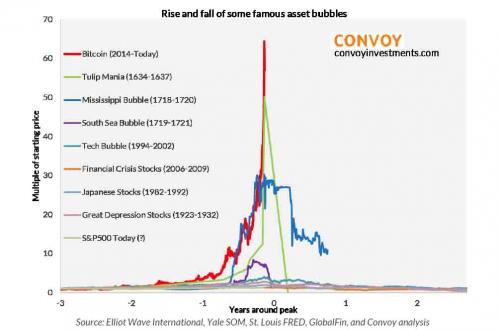

Virtual currency bitcoin is the biggest bubble in history.

It has eclipsed the 1637 "Tulip Mania", a speculative bubble that rocked the Dutch economy before it collapsed.

Insane price increase

The bitcoin price has “gone up over 17 times this year, 64 times over the last three years and superseded that of the Dutch tulip’s climb over the same time frame,” according to analysts Howard Wang and Robert Wu from Convoy Investments.

Just one month ago, the duo's previous asset bubble chart went viral after it was released.

It showed that bitcoin was only lagging the 17th-century tulip bulb mania among all of the world's most famous asset bubbles.

The analysts have updated the chart to show the price of the digital currency more than doubling in just a month.

As of now, bitcoin has won the global bubble race.

What drives bubbles

Talking about the main driver of bubbles, Wang said: “When we see a dramatic rise in asset prices, there is often an internal struggle between the two types of investors within us.”

According to the analyst, the first is the value investor, “is this investment getting too expensive?”

The second is the momentum investor, “am I missing out on a trend?”

“I believe the balance of these two approaches, both within ourselves and across a market, ultimately determines the propensity for bubble-like behavior,” Wang was cited as saying by ZeroHedge.

While the effects of the tulip craze were devastating, bitcoin's rally is far from over and does not mean it is going to collapse, at least, not anytime soon.

It is possible for bitcoin to breach the US$40,000 threshold at the end of 2018.

Tulip mania was a period in the Dutch Golden Age of the 17th century that saw contract prices for some bulbs of the recently introduced and fashionable tulip reach extraordinarily high levels.

At the peak of tulip mania, some single bulbs sold for more than ten times the annual income of a skilled craftsworker.

The prices dramatically collapsed in February 1637.

Tulip bubble is generally considered the first recorded speculative bubble and the term "tulip mania" is now often used metaphorically to refer to any large economic bubble when asset prices deviate from intrinsic values.

H/T ZeroHedge

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.