Even as Singaporeans get sucked into the attention-grabbing Twitter banter between Razer CEO Tan Min-Liang and Prime Minister Lee Hsien Loong, one other attention-grabbing detail is equally hard to overlook.

The upcoming Razer initial public offering -- possibly in October 2017 in Hong Kong -- will make PM Lee's younger brother, Lee Hsien Yang, much richer than he already is.

Or as us plebs will say: Very, very, very rich.

An early investor

Chief executive Tan founded Razer in 2005.

Lee Hsien Yang first invested in Razer in May 2007, as reported by Quartz in July 2017.

Lee Hsien Yang getting a piece of the Razer action early on, undoubtedly puts him on the veritable who's who list of super rich investors from around the region.

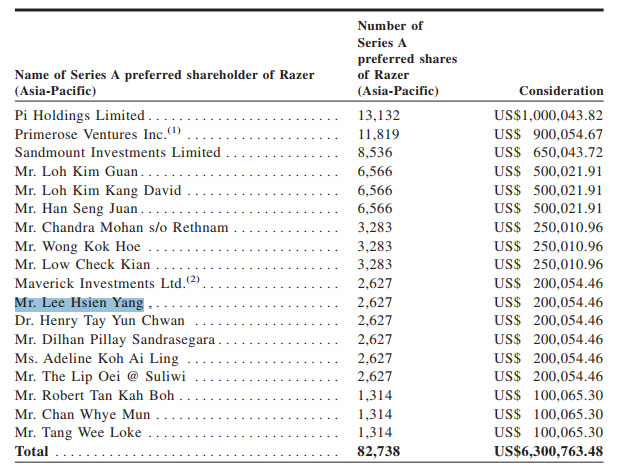

This information is public knowledge as QZ scoured through Razer's draft prospectus in the lead-up to the IPO, that provided a detailed breakdown of stakeholders.

Table via

Table via

Lee Hsien Yang has 0.32% stake

Some of these details include:

In September 2009, Lee Hsien Yang exercised a call option to buy more shares.

In 2016, he sold a tranche of shares during a corporate share buyback.

As an early investor, even though his holdings amount to a 0.32 percent stake, a low-bar estimate based on QZ's assumptions suggests Lee Hsien Yang should get paid at least US$8.2 million from an initial investment of US$300,000.

This is a whooping 27 times the return of capital invested -- in a mere 10 years.

Via QZ

Via QZ

Razer drumming up publicity ahead of IPO

Singaporean CEO Tan has in the past few weeks done a credible job getting the attention of Singapore's prime minister and ingratiating himself with the government side of things as well.

On Sept. 7, Tan announced that Razer has delivered a 36-page proposal to the Prime Minister’s Office (PMO), the Monetary Authority of Singapore (MAS), and the Smart Nation and Digital Government Office (SNDGO) -- as promised.

This is regarding the building of a e-payment system, "by Singaporeans, for Singaporeans".

However, the nationalistic undertones, midtones and overtones end there, as Razer will in all probability be listed in Hong Kong.

But, hey, fair play, whatever works and floats your boat in this flotation (pun intended).

The size of its initial public offering (IPO) remains a secret though, but the word out there is that Razer plans to raise US$400 million.

It is gunning for a valuation of between US$3 billion and US$5 billion, despite Razer raking up losses even as its revenue grows.

Therefore, any high-profile publicity in the lead-up to the Razer IPO would stand the company in good stead.

The core business of selling gaming mice and other hardware is suddenly potentially supplemented with being tasked to build the e-payments system for an entire country.

What about conflict of interest?

And this is where it gets tricky.

Especially if you get the following line of logic:

The Razer CEO getting chummy with the prime minister of Singapore → could result in the soon-to-be-listed company developing an e-payment system given its convincing proposal → thus enabling a favourable IPO event that will enrich the early investors of Razer → one of whom is Lee Hsien Yang → who is the prime minister's brother → even though both parties are at loggerheads → they are still related by blood.

That's awkward.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.