BTO season is back, with an estimated 4,810 build-to-order HDB flats up for grabs this month in Hougang, Sembawang, Yishun, and Tampines.

Buying one’s first home can be an exciting milestone. And for most young couples, getting a BTO flat has become somewhat of an autonomic nervous response - many of us find it to be the most affordable housing option, we know we need one, and we more or less know how to apply for one.

We also know that flat prices are a whole lot less intimidating once we’ve factored in various grants, loans, and repayment schemes. The most well-known of these include the Additional CPF Housing Grant (AHG) and Special CPF Housing Grant (SHG). Used together, eligible first-timer applicants can receive up to $80,000 in CPF grants (not a small amount hor!), which can be used to offset the purchase price of the flat or reduce the mortgage loan.

But what are some oft-overlooked costs? Which items must be financed with cash, and which can be financed using one’s CPF savings?

Here, we help first-time home buyers cut through the crap clutter and focus on the essential expenses in financing their desired BTO home:

1. Application Fee

You pay this fee when submitting your online flat application. Because gahmen computer system also need electricity and maintenance one, okay.

How much: $10.

Payable with CPF: No. (Seriously no need to use CPF for this lah.)

2. Option Fee

You may wonder, “Wah, how come follow queue number and book flat also must pay money?” Don’t worry, the option fee is merely a part of your downpayment; it’s not an additional expense.

If you are taking an HDB housing loan, the option fee is reimbursed to you in cash if there are enough savings in your CPF account to pay the downpayment. If not, the option fee simply goes towards the cash portion of the downpayment.

How much: Between $500 and $2,000 (the larger the flat, the higher the option fee).

Payable with CPF: No. This must be paid in cash.

3. Downpayment

Same principle as buying, say, a car on instalment. Pay a certain amount upfront to signal your commitment to the purchase. Good stuff must chope!

How much: If taking a HDB housing loan, this amount is 10% of the flat purchase price. If taking a bank loan, this is the remaining portion of the flat purchase price above the loan ceiling (e.g. if loan ceiling is 80%, downpayment is 20%).

Payable with CPF: Yes and in full, if taking a HDB housing loan (or not taking any loan). If taking a bank loan, can use CPF to pay up to 15% of the downpayment.

4. Stamp Duty & Legal Fees For Agreement Of Lease

Image Credit: ProjectManhattan via Wikimedia Commons

Image Credit: ProjectManhattan via Wikimedia Commons

Stamp Duty involves paying the Inland Revenue Authority of Singapore (IRAS) for a stamped certificate acknowledging that the flat is indeed owned by you.

It is calculated based on the purchase price of the flat:

- 1% on the first $180,000;

- 2% on the next $180,000; and

- 3% on the remainder.

Legal fees include Conveyancing Fees and Caveat Registration Fees (to cover manpower and paperwork in processing your flat purchase).

The Conveyancing Fee is calculated based on the purchase price of the flat:

- 90 cents per $1,000 for the first $30,000

- 72 cents per $1,000 for the next $30,000; and

- 60 cents per $1000, for the remaining amount.

The Caveat Registration Fee of $64.45 (inclusive of GST) is payable when you sign the Agreement for Lease.

How much: Depends on the purchase price of flat - the higher the purchase price, the higher the fees. As a rough guide, set aside a few grand for Stamp Duty and a few hundred bucks for Conveyancing Fees. Caveat Fees are chargeable at a fixed amount of $64.45.

