After the New Year and Chinese New Year holidays, the next vaguely interesting event (read: fodder for small talk) on the calendar is one that you might have a love-hate relationship with.

Love because you might reap some benefits from it.

Hate because, well, sometimes it’s just so technical that your brain can’t process everything. Also, FOMO, because it’s kinda a hot topic so almost everyone’s talking about it.

That’s right, we’re talking about the Singapore Budget.

And the terminology. Some of the terms used in the Budget are so cheem it leaves you wondering if you’re the only one scratching your head in confusion. That’s understandably a turn-off for some.

*deep breathing* (via)

*deep breathing* (via)

In the wise words of Coldplay, nobody said it was easy. But we’re here to help you explain some commonly used Budget terms… in the best way we can.

1. Operating revenue

Definition you’d understand:

Think about it this way -- the amount of money collected by the drink stall auntie is the operating revenue for that drink stall.

How a public officer may explain it to you:

Quite simply, this refers to money collected from the Singapore government’s day-to-day activities.

In 2016, a large portion of the government’s operating revenue came from corporate income tax, goods and service tax, and personal income tax. Others include fees and charges such as ERP charges, stamp duties, betting taxes, and so on.

Operating revenue is not to be confused with profit or surplus.

Why it matters to Singaporeans:

The operating revenue is one way to gauge how well our economy is doing and how Singaporeans are doing.

The operating revenue for FY2015 was $64.2billion.

Sounds like a huge figure? But without revenue, how can any government then carry out its spending plans?

2. Net Investment Returns Contribution (NIRC)

Definition you’d understand:

Not to be confused with NRIC. NIRC, to explain simply, is like the returns from your investments, part of which you can use to supplement your annual income, especially after you bought that new car. You can also reinvest the returns to generate even more returns.

How a public officer may explain it to you:

A sum of money taken out of investment profits earned from government financial assets (cash, bonds, stocks etc) yearly, contributing to our national Budget.

This sum comprises up to 50% of the total investment returns expected to be earned on net assets invested by GIC, MAS, and Temasek, and up to 50% of investment income from other assets.

Still sounds kinda complicated? To put it even more simply:

GIC, MAS and Temasek make investments, and up to half of the money earned can be used to supplement our national Budget. The rest are reinvested to generate more returns for Singapore.

Why it matters to Singaporeans:

Because money from the investments of GIC, MAS and Temasek trickles down to us via the Budget, allowing us to help our needy, upgrade our workers’ and businesses’ capabilities, get the GST Voucher and have a new OBS on Coney Island.

3. Fiscal position

Definition you’d understand:

The amount of money you see in your bank statement at the end of the year. A surplus if you have conscientiously kept track of your finances and saved some money; a deficit if you have spent more than you’ve earned and have clocked up huge credit card bills in the process.

Best if it's a surplus, of course. (via)

Best if it's a surplus, of course. (via)

How a public officer may explain it to you:

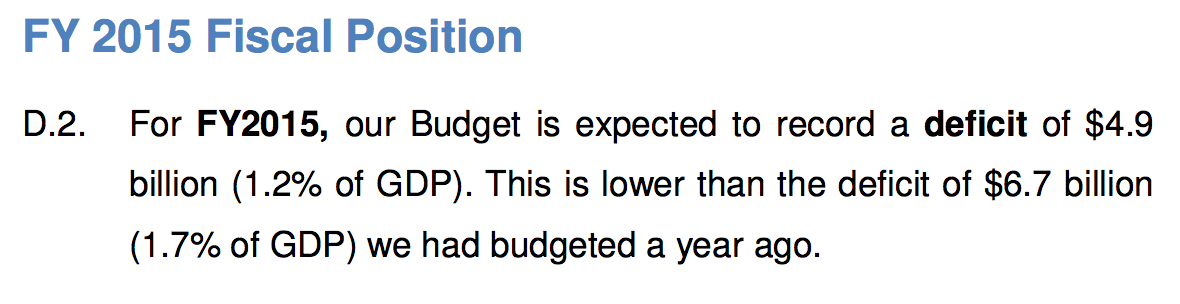

Basically the state of our finances for the year, such as whether there is a projected budget surplus or deficit.

Screenshot via

Screenshot via

Why it matters to Singaporeans:

Finance Minister Heng Swee Keat mentioned in the 2016 Budget that as Singapore’s economy and workforce matures, GDP growth will slow. With rising expenditure, we will face a “tighter fiscal position” in the future.

That means that our public finances won’t be as strong as before, if Singapore’s income cannot catch up with rising expenditure that’s necessary to meet the country’s needs.

4. Budget surplus

Definition you’d understand:

You’ve set aside $50 for groceries this week. But because of your extreme couponing skills and other discounts, you paid only $40. Yay.

How a public officer may explain it to you:

The amount left from the operating revenue after deducting what the government has spent and then adding the NIRC.

In 2016, Singapore had an overall budget surplus of $3.45b.

Why it matters to Singaporeans:

Budget surplus means we can squirrel past earnings for future use. You don’t always spend every single dollar you earn each year. That goes for governments too.

Chances are, we will be safer in a future crisis because the government has the funds from past years, giving it the ability to respond quickly.

Yay.

Imagining Benedict Cumberbatch as the face of our government… helps make things better too. (via)

Imagining Benedict Cumberbatch as the face of our government… helps make things better too. (via)

5. Tax rebate

Definition you’d understand:

Like the promo code which you apply at the checkout to reduce the damage from your online shopping spree (again!).

How a public officer may explain it to you:

An amount given back to taxpayers that reduces the total amount of tax payable. Not to be confused with tax refund.

Here’s a quick example:

For the Year of Assessment (YA) 2015, which covered income earned the previous calendar year (i.e. calendar year 2014), resident taxpayers can enjoy an income tax rebate of up to $1,000 as part of SG50 Jubilee celebrations.

Assume that the gross amount of tax you have to pay in YA 2015 was $2,500. With the income tax rebate of $1,000, you only have to pay $1,500 in taxes.

This is different from tax refund, where the tax authority returns you money if you have paid more tax that you should have.

Sounds confusing, right? We feel you.

Why it matters to Singaporeans:

Well. It just means that we get to pay less taxes and the extras can be used to invest in yourself or to grow your business. Wooo.

--------------------

Budget 2017 will be delivered by Finance Minister Heng Swee Keat on Feb. 20, 2017. We hope this guide will come in handy then.

Top image via Heng Swee Keat Facebook page.

This sponsored post gives us strength to sit through Budget 2017.

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.