GIC (which used to stand for Government of Singapore Investment Corporation up until 2013) has just released its 2015/2016 annual report on the management of the Government’s portfolio.

Why should you care?

In case you did not know, GIC is a fund manager, i.e. people, companies, institutions, countries utilise fund managers to grow their wealth through investments.

GIC's biggest client happens to be the Government of Singapore. GIC manages Singapore's foreign reserves and the type of risks it takes is mandated by the Government. Its investment returns is then used by the Government to improve Singapore in various ways. The Pioneer Generation Package did not drop from the sky.

The Soverign Wealth Fund Institute estimates that GIC has US$344 billion (S$467 billion) of assets under management, making it the world's eighth-biggest sovereign wealth fund.

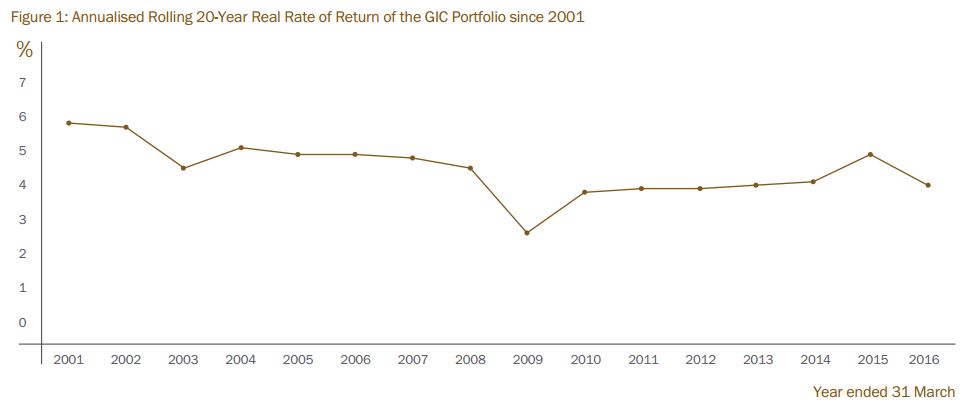

GIC's annualised 20-year real return for 2015/2016 is 4% for the financial year that ended on March 31.

This is the number everyone looks out for when GIC puts out its annual report. It is a string of financial terms that may confuse some, so let's take a few sentences to break this down.

"Annualised 20-year return" means that from the period of 1997 to 2016, the gains that GIC made from investments averages out to be 4% annually. So if you gave GIC US$100 to invest in 1996, and left it with them for twenty years, you would have US$303 in 2016.

How about the term "real return"? Simply put, if your investments made a nominal profit of 5%, but inflation rate was 3%, your real rate of return is 2%.

After beating global inflation, GIC's portfolio is returning 4% on average in the last 20 years. This 20-year period includes major financial events such as the Asian Financial Crisis, the dot com Bust, Global Financial Crisis and Euro Debt Crisis.

A dip from previous year's number

Here are the return rates in the last few years:

Here are the return rates in the last few years:

2010/11: 3.9%

2011/12: 3.9%

2012/13: 4.0%

2013/14: 4.1%

2014/15: 4.9%

GIC explained that the decrease from 4.9% to 4.0% between 2014/15 and 2015/16 was partly due to the fact that 1996, a very strong year in terms of growth, was dropped out of calculations for the 20-year annualised rate for 2015/16.

The other reason for the decrease is the uncertainties of a low-yield environment all investors are facing, according to Lim Chow Kiat, Deputy Group President and Group Chief Investment Officer at GIC.

Painting a clearer picture, GIC chief economist Leslie Teo said that ageing populations and a shrinking labour force in some countries, as well as lacklustre global productivity growth also played a part. He also noted that China was no longer experiencing double digit growths and growth in developed economies like the United States was slowing.

Strap in for a protracted period of low yield of up to 10 years

The main issue of concern in this year's annual report is a low-yield environment.

According to Lim, "these difficult investment conditions can stretch for the next 10 years. GIC is prepared for this protracted period of all-time low interest rates, modest global growth prospects and high valuations of financial assets. Even as we expect the real returns for the GIC Portfolio to be lower going forward, we aim to take advantage of our long-term horizon, skills and global reach to find attractive investment opportunities."

Yet another statement full of financial terms, so we will explain two points for you.

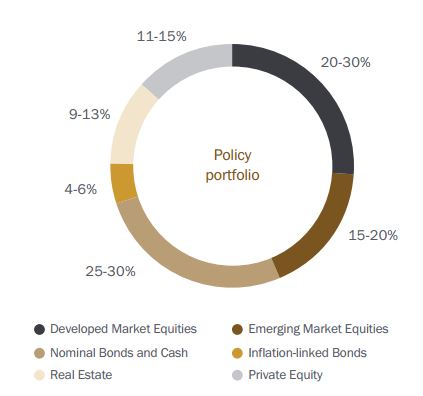

It is noted that it is a period of "all-time low interest rates". GIC's portfolio consists of bonds and equities. Low interest rates push down returns.

GIC's portfolio mix

GIC's portfolio mix

Next a period of "high valuations of financial assets" means that it is challenging to find a good deal, i.e. buying something cheaper and selling it for more. Things are priced (valued) highly.

Bottom line, the world is in a period where it is harder to earn investment returns (low yield) which will last some time but GIC has a plan already in place. Which brings us to the next point.

How is GIC manuevering in this low yield environment?

Previously we referenced a 2013 speech by GIC's Lim who was already talking about how you can invest in low yield environment, and how everyone has been hunkering down in preparation for this to happen.

Basically GIC has seen that the low yield environment was coming even back in 2013, so what has GIC been up to since?

It said it would "emphasise generating returns through a long-term, diversified and relatively conservative portfolio." GIC says it does this through its investment framework, which is how it allocates its asset mix, as well as how its investment teams actively manage investments within each asset class.

In laymen terms it means having teams of people study which baskets are the best to put Singapore's eggs in; and on top of that, having other teams to look after individual baskets to make sure we grow more eggs/chicks.

To translate it all and applying it to the real world and geopolitical developments, here's how Lim talked about GIC's view on Brexit and the United Kingdom:

UK has adjusted in terms of its currency movement. Its currency has weakened, which has allowed some of its assets to perform better. (This) has reflected in stock market performance - stocks in external business (businesses doing exports) are doing extremely well. So you have to do the work of individually looking at what the asset is. At the same time, those assets which are more domestic-dependent, they suffered and will go through a difficult period. We have to go down and especially look through this lens of whether it is more external-facing or domestic-facing.

If you had only one thing to take away from all this

Throughout the annual report GIC has been hammering away at one thing: they are expecting a difficult investment environment (low yield, low yield, low yield) of up to 10 years and they said that the "long-term (20-year) returns are likely to be significantly lower than what we saw since 1980." Although investment conditions look discouraging, GIC said it is "well-placed to invest in this new environment."

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.