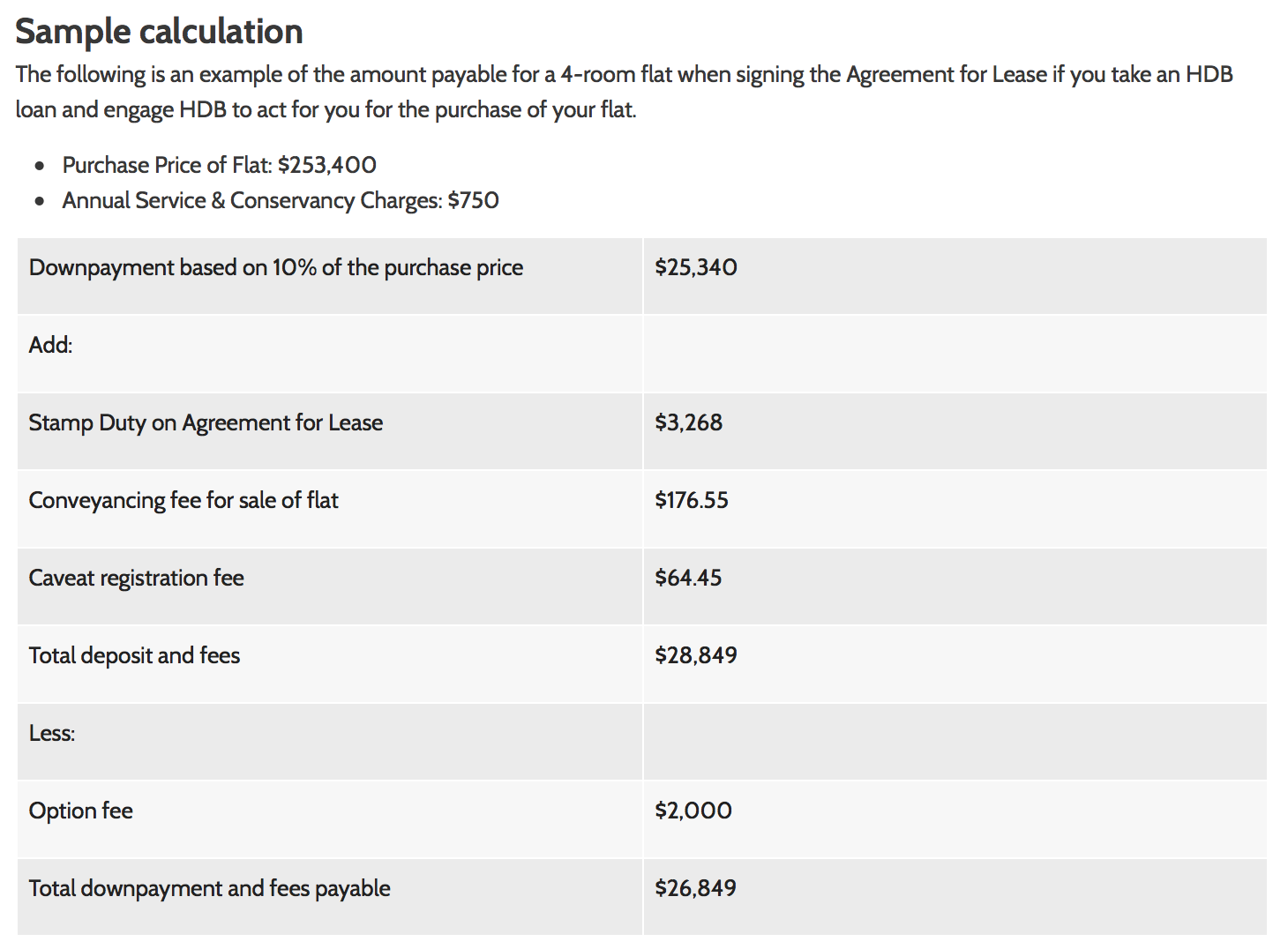

Here’s a sample breakdown from the HDB website:

Image Credit: Housing & Development Board

Image Credit: Housing & Development Board

Payable with CPF: Yes.

5. Stamp Duty & Legal Fees During Key Collection

Image Credit: TheEgyptian via Wikimedia Commons

Image Credit: TheEgyptian via Wikimedia Commons

So you have waited a few years for your flat to be built. It’s time to collect the keys to your spanking new apartment and everyone is excited.

But wait a bit more. You need to pay the Survey Fee (for a surveyor to inspect the condition and value of the flat) and Registration Fees (for the management of the flat purchase transaction) to be legally entitled to your flat.

If you are taking a bank loan, you also need to pay Stamp Duty on Deed of Assignment.

How much: Survey Fee varies according to flat type - between $150 (1-room flat) to $375 (Executive Condominium). Registration Fees are charged at a fixed amount of $38.30. Stamp Duty on Deed of Assignment is 0.4% of the bank loan amount, subject to a maximum of $500.

Payable with CPF: Yes.

6. Home Protection Scheme (HPS)

The HPS is an insurance scheme by the CPF Board that protects members and their families from losing their flat in the event of death, terminal illness or total permanent disability, up to age 65 or until their housing loans are paid up (whichever is earlier).

If you intend to use your CPF savings to pay your monthly housing loan instalments, you have to be insured under the HPS.

How much: Depends on insured member’s age, outstanding loan amount, interest rate of the loan, loan repayment period, and desired coverage. Calculate here.

Payable with CPF: Yes, the annual premium can automatically be deducted from your CPF Ordinary Account.

7. Fire Insurance

Fire statistics from the Singapore Civil Defence Force (SCDF) record close to 3,000 residential fires every year. This works out to just over 8 residential fires per day!

HDB Fire Insurance provides basic fire insurance cover for your flat. It is mandatory to purchase a HDB Fire Insurance policy if you take up a HDB housing loan.

How much: Between $1.50 and $7.50 (depending on flat type) per 5-year term.

Payable with CPF: No.

8. Renovation

Renovation involves a significant cash outlay so it is advisable to plan way ahead. If cashflow is a concern, consider staggering your home renovation and installing the most essential furniture and equipment first.

New BTO flats come ready with basic features which can be enhanced or supplemented through HDB’s Optional Component Scheme (OCS). The opt-in costs for OCS components can be up to 20-30% cheaper than market rate, and exercising some of these options gives couples the convenience of having their new flat closer to move-in condition by the time they collect their keys.

