Still using this?

The trusty POSB Savings Account has been a mainstay of Singaporeans’ financial lives since we started saving when we were in primary school.

We mostly use it for convenience. It was our first love after all - the first time we started saving money.

Then again, its somewhat low interest rate is at times a source of contention. While some say that 0.05% interest is to be expected for a savings account, others may say, “Might as well don’t give, right?”

Some of us have turned disloyal to other bank accounts that offer a higher interest rate. But there’s always some kind of catch.

Look more closely at some of said accounts, and you’ll realise how complicated they can be.

What’s with cumbersome conditions like “minimum salary credit” and “minimum credit card spend”? Or different bonus interest rates for different types of transactions?

How to keep track, man?

Of course such conditions make little sense, so DBS rolled out a product just late last year worthy of our attention.

Say hi to the enhanced DBS Multiplier Account, whose mascot happens to be a rabbit. Cos rabbits multiply quickly.

How does it work?

With the account, all you need to do is to credit your monthly salary and make just one other kind of transaction (credit card spend, home loan instalment, insurance, or investment - basically almost any other kind of financial transaction).

The interest rate, which can go as high as 3.5% p.a., is simply determined by the total value of your eligible transactions per month. This interest is then multiplied onto the balance in your Multiplier Account.

Yeah, that really is all. Say goodbye to confusing and complicated stuff.

Of course, there’s no programme in the world that is one-size-fits-all.

Are you suitable and eligible for such an account?

Young working adults stand to benefit the most, since: 1) we may not be earning that much yet, and 2) we may not spend that much either (mostly because of point 1).

All you need is at least $2,000 or more worth of transactions per month to enjoy interest rates starting from 1.55%. No minimum salary required, and no minimum credit card spend required.

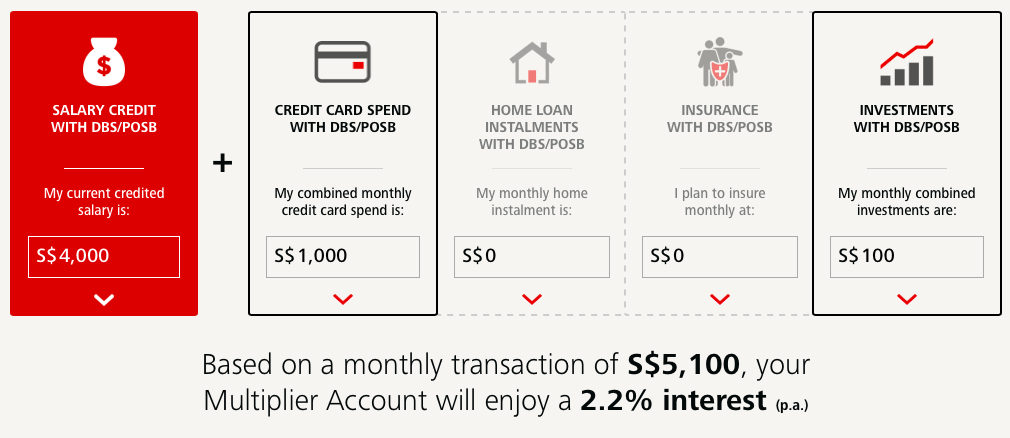

Take the example of a typical young working adult (a.k.a. me) who spends about a quarter of his $4,000 salary and invests a very modest $100 a month through a regular investment plan.

Here’s what I get:

Calculate your own interest rate here.

2.2% interest is a whopping 44 times of 0.05%, by the way, just for doing what I’m already doing currently.

If you don’t want it, I have nothing to say.

--

Visit DBS today to find out more and apply for the Multiplier Account.

If not, do us a favour and watch this video. Cos cute rabbits.

[embed]

Top image adapted from DBS Facebook page.

This sponsored post is brought to you in collaboration with DBS and helps young people like us learn how to make the most of our savings. Please read all terms and conditions carefully and do your due diligence before signing up for any financial products.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.