In 2013, a supposed screenshot from Apple’s iOS 7 agreement went viral. It included a “hidden” short rant by an “Apple employee” who made use of the fact that people don’t usually read T&Cs before agreeing to them.

While we wish it were real, it turned out to be a joke created by Huffington Post's UK Comedy team.

But more than just poking fun at people’s obliviousness, the joke also underlined our carelessness in agreeing to contracts without first double-checking the fine print.

So to make sure you don’t accidentally sell your organs away, we’ll be covering the most crucial elements of a type of contract you’re likely to sign a few times in your life -- the employment contract.

Here are five die-die-must-check things before you sign this important document.

Leave

via Flickr

via Flickr

Depending on the individual, there are different types of leave one can apply for, including adoption leave. An employee (who is covered by the Employment Act and has worked for at least 3 months) is entitled to a minimum of 7 days of annual leave in their first year of service. Your annual leave entitlement will depend on how many years of service you have with your employer.

And if you’re one of those people with only seven days of Annual Leave a year, (we’re sorry to hear that, but anyway) here’s a nifty guide on long weekends in 2018 for you to better maximise those precious days.

Notice period

“Please elaborate on the rationale behind your resignation.” via Giphy

“Please elaborate on the rationale behind your resignation.” via Giphy

A little bleak to be mentioning this even before you sign your employment contract, but yes, the notice period is something you should definitely be mindful of.

Some employers state different notice periods for themselves and their employees, such as one month for the employer but two months for the employee (yes, it happens).

This should not be the case as the notice period for both parties should be the same, so remember to have your back covered on this issue.

Work hours and rest days

via Giphy

via Giphy

If you are a workman (i.e. manual labourer) with a basic monthly salary of not more than $4,500, or a non-workman with a monthly basic salary of not more than $2,500, please take note.

You should check that your work hours and rest days are clearly stated on the contract. An employee is entitled to at least one day of rest per week, and it can be any day as agreed by both parties.

According to the Ministry of Manpower (MOM), the general guideline is that an employee should not work more than 44 hours a week.

Shift workers go by a 3-week time frame, where they can work 40-hour or 48-hour weeks, but the average weekly hours for those three weeks should not exceed 44 hours as well.

All in all, just remember that 44 is an inauspicious number (especially in Chinese Numerology), and your weekly working hours shouldn’t exceed it.

Overtime

No one likes to work overtime. But the good thing is that if you’re a workman with a basic monthly salary of not more than $4,500, or a non-workman with a monthly basic salary of not more than $2,500, you’ll be paid for it. Managers and executives, again, are excluded from this rule.

via Giphy

via Giphy

Also, you’ll be paid at a rate that’s at least 1.5 times your hourly basic rate (capped at the monthly salary level of $2,250). So that works out to OT pay of up to $17.70 per hour.

Another good thing is that overtime pay also attracts CPF contributions, so essentially, you get more disposable income as well as CPF savings.

Salary

via Giphy

via Giphy

Terms like “salary before CPF” and “salary after CPF” can get quite confusing, especially for new job seekers in the market.

One thing to note is that most companies usually state the amount you’ll get (inclusive of the 20% CPF contribution made from your monthly salary) on the contract document, meaning your take-home pay is 80% of what’s stated there. You are also entitled to CPF contributions on some other items such as bonuses and allowances.

Of all the things you need to be clear about, CPF contribution really is something you die-die-must-check, because a portion of your salary goes into your CPF accounts. Plus having enough CPF savings can help you a great deal in financing your housing, healthcare, and retirement needs in future.

Every month, while you contribute 20% of your salary to your three CPF accounts -- the Ordinary Account (OA), the Medisave Account (MA), and the Special Account (SA) -- your employer also contributes 17% of your salary to these accounts.

This means that 37% of your monthly income is deposited into your CPF accounts every month. These monies are your CPF savings, which can be used for your home purchases (using your OA savings), healthcare expenses (using your MA savings), and retirement (using your SA savings).

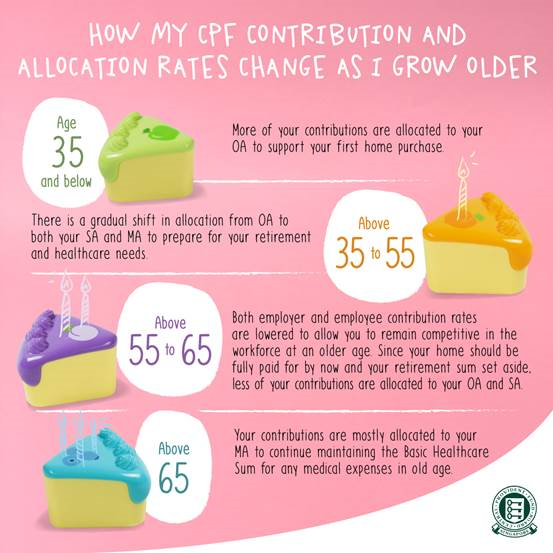

In addition, to meet different needs at different stages of your life, the allocation rates for your CPF account are automatically adjusted as you get older.

Given that CPF savings earn compounded interest over time, it is possible for young adults to afford their first home after working (and receiving monthly CPF contributions) for just three years.

--

Now that you’re equipped with the knowledge of key employment terms (KETs) and what exactly makes up your CPF contributions, you’re ready to tackle the working world.

But here’s a TLDR version of whatever we just covered -- in the form of a helpful CPF calculator -- in case you’re still confused by all the numbers mentioned above.

All infographics via CPF.

This sponsored post in collaboration with CPF keeps Mothership.sg’s writers assured that we will have money to spend on Kopitiam beers in our retirement years.

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.