How much: Varies, but local renovation company Singapore Renovation estimates that one should be prepared to set aside at least $14,000 (for a 3-room flat) and upwards of $20,000 (for a 5-room flat) for a full renovation.

Payable with CPF: No, if you intend to go the private contractor or DIY routes. If you intend to use the OCS, the optional component cost is added to the purchase price of the flat - so depending on your loan repayment arrangement, you may be eligible to pay for the components with your CPF savings.

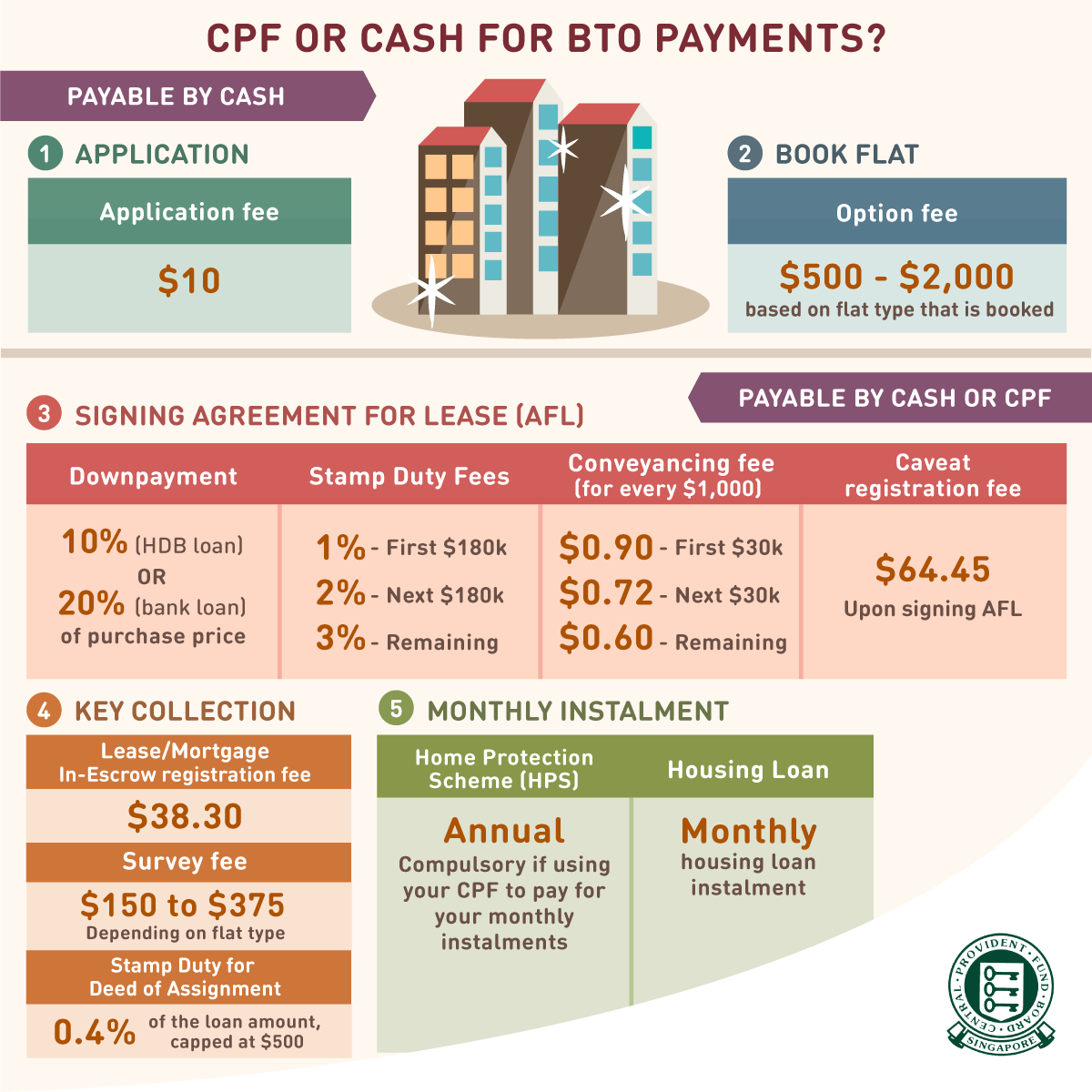

Image Credit: CPF Board

Image Credit: CPF Board

A quick summary, and a final note on using your CPF savings:

Image Credit: CPF Board

Image Credit: CPF Board

While many housing items can be financed with CPF, the rule-of-thumb is to buy within your means. Never purchase a flat so costly that you find yourself exhausting your CPF savings.

Plan your flat purchase in a way that you can finance most of your loan repayments with CPF and minimal cash top-up, while still leaving enough room to build your retirement savings.

Know of other useful home financing tips? Let us know.

This sponsored post fuels Mothership.sg so our writers can buy their own BTO flats too!

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.