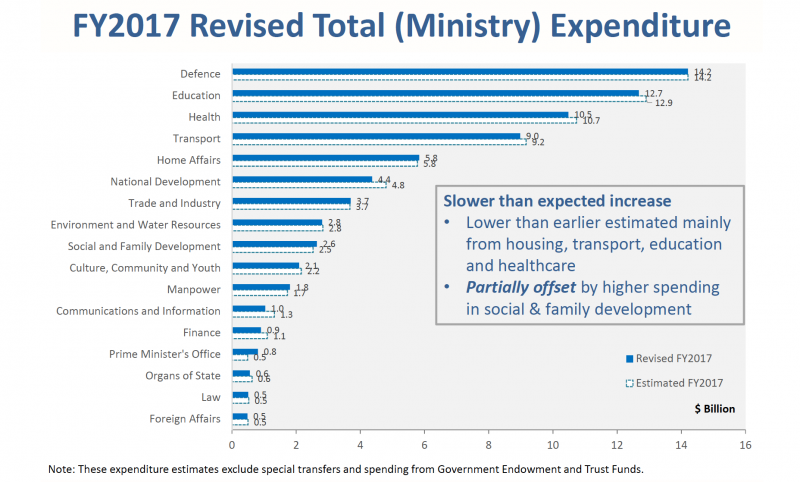

On the expenditure front, there were also slower increases than expected in areas such as housing, transport, education and healthcare.

One reason was that infrastructure projects, such as the Integrated Development of the Sengkang General and Community Hospital, are nearing completion, resulting in lower expenditure.

Screenshot from MOF.

Screenshot from MOF.

Biggest surplus in 20 years

This surplus is the largest in Singapore's history since 1997 -- in dollar terms, although not necessarily as a percentage of the nation's GDP.

It intends to set aside part of the surplus for the Rail Infrastructure Fund ($5 billion) and ElderShield subsidies ($2 billion, set aside for when the review is complete).

Against the backdrop of the government pushing on with other measures to raise revenue for FY2018 and beyond, this is perhaps an inconvenient situation to be in.

It will have to work harder to communicate to Singaporeans that the two sources of increased revenue -- MAS investment returns and high Stamp Duty -- are unlikely to be repeated in FY2018 or other years ahead.

Meanwhile, the government has higher expenditure commitments looming, like transport infrastructure upgrades and increased social spending.

It's kind of like striking TOTO once, but it's unlikely that you'd strike TOTO every year.

Top image from Visit Singapore.

Here are some totally unrelated but equally interesting stories:

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.