You don’t usually hear news of Singapore’s state investment company every day, unless you’re in the financial sector.

Even then...

When you hear of Temasek Holdings (Temasek), it’s usually news about profits, or worse, losses, posted in their annual reports.

Or angry speeches at Hong Lim Park. Or even angrier election rallies. Okay, we digress.

When we were invited to this year's Temasek Review, TH's annual report press conference, we wondered what we can write about besides mentioning Temasek's portfolio returns for the past year.

We thought of just writing about the Temasek Rice, the 1kg paper weight that was included in the media kit.

Photo by Ng Yi Shu.

Photo by Ng Yi Shu.

Who knows? Maybe if one was to eat the rice, he/she can be as smart as the CEO.

But that would be making light of such a serious press conference.

Anyway, here are five myths we discovered when we mixed around with the financial whizkids of Singapore.

1. Temasek Review is actually not the blog that shares the same name.

One of them is the real Temasek Review.

One of them is the real Temasek Review.

When people talk about Temasek Review (TR), they often picture a socio-political blog that shared its same name for a brief period from 2009 to 2010.

But the TR is also the annual report of Temasek, and is considered the yearly financial scorecard for the state investment company that bloggers in Temasek Review Emeritus (TRE) love to hate.

TR has been the name of Temasek’s annual report since 2004, and it lists the statistics regarding Temasek’s investment and corporate social responsibility profiles for its past financial year.

It includes TH's ten-year performance overview, Temasek’s opinion on the economic outlook in the next year, its investment strategy, and the list of its major investments.

It has also in recent years gone online, with its own microsite, and the state investment company has slowly reclaimed the TR name.

2. The people at Temasek aren’t all financial whizkids - they are mere mortals.

Singaporeans usually think of people in Temasek as brilliant financial wizards who can keep growing our money.

With a 40-year Total Shareholder Returns (TSR) of 15%, we thought that the TH folks can walk on water.

This year’s negative TSR indicate that they are mere mortals.

TH's TSR for this year was - 9.02%.

As Temasek primarily invests in equities, it was particularly impacted by a 21% slump in the China’s CSI 300 index and an 18% decrease in Singapore’s Straits Times Index in the previous years. Globally, real global growth was just 3.1%, the slowest since the financial crisis in 2008.

So Temasek’s money cannot be protected against global trends through some financial wizardry - particularly as nearly 61% of their assets are either liquid or listed on a stock market.

“We’re not immune to movements in markets,” said Rohit Sipahimalani, joint head for portfolio strategy and risk at Temasek. He added that Temasek’s portfolio performance was impacted by market performance in Singapore.

3. They do not manage CPF money.

With all the online chatter with blogger Roy Ngerng, CPF savings, Government Investment Corporation and Temasek, some Singaporeans have the misconception that TH actually manages our reserves and CPF savings.

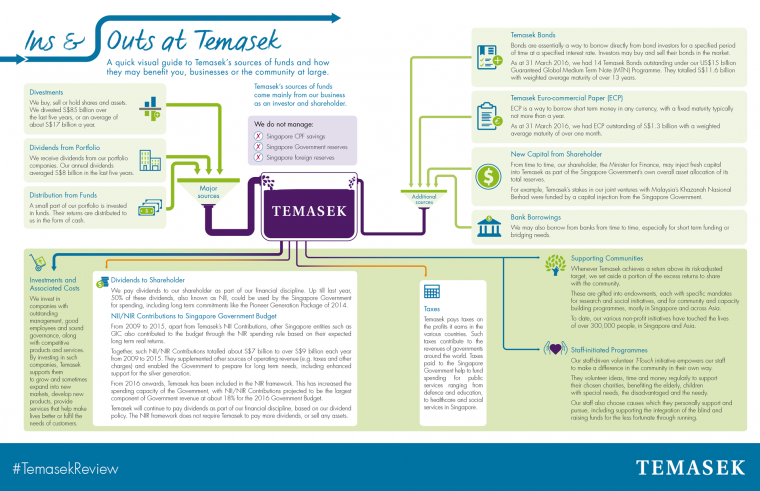

This graphic will declare once and for all that Temasek does not manage CPF savings (which are managed by the Board of the Central Provident Fund), Government surpluses, or Singapore’s Official Foreign Reserves (which are managed by the Monetary Authority of Singapore).

