Goods and Services Tax (GST) has been hoarding the news.

This was after a Singaporean woman was arrested for evading it when she failed to declare she was carrying S$11,000 worth of branded goods on her from Paris.

This was followed by another piece on the need to pay the 7 percent GST on grocery shopping in Johor Bahru, if the amount spent exceeded the S$150 tax relief.

This Channel News Asia piece is actually a riff on a topic that was already making Singaporeans shake their collective heads when it was suggested back in 2014 that GST had to be paid for overseas purchases.

[related_story]

How Singaporeans work with/ around GST

As with all laws and regulations, it is good to know how far your rights as individuals extend.

Frequent shoppers volunteered their knowledge in the CNA piece.

Here is a list of them.

1. Regardless of how much you buy from Johor Bahru, it is still worth it after accounting for the 7 percent GST.

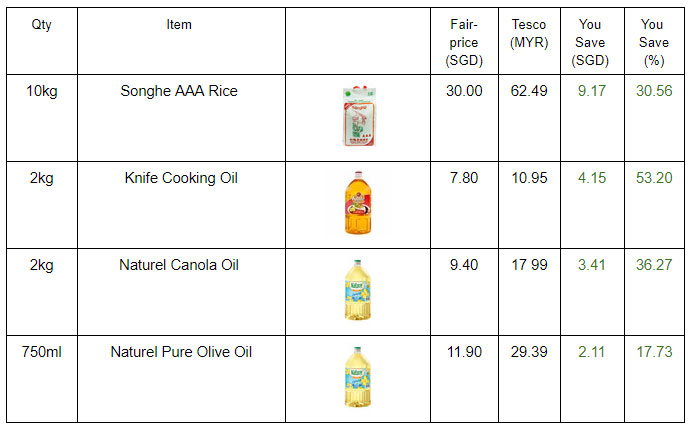

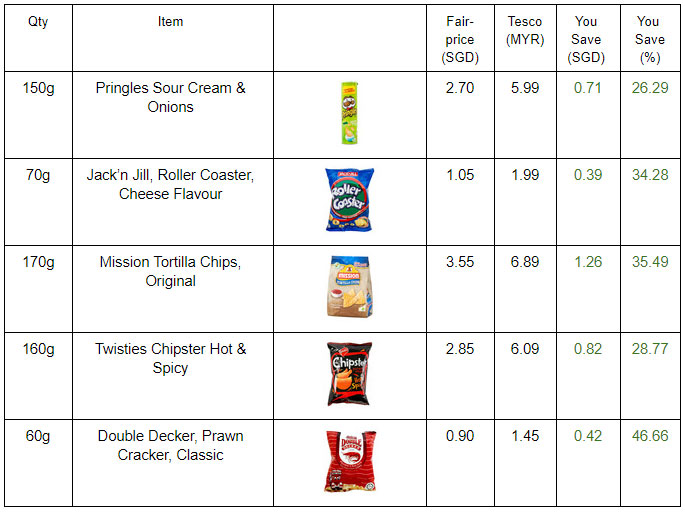

A trip up north to buy groceries is worth the hassle and queuing for a lot of Singaporeans simply because essentials and junk food are way cheaper.

Cost savings for some products can be more than 50 percent.

Here are some price comparison examples:

2. The GST relief is S$150 per person out of Singapore for less than 48 hours

This means that if there are, for example, four people in the car crossing the Causeway, the GST relief is S$600 in total. That's RM1,800.

Taken to its logical conclusion: If time allows and if you know that the GST you are going to pay exceeds the cost of, say, a staycation in JB, you can stay out of Singapore for more than 48 hours.

For those who are away for more than 48 hours, GST is exempt for goods valued up to S$600 per person.

3. Declare visible items

The common thread running through all these media coverage is the admonition to declare big-ticket items, such as televisions, furniture and branded goods.

One creative way mentioned that is employed by Singaporeans to avoid detection when sneaking in luxury items, such as handbags and wallets, is to take off the price tags and wear or use the items.

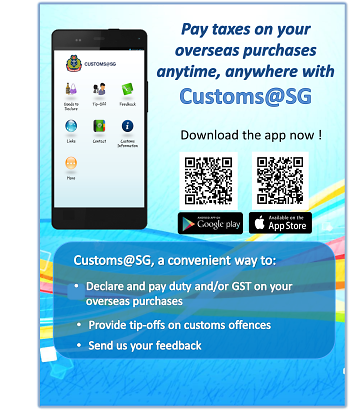

4. It is a hassle to physically pay at the customs

Don't choke up the Causeway by volunteering to pay GST only at the checkpoints.

Inefficiencies like this -- paying something like S$3.20 GST -- is simply not worth it even for the authorities or you.

Settle your GST beforehand using the customs@sg app.

Here's an unrelated but equally interesting article:

You need to get with the times, both for your bank account and your life

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.