Firsthand Takes On: Housing is a new series by Mothership, diving into the topic of housing in Singapore with in-depth articles and videos.

We’ll explore the uniquely Singaporean housing system by experiencing it for ourselves, gathering expert opinions, and hearing the perspectives of young Singaporeans, to present the points of view that matter, firsthand.

The Singapore government has acted decisively to cool the property market, with new tax rates from Apr. 27, 2023.

This move favours those buying for owner-occupation, and serves as a disincentive to those seeking to purchase property for investment purposes.

Speaking to the media at HDB Hub on Apr. 27 morning about raising the ABSD rates, Lee also touched on the rental market.

He said that MND expects to see rental prices moderate later this year, citing a report by the Monetary Authority of Singapore (MAS) on Apr. 26.

Can Singapore still explore rent regulation? Mothership produced a video on Apr. 23 to explore this question.

Singaporeans awoke on Apr. 27 to news of unprecedented property market cooling measures — Additional Buyers Stamp Duty (ABSD) increases of up to 30 per cent for certain categories of buyers, announced late in the evening on Apr. 26.

For Singaporeans and Permanent Residents (PRs) buying their first home, there were no changes — they would continue to pay 0 per cent and 5 per cent respectively.

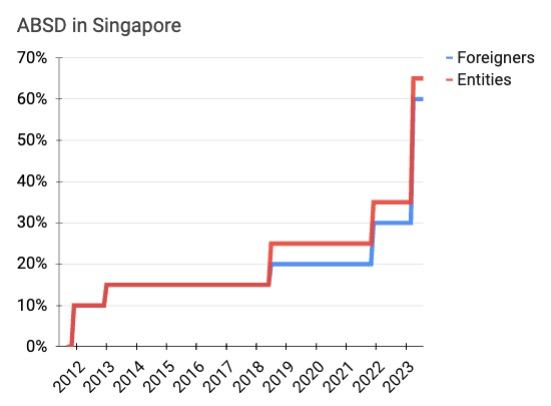

But foreigners buying any residential property have to pay 60 per cent ABSD instead of the previous 30 per cent. ABSD has always been higher for foreigners, but a doubling of the tax rate for that category has never been done before.

Increases in ABSD over the years for foreigners and entities. Graph by Nigel Chua.

Increases in ABSD over the years for foreigners and entities. Graph by Nigel Chua.

Raising ABSD has been the latest step in a slew of property market moves by the authorities in Singapore.

Winners and losers

Obviously, foreigners who were just about to decide to purchase a home would be most affected — a S$2 million property now incurs S$600,000 ABSD, up from $300,000 before Apr. 27.

As of 2022, foreign home buyers still constituted a "small proportion" — around 3 per cent of all private housing transactions, a drop from the pre-pandemic level of 5 per cent from 2017 to 2019.

But based on Urban Redevelopment Authority (URA) data from the first quarter of 2023, the proportion of foreigners buying residential property is now 6.9 per cent, The Straits Times (ST) reported, so this most-affected group has actually been a growing one — at least in the past few months.

The new ABSD rates also aim to dampen local demand, albeit with a smaller increase, as local buyers are more price sensitive than their foreign counterparts, national development minister Desmond Lee explained.

So... problem solved?

As with almost everything that happened in the past three years or so, a full explanation is not possible without reference to Covid-19.

Looking at Singapore's housing market, the pandemic has been blamed for increased prices in both the resale and rental market.

With thousands of new homes getting delayed, affected homeowners have needed alternative options, driving up demand and thus prices.

This comes after Lee told ST there were "early signs" the housing market was cooling, referring to both the resale and rental markets.

Speaking to the media at HDB Hub on Apr. 27 morning about raising the ABSD rates, Lee also touched on the rental market.

Lee said that MND expects to see rental prices moderate later this year, citing a report by the Monetary Authority of Singapore (MAS) on Apr. 26.

Lee noted that some 40,000 housing completions this year, about half HDB and the other half will be private residential, will add supply to the rental market.

Lee also said that locals who have been waiting for the homes but who are currently renting will be able to move to their homes and then exit from the rental market.

Positive relationship between housing prices and rent

In theory, there is a positive relationship between housing prices and rent — when one comes down, the other should too.

The housing prices and rental rates do have a positive relationship, explained Lee Kwan Ok, an assistant professor who is the Dean's Chair of Urban Planning at the National University of Singapore (NUS) Business School and deputy head in the NUS Department of Real Estate.

The two are so closely linked that there is a possibility of both increasing in a vicious cycle.

As Lee explained in a Mothership video:

"On the one hand the people see the rising rent and they want to buy housing because they can also make a lot of profits out of renting their units.

But also, you can always choose in the housing market — you can either rent or buy. If rents are too expensive, people think, 'Okay you know maybe I should buy housing,' which would actually eventually increase housing prices as well.

So because housing prices is also high now, the home buyers would ask for higher rent to compensate for their housing purchase cost."

"Once we start this cycle, it's very hard to break," she said.

ABSD should have some impact on prices, and more housing supply on the way will further alleviate price pressures.

Thus, those currently in the property market, whether to buy or rent, should hang tight — and things should get better, sooner or later.

Could there still be a place for rent regulation to safeguard tenants from a similar situation in future, though?

Watch the full video here:

Top image by Danist Soh via Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.