Photo from Temasek Holdings. Click to enlarge

Photo from Temasek Holdings. Click to enlarge

Let's focus on the "Outs" though, as this is the main impact of Temasek on Singapore and Singaporeans.

Temasek's shareholder is the Minister for Finance and Temasek pay dividends to its shareholder.

50 percent of TH's dividends could be used by the Government for spending, such as the Pioneer Generation Package.

Temasek also pay taxes on the profits it earns, including the S'pore government.

More importantly, TH sets aside a portion to establish 16 endowments to benefit the community, impacting the lives of more than 300,000 people in Singapore and Asia. They include Temasek Foundation, Temasek Cares, and the S Rajaratnam Endowment.

4. TH is not all about Ho Ching.

Source: Ho Ching Facebook

Source: Ho Ching Facebook

Yes, we know that Temasek is synonymous with Ho, its CEO since 2002 (and the wife of the PM).

But the TR 2016 press conference, similar to the TR press conferences in the past few years, is not fronted by Ho.

The press conference was also not led by Lee Theng Kiat, the CEO of Temasek International. Lee of course was the boss man when Ho was away on a six-month sabbatical last year.

Instead the leadership beauty parade press conference was fronted by five young guns from its 22-member senior management team.

They were:

Michael Buchanan (Head, Strategy, Senior Managing Director, Portfolio Strategy & Risk Group);

Png Chin Yee (Head, Financial Services and Senior Managing Director, China);

Dilhan Pillay Sandrasegara (President; Joint Head, Enterprise Development Group; Joint Head, Investment Group; Joint Head, Singapore; Head, Americas);

Chia Song Hwee (President, Joint Head, Investment Group, Joint Head, Portfolio Management Group, Joint Head, Singapore) and

Rohit Sipahimalani (Joint Head, Portfolio Strategy & Risk Group, Joint Head, India).

Or you can casually call them Michael, Chin Yee, Dilhan, Song Hwee and Rohit:

Temasek panellists speak to the media. Photo: Ng Yi Shu

Temasek panellists speak to the media. Photo: Ng Yi Shu

As Lee is already 63 years old, the same age as Ho, the next CEO is likely to come from this vintage.

And since Dihan, who joined Temasek in 2010, was sitting in the middle, he gave an opening salvo for his bid of Temasek's leadership this reply to a Straits Times query on TH's leadership succession plans:

"Ho Ching is CEO of Temasek Holdings. As we have said over the years, the board has an annual succession review and that's the discipline they put in place. Back in October last year, it was announced that Lee Theng Kiat was appointed the CEO of Temasek International and in that role, he takes on the role of overseeing our investments, and our role as an investor, shareholder of our companies. Ho Ching has taken on the role of being responsible of the overall performance of the company as well as the stewardship role, and that includes dealing with the constitutional responsibilities. Between Ho Ching and Theng Kiat, they are both engaged in ensuring that we remain a forward-looking institution, as we prepare ourselves for the future."

Which proves that he can memorise Chairman Lim Boon Heng's message on page 12 of Temasek Review well.

5. They’re unlike the stone-hearted "wolves of Wall Street".

Everyone thinks that Temasek is just an investor.

But they are "givers" too.

The sovereign wealth fund gives back to the people - especially those who need it the most.

Temasek manages 16 endowments - some of which are relatively well known, like the Temasek Foundation - and others not so, like the Temasek Life Sciences Laboratory:

" width="760" height="427" frameborder="0" allowfullscreen="allowfullscreen">

When people are feeling poor -- they donate less to charity.

But not them.

The money for Temasek's endowments have been ringfenced in the Temasek Trust, a trust set up to oversee the financial management of its own donations.

One of these endowments - Temasek Cares - is a charity focused on meeting the needs of the underprivileged. It was given a $100 million endowment when it was launched in 2009, and it has since been given three additional endowments.